JD.com Inc. (NASDAQ: JD), a leading e-commerce firm in China, on Wednesday reported higher revenues and adjusted earnings for the third quarter of 2023.

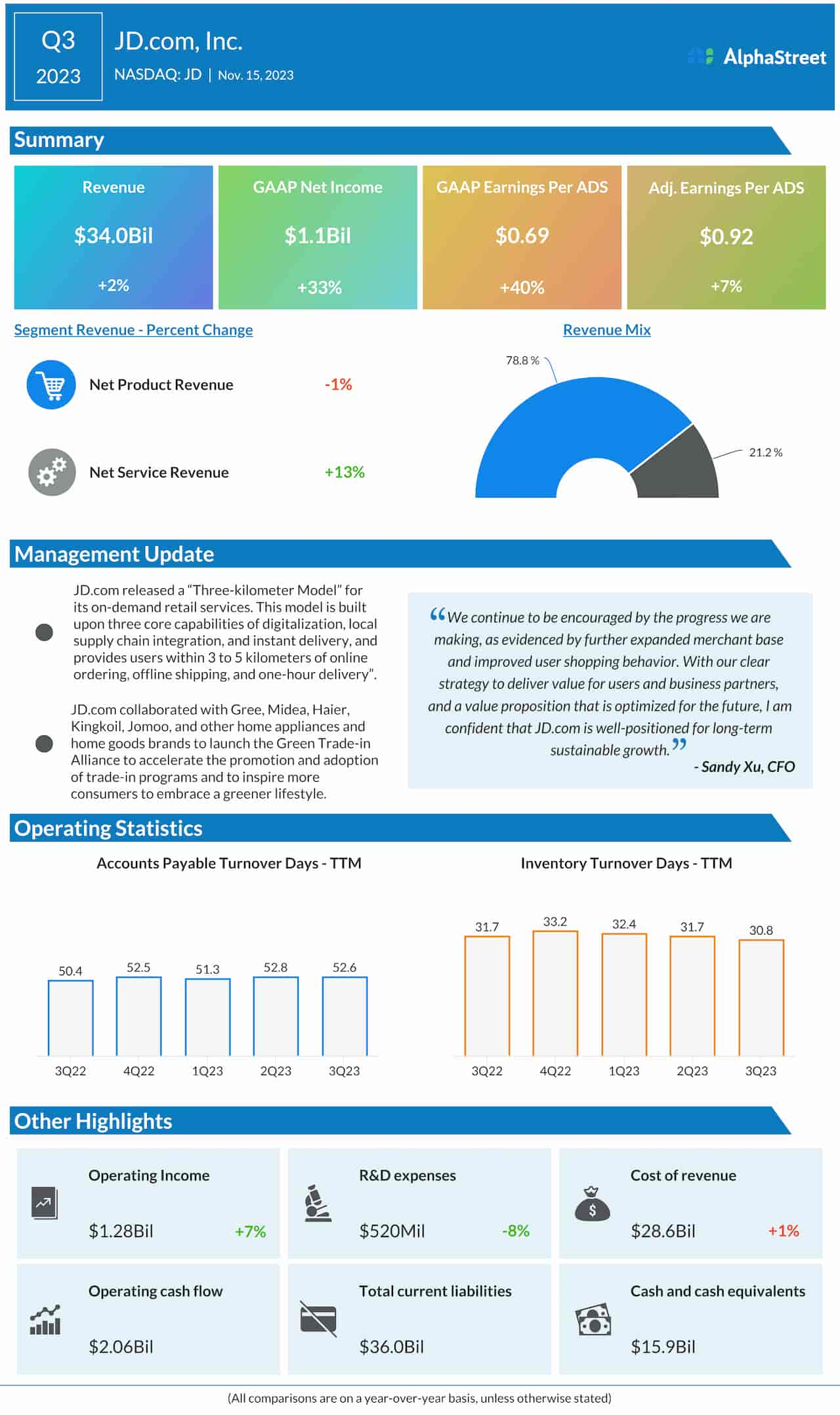

Adjusted profit moved up 7% annually to $0.92 per ADS in the third quarter. On an unadjusted basis, the net profit was $1.1 billion or $0.69 per ADS, which is up 33% and 40% respectively from the prior-year period.

At $34.0 billion, third-quarter revenues were up 2% from the corresponding period of 2022. A decrease in the core Net Product revenue was more than offset by an increase in Net Service revenues.

“We continue to be encouraged by the progress we are making, as evidenced by further expanded merchant base and improved user shopping behavior. With our clear strategy to deliver value for users and business partners and a value proposition that is optimized for the future, I am confident that JD.com is well-positioned for long-term sustainable growth,” said Sandy Xu, CEO of JD.com.