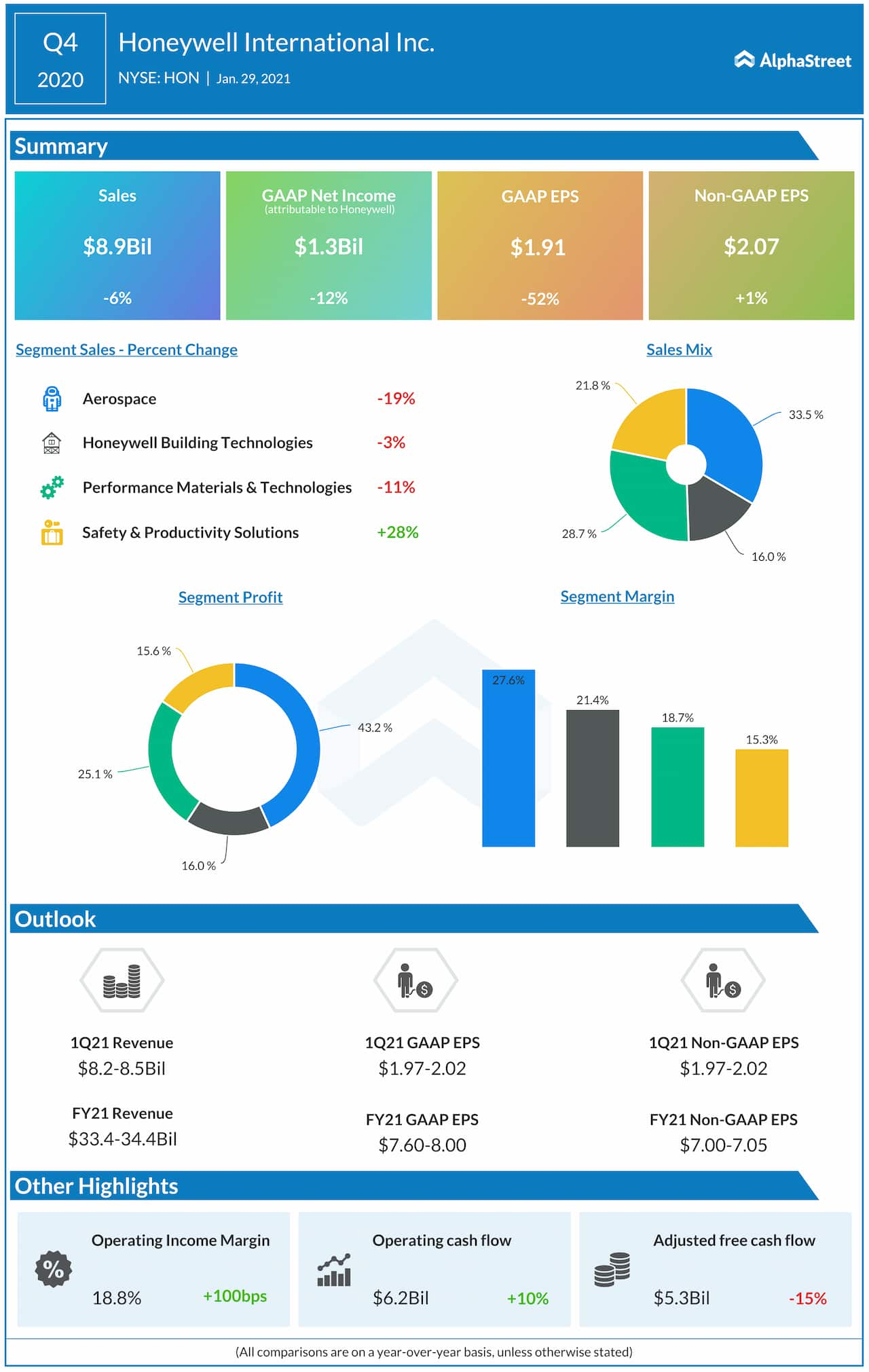

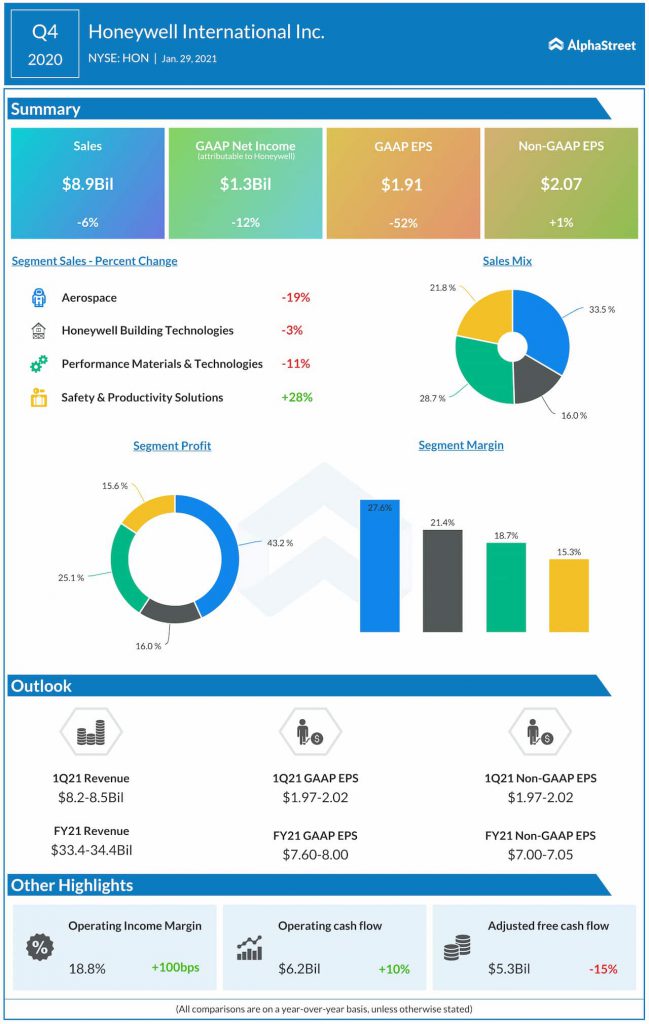

Honeywell International (NYSE: HON) ended a very challenging year on a positive note, with a strong fourth-quarter marked by impressive sales, earnings, and cash flow performance. In fiscal 2020, the aerospace segment generated maximum revenue for the company, despite the massacre of the airline industry by COVID-19 during the year.

In the fourth quarter, the company delivered adjusted earnings per share of $2.07, flat year-over-year and $0.05 above the high end of its guidance range. The company recorded double-digit organic sales growth in defense, space, fluorine products, and recurring connected software sales. There was a 27% organic growth in Safety and Productivity Solutions, which is a strong number for the quarter.

Read management/analysts’ comments on quarterly reports

The company was able to make discrete investments during the quarter in different businesses and its employees, including in IT and marketing for creating and expanding the brand in the Middle East and China and for rewarding employees who performed during the crunch times of 2020.

Mergers and Acquisitions

In the fourth quarter, Honeywell made a series of announcements that align directly with its ongoing transformation into a software-industrial company. The company completed three acquisitions that became a key part of its portfolio and helped it not only in diversifying but also in creating higher returns.

It has agreed to acquire Rocky Research and Ballard Unmanned Systems, which will provide innovative technologies and a strategic position in the aerospace industry. The strategy would also help the company get complete ownership of Trinity Mobility. Trinity, a digital platform that supports smart cities, will contribute to the breakthrough initiatives of Honeywell Building Technologies.

Honeywell also acquired Sine Group, a technology, and software-as-a-service company that provides digital management solutions readily accessible for mobile devices. The acquisition will help the company enhance its connected building offerings and support the mobile platform for a broader portfolio of Honeywell Forge offerings.

In addition, the company recently announced an agreement to acquire Sparta Systems for $1.3 billion, which is a leading provider of enterprise quality management software or EQMS for the life sciences industry. Honeywell previously highlighted the importance of the life sciences market for breakthrough growth initiatives. The acquisition of Sparta will further encourage software controls and analytical capabilities in the life science space.

Market Outlook

Honeywell’s Aerospace segment would gradually improve as the government is planning to increase the flight hours as the pandemic subsides. The demand for commercial aerospace services is also expected to accelerate in the second half of 2021. Honeywell Building Technologies expects the non-residential market to remain relatively stable. However, the company is anticipating solid demand for building products and management systems in key verticals, including data centers, warehousing, and healthcare.

When it comes to the Performance Materials and Technologies segment, the company expects the oil & gas and petrochemical markets to remain relatively flat, with oil consumption picking up slightly in the second half of 2021. Honeywell anticipates increasing investments in renewable fuels to drive demand for the new sustainable technology solutions business to partially offset challenges in the oil and gas market.

The specialty chemicals market is expected to grow modestly in 2021, with strength in global healthcare, automotive and residential construction end markets driving demand for advanced materials. So overall, the company predicts improvement across most of its key end markets in 2021 and has confidence in its continued operational execution.

Financial Guidance

Honeywell expects sales to increase from $33.4 billion to $34.4 billion in fiscal 2021, which represents solid organic growth. The company is anticipating free cash flow to be in the range of $5.1 billion to $5.5 billion in 2021.

Garrett Motion, formerly Honeywell Transportation Systems and Honeywell Turbo Technologies, has agreed to the plan for a reorganization under which it will be recapitalized to meet its obligations, including those to Honeywell. It will also help in avoiding costly litigation, which is the right path forward to maximize value for all stakeholders.