HBO Power

The next year will be crucial for the company, given the mixed outlook for Time Warner that is expected to face stiff competition. Being one of the early entrants into the 5G space, AT&T will continue expanding its high-speed network in the coming months. However, it will have to focus on pricing and value-addition to keep pace with rivals like T-Mobile (TMUS), which is set to become a dominant player in the sector through the Sprint (S) buyout.

Margin Squeeze

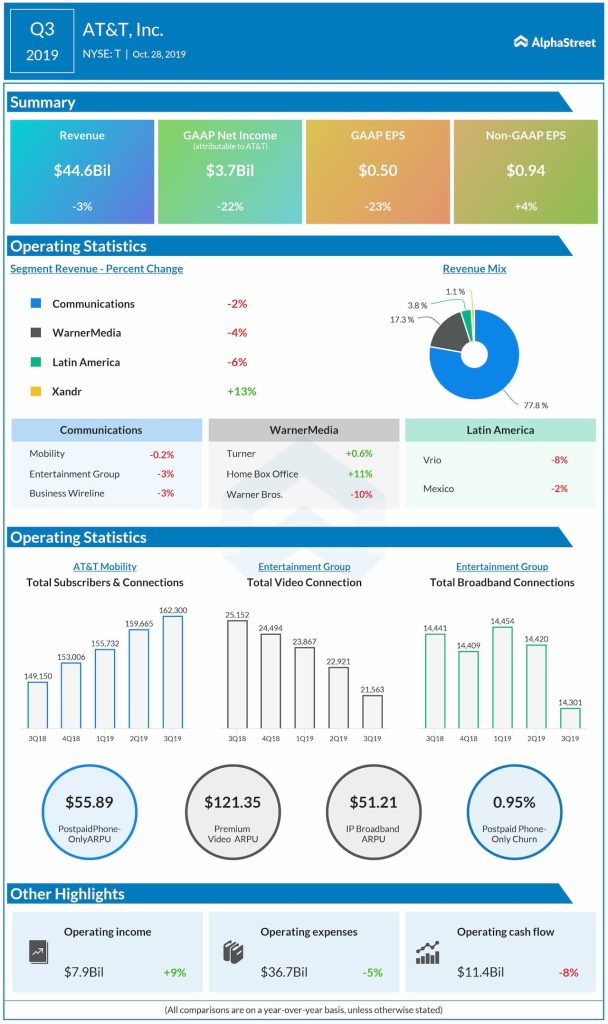

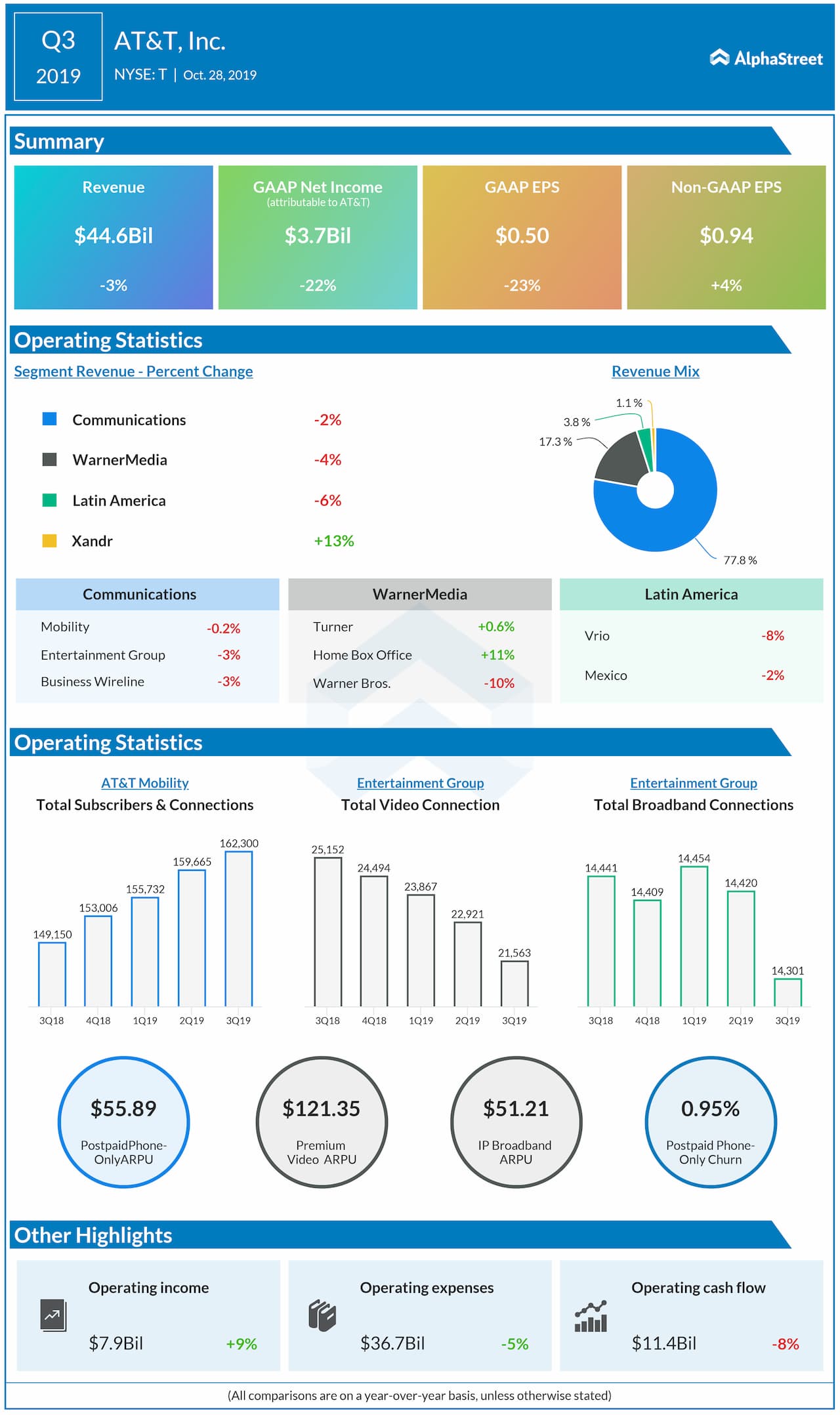

Meanwhile, margins will likely remain under pressure due to investments in network infrastructure, mainly 5G, and technology innovation. While plans are afoot to shift the business to high-growth mode next year, the process might take a long time. In the third quarter, revenues dropped 2%, hurt mainly by softness in the legacy wireline services, WarnerMedia, and domestic video. Meanwhile, adjusted earnings rose 4% and topped expectations.

Buy AT&T?

The fact that the company has a proper growth plan and steady cash flow to execute it points to a marked improvement in shareholder value in the long term. It needs to be noted that AT&T has been good at returning capital to shareholders, which management intends to maintain in 2020. Nevertheless, the moderate buy rating on the stock and target price of around $40, representing a 2.5% upside, call for a little bit of caution as far as investing is considered.

Also read: Verizon’s Q3 results beat expectations

Over the past twelve months, the stock gained around 30% after falling to a multi-year low towards the end of last year.