The slowing global economy, UK’s Brexit decision, and trade wars are expected to act as headwinds for earnings growth in the Q1 period for JPM and its peers. When it comes to US markets, the uncertain economic conditions and whether the Fed hikes interest rates or not are going to be major drivers for JPMorgan and its rivals. The decline in interest rates would impact the yield curve, which would hurt banks’ profits.

JPMorgan’s stock has increased by nearly 8% which is a good sign for investors, recovering from 10% drop it witnessed last year. Wells Fargo (WFC) is also scheduled to report its results on Friday before the market opens.

Key metrics to track

Investors would be looking at JPMorgan’s segments performance amidst tough comps due to tax reform benefits recorded last year and tough macro situation. The key metric tracked by the street generally for banks will be net interest margins (NIM). It would be interesting to see how NIM’s are going to come up on Friday. Last quarter, JPMorgan’s NIM came in at 2.54% meeting analyst expectations.

As a follow-up to last quarter’s results, trading revenues from the bond markets is an important factor to look at when the bank reports on Friday.

For the first quarter, the street is expecting JPMorgan’s earnings to be $2.37 per share, unchanged from last year. Revenue is anticipated to see a modest increase of 0.10% to $28.54 billion.

Outlook

For the fiscal 2019 period, the banking major expects net interest income to exceed $58 billion aided by interest rate hikes and growth in loan and deposits. On an adjusted basis, expenses are going to come in below $66 billion range, an increase of 4% from last year.

When it comes to the first quarter guidance, net interest income is forecasted to be flat compared to last reported quarter. Expenses are projected to increase mid-single digits over last year. The bank also has cautioned that markets revenue in the Q1 period would see a dip over last year based on the market conditions.

Q4 Performance

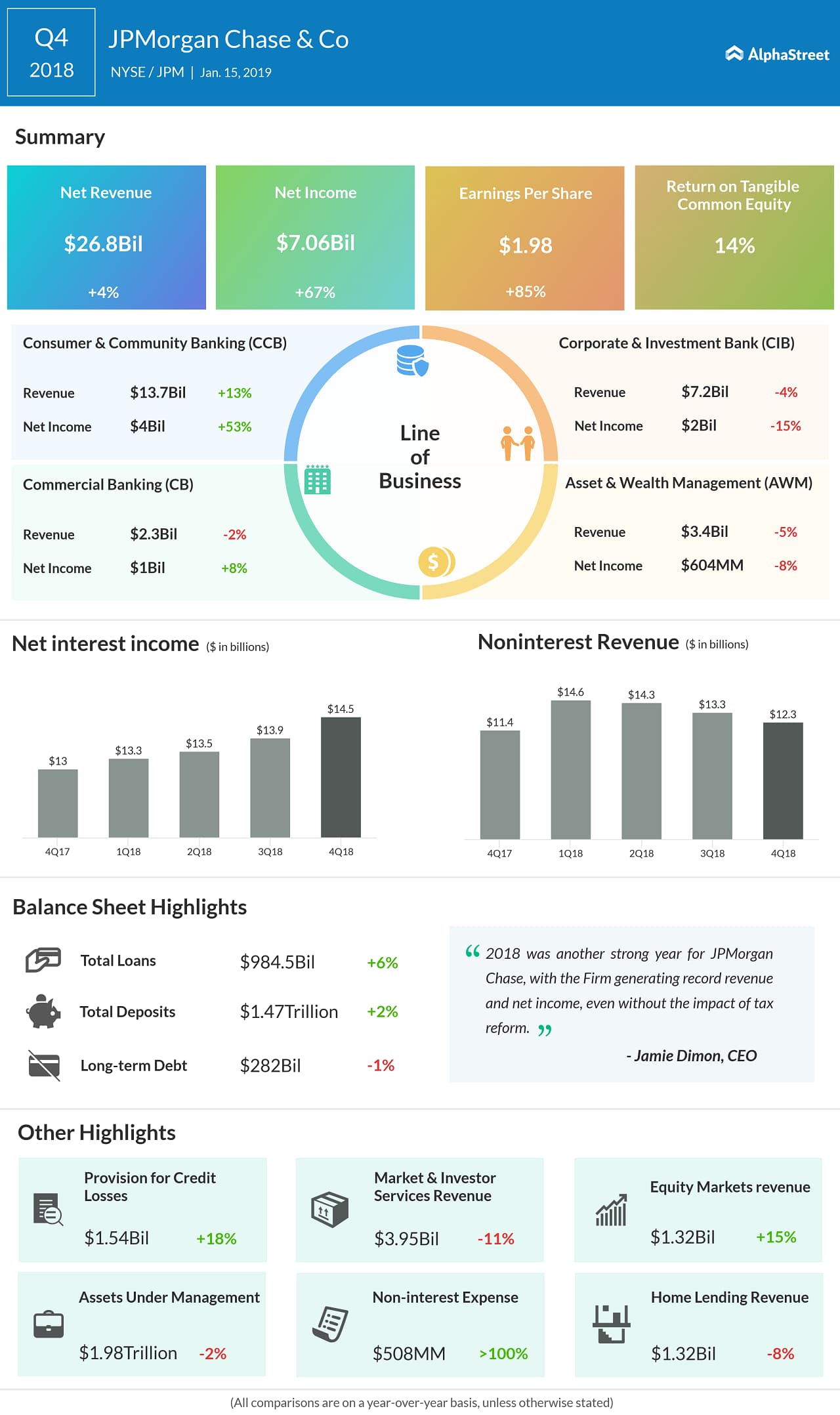

In January, when the firm reported its Q4 results, sales topped estimates but earnings failed to beat analyst expectations. This is the first time the bank has missed the expectations on the profit front breaking the 15-quarter streak, hurt by lower trading revenues. Bank’s consumer business reported solid numbers helped by deposit growth, improved card margins, and balanced growth. All other divisions saw a dip in revenues.