IT solutions provider Hewlett Packard Enterprise (NYSE: HPE) this week impressed the market with strong second-quarter results, aided by the growing demand for its AI-powered services, and issued positive guidance. With double-digit revenues and operating profit growth, the Server segment performed particularly well.

Stock Gains

Post-earnings, the tech firm’s stock rallied and set a new record, extending the positive momentum seen ahead of the announcement. It was one of the biggest single-day gains for HPE, which has grown an impressive 27% in the past six months. The stock is relatively cheap and the recent uptrend is likely to continue this year. Long-term investors might find it attractive due to regular dividend hikes and above-average yield.

Hewlett-Packard’s fundamentals improved recently as the company positioned itself to ride the AI wave and boost profitability. Last year, it entered into a partnership with Nvidia to build an enterprise computing solution for generative AI. While a part of the portfolio stands to benefit from the AI data center boom, other areas might experience a slowdown due to softness in enterprise demand. The company’s revenue has been under pressure lately amid weak PC and printer sales.

Q2 Results Beat

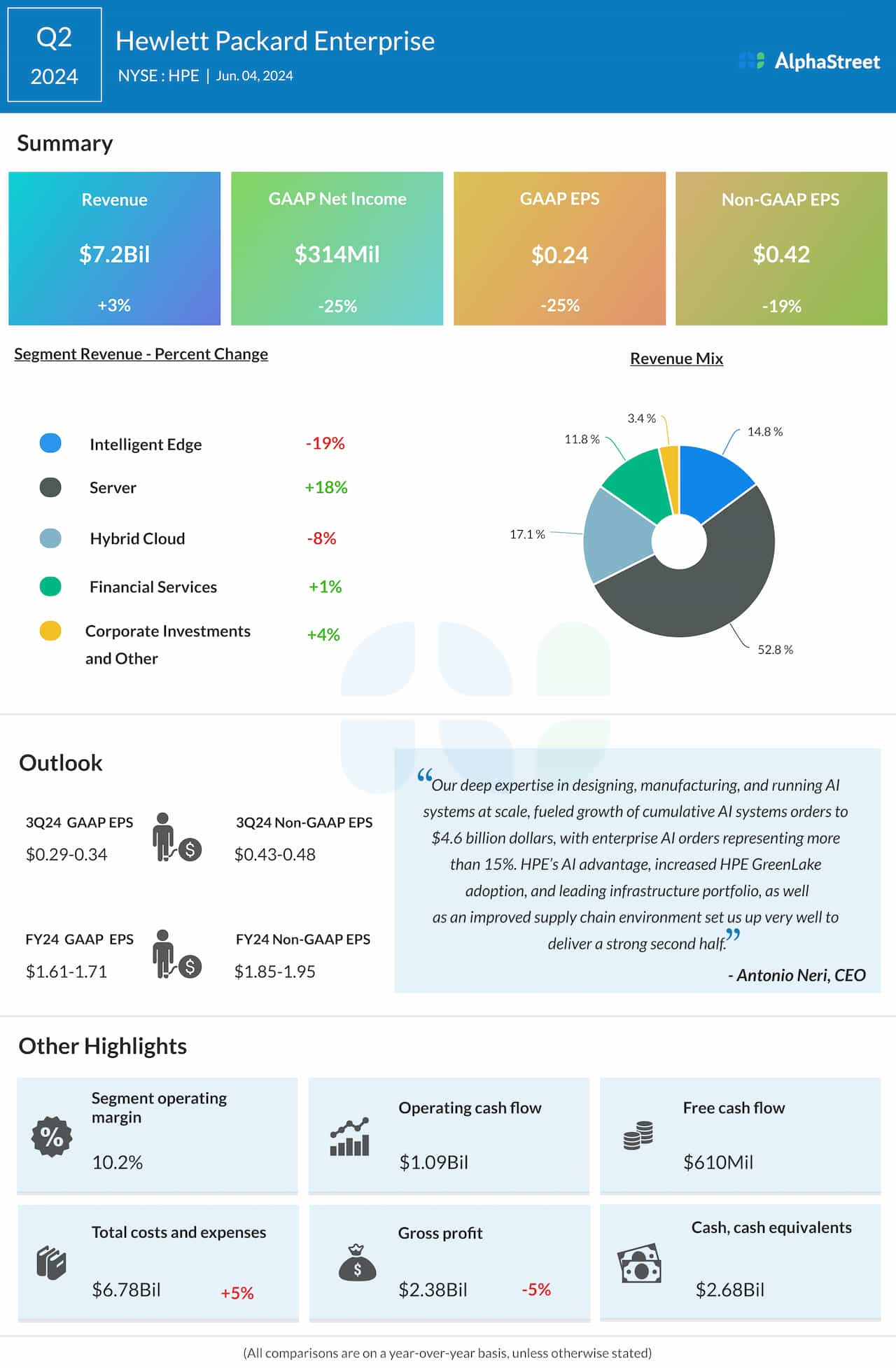

The company reported better-than-expected profit for the second quarter – the sixth consecutive earnings beat. Excluding one-off items, Q2 earnings dropped to $0.42 per share from $0.52 per share a year earlier. On an unadjusted basis, net income was $314 million or $0.24 per share, compared to $418 million or $0.32 per share in the second quarter of 2023.

Revenues moved up 3% annually to $7.2 billion in the April quarter and topped expectations, after missing in the preceding three-month period. An 18% growth in the core Server division was partially offset by lower revenues at the Intelligent Edge and Hybrid Cloud segments.

Sharing his bullish view on the company’s prospects, Hewlett Packard’s CEO Antonio Neri said at the Q2 earnings call, “I am very optimistic about where we’re headed. AI demand continues to accelerate with cumulative AI systems orders reaching $4.6 billion this quarter. We have a robust pipeline in this business, though large AI orders can cause fluctuations during the quarter. We anticipate continued revenue growth driven by increased AI systems demand, continued adoption of HPE GreenLake, and ongoing improvement in the traditional infrastructure market, including servers, storage, and networking.”

Road Ahead

For the third quarter, the management forecasts adjusted profit in the range of $0.43 per share to $0.48 per share, the mid-point of which is slightly below Wall Street’s consensus estimate of $0.47 per share. The company also raised its full-year 2024 guidance, and currently expects adjusted EPS between $1.85 per share and $1.95 per share, compared to the market’s latest projection of $1.91.

Shares of Hewlett-Packard traded higher throughout Friday, after opening the session slightly above $36. They have traded above the long-term average since last month.