Quarterly numbers

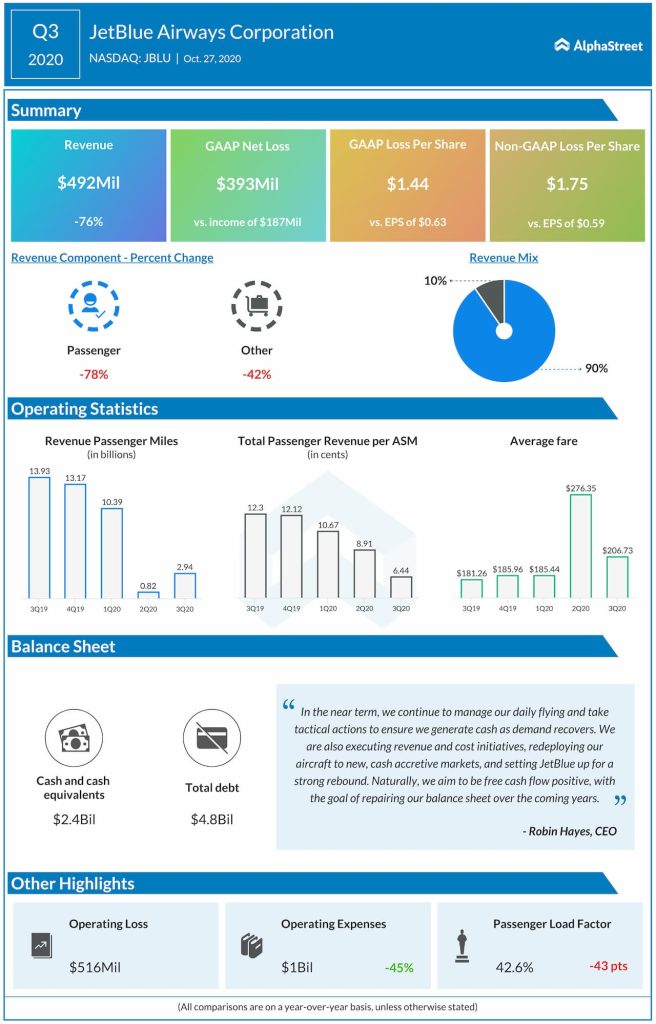

Revenues declined 76% to $492 million due to the impact of the pandemic. JetBlue had anticipated a decline of 80% but improvements in leisure travel and visits to friends and relatives had a positive effect on revenues. Adjusted loss amounted to $1.75 per share which was narrower than market estimates.

The company reduced its capacity by 58% year-over-year and managed to cut operating expenses by 45%. Average daily cash burn during the quarter was $6.1 million, which was better than the previously projected range of $7-9 million.

Demand trends

JetBlue witnessed a sequential improvement in demand through August and September as restrictions eased in some regions. The Latin and Caribbean regions saw a pickup in momentum driven by visiting friends and relatives, or VFR, demand. By the end of the quarter, 20 out of 35 of the company’s international destinations had reopened and JetBlue expects more destinations to reopen going forward.

JetBlue anticipates a steady improvement in bookings going into the holiday season on pent-up demand from customers who are looking to visit their family and friends or go on vacation. The company believes it is well-positioned to meet this demand going forward.

Outlook

Looking into the fourth quarter, JetBlue expects revenues to decline approx. 65% year-over-year and capacity to be down approx. 45%. The company expects daily cash burn to range between $4-6 million. Operating expenses are expected to decrease approx. 30% year-over-year.

Since the start of the health crisis, JetBlue has managed to bring down its total Capex by around $2 billion between 2020 and 2022. The company expects Capex for the rest of 2020 to be around $200 million and looking into 2021, Capex is projected to be less than $1 billion.

Click here to read the full transcript of JetBlue Airways Q3 2020 earnings results