Hewlett Packard Enterprise Company (NYSE: HPE) is one of the few tech firms that failed to fully leverage the pandemic-driven demand growth in the information technology sector. The company is has been transitioning the business into an ‘on-premise IT-as-a-service model’ to tap the unfolding opportunities.

HP in recovery mode as digital transformation enlivens PC market

Hewlett Packard’s stock breached the $10-mark last month after languishing in the single-digit territory for several weeks. The uptrend continued after it reported stronger-than-expected fourth-quarter results this week, though earnings declined. Experts are of the view that the recovery might be short-lived and see a moderation in value in the coming weeks. For the shareholders, there is nothing much to cheer about, while prospective investors could be dissuaded by the bleak prospects of returns. In short, it makes sense to hold the stock for now.

From Hewlett Packard Enterprise’s Q3 2021 earnings conference call:

“We are a market leader in Compute and we are being deliberate in our focus on gaining market share in profitable market segments. This quarter, we became the first company to embed silicon-based security into our industry-standard servers being manufacturing through our HPE trusted supply chain in the United States. This security is critical to a growing number of U.S. customers across federal, public banking, and finance and healthcare verticals.”

Headwinds

The server maker, which is moving its headquarters from Silicon Valley to the Texas area, has been hit by competition and the cyclical nature of the business. Also, enterprises tend to delay expensive IT infrastructure projects – like datacenter upgrades – during periods of uncertainty. It needs to be noted that the other areas of the sector have been witnessing strong demand growth since the home-based work/learning trend set in.

Going forward, the company’s bottom-line will likely benefit from the ongoing cost-cutting initiatives. Currently, the growth strategy includes stabilization of the core businesses, doubling down in areas of growth, and expediting the adoption of the new business model, while taking decisive action to strengthen the financial foundation.

Mixed Q4

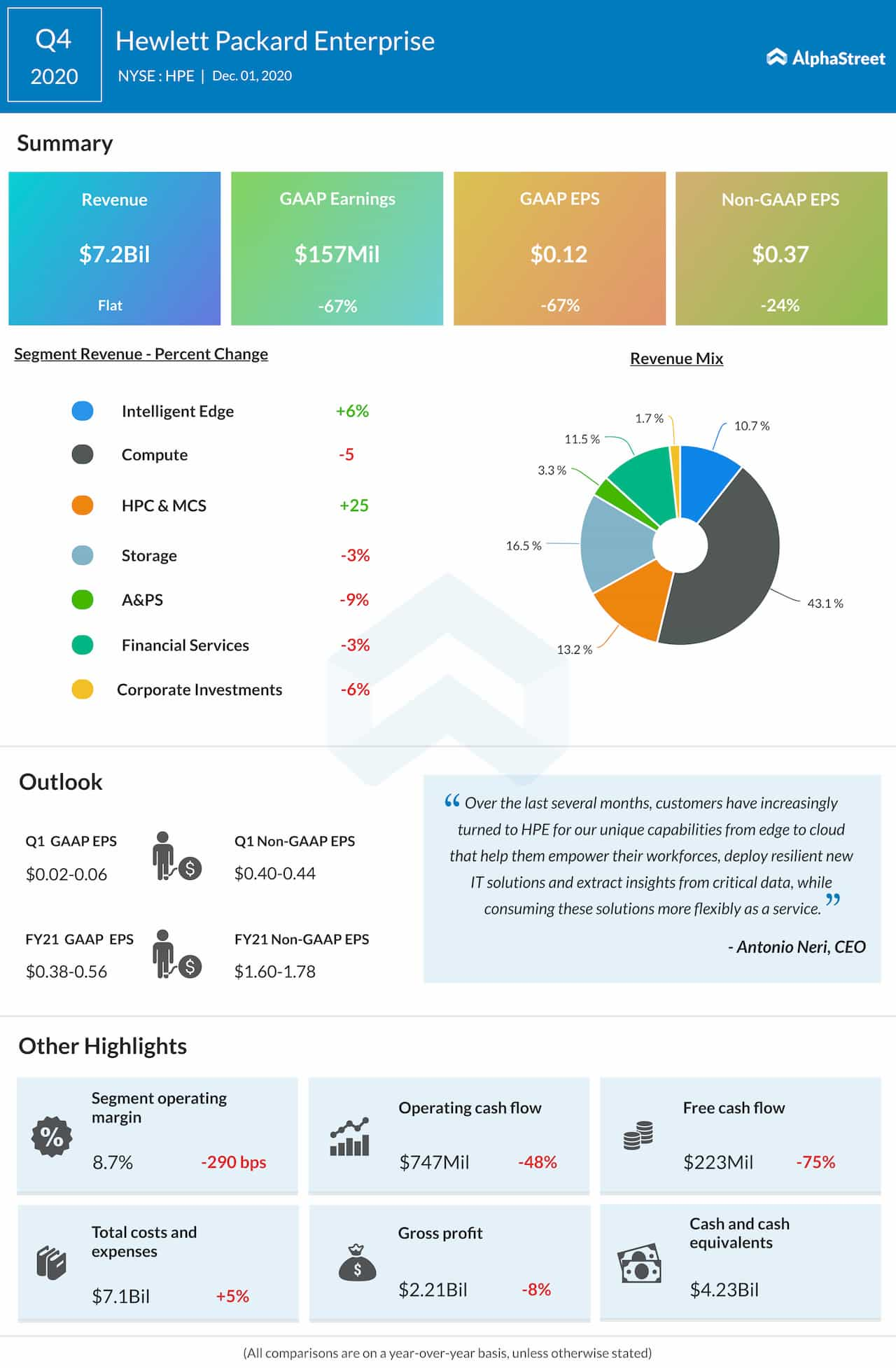

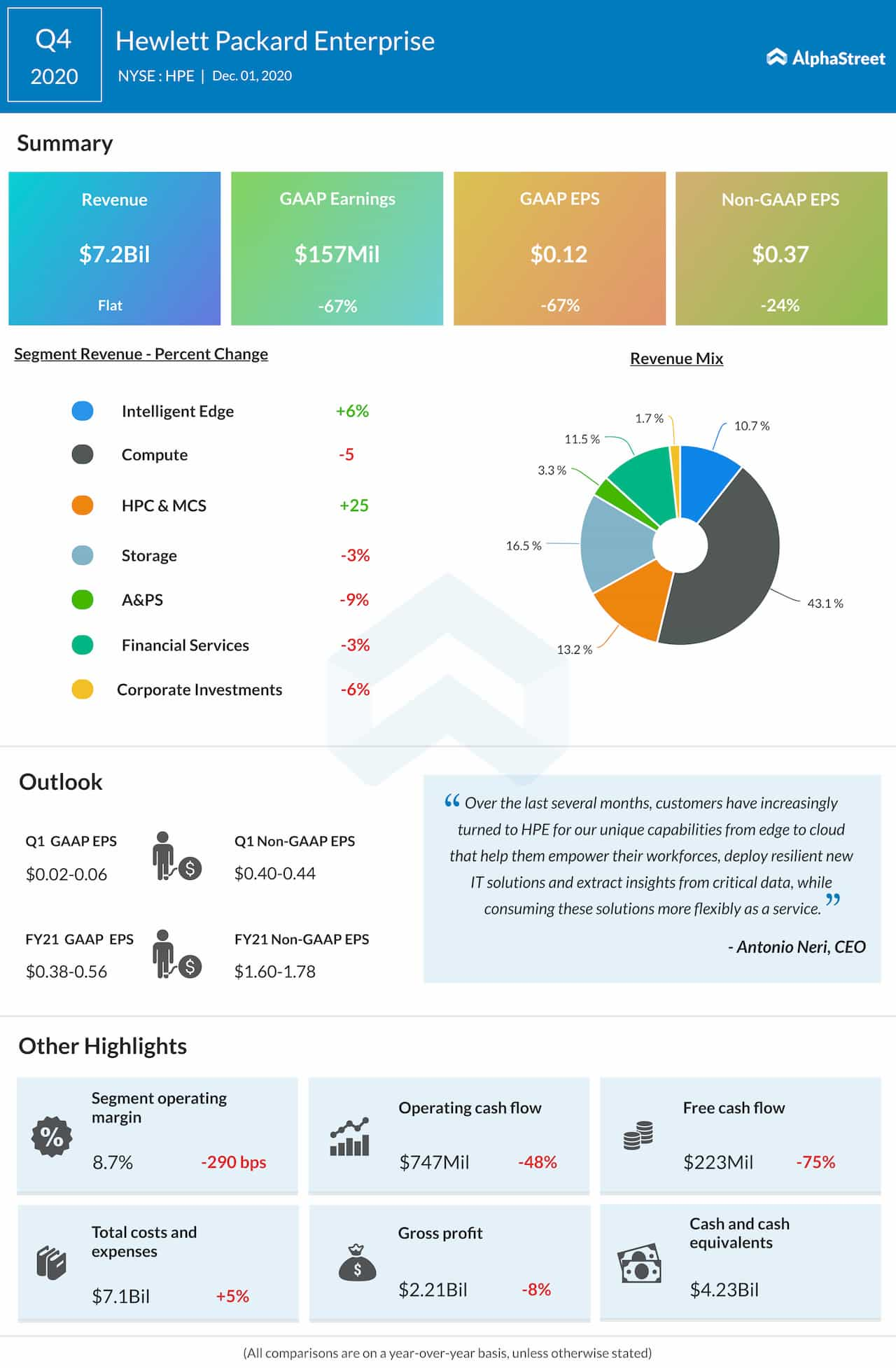

The company ended fiscal 2020 on a mixed note, with fourth-quarter earnings falling in double-digits to $0.37 per share on revenues of $7.2 billion, which remained unchanged from the prior-year period. On the positive side, the numbers came in above the consensus estimates. Most of the business segments, including the core Compute division, witnessed a slowdown during the quarter.

Commenting on the results, chief executive officer Antonio Neri said at the fourth-quarter conference call, “We are encouraged by new orders intake that point to stabilization in this business, taken into account the typical Q1 seasonality. Most importantly, if you look at the combined server view across Compute and HPC/MCS businesses, which is how the market tracks server performance, our total net revenue in the server market will be up 3% sequentially and up 1% year-over-year. As a result, we believe we gained share in total server for the second consecutive quarter.”

Read analysts/management’s comments on Hewlett Packard’s Q3 earnings

Stock Performance

Hewlett Packard’s stock had remained almost flat after falling to a three-year low early this year when markets were battered by the pandemic. It finally picked up momentum last month and has maintained the uptrend since then. The shares gained 14% in the past twelve months but underperformed the market.