Social media stocks benefited in general during the COVID-19 pandemic this year as people who stayed at home spent more time online to keep themselves updated on the latest news as well as to search for new sources of entertainment. Twitter Inc. (NYSE: TWTR) benefited from this trend in terms of higher engagement levels. Looking ahead, there are a few factors that could determine the company’s performance going into 2021.

Advertising

Like most players in the digital advertising space, Twitter’s revenues were hurt by the drop in advertising due to reductions in ad budgets and other cost-cutting measures by companies. During the first two quarters of FY2020, total revenues dropped 20% and 15%, respectively, quarter-on-quarter, dragged down by sequential decreases in advertising revenues of 23% and 18%.

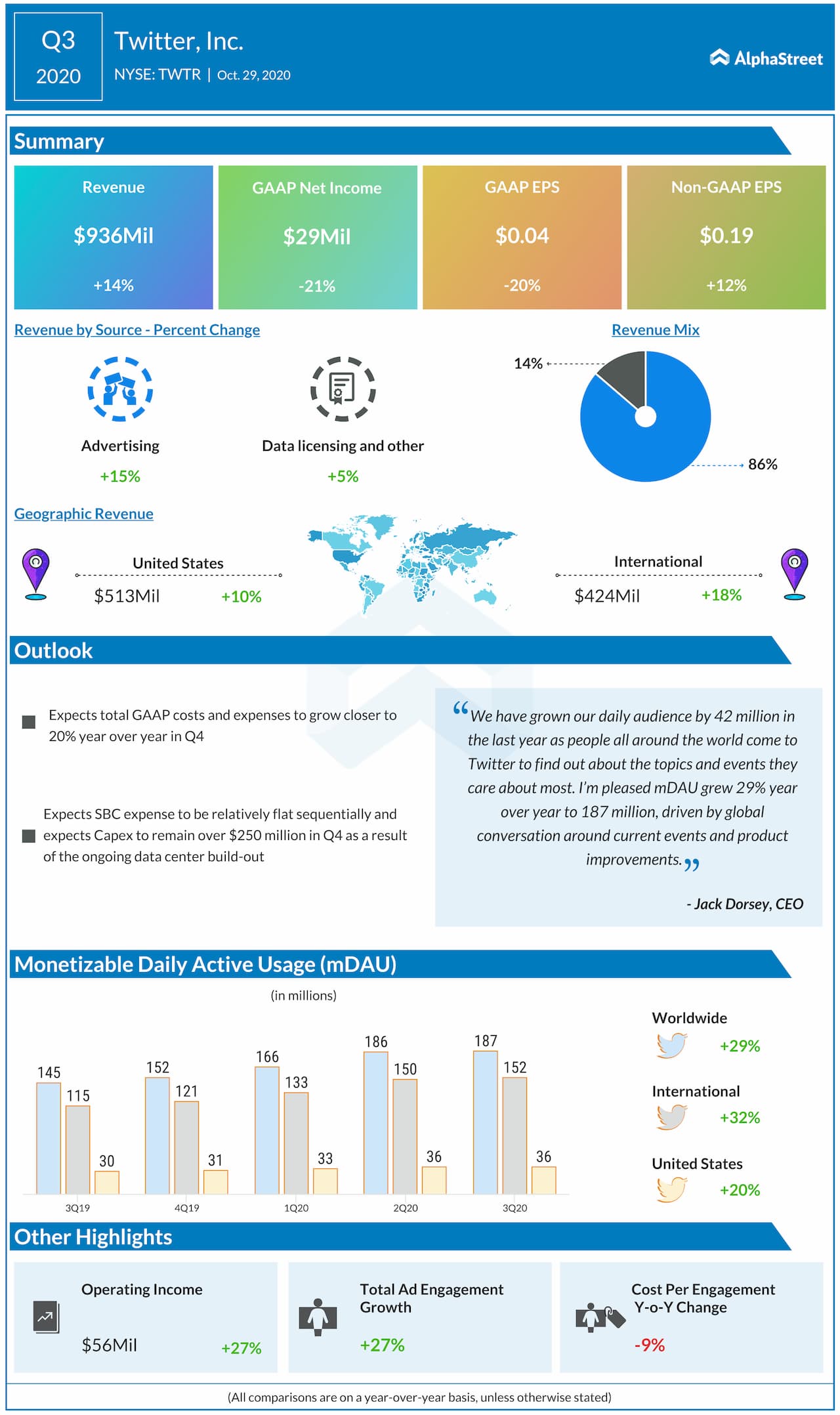

Advertiser demand slowed down in March and into the second quarter of 2020 but picked up during the third quarter as advertisers increased their investment in order to drive engagement around the return of events and delayed product launches. On a sequential basis, ad revenues rose 44% during the third quarter, in turn driving a 37% growth in total revenues.

The holiday season, which is more digital than ever this year, is likely to bring a spike in ad revenues and festival-related promotions could drive growth in advertising. This momentum could benefit the company going into 2021 but any unexpected impacts from the pandemic could take a toll on performance.

Engagement

Twitter saw a steady increase in engagement levels during the first three quarters of this year. During the most recent quarter, global monetizable daily active usage (mDAU) increased 29% year-over-year, with a 20% increase in the US and a 32% growth internationally. mDAU remained steady on a sequential basis too as users turned to the platform for updates related to the health crisis as well as other entertainment content.

Looking ahead, engagement levels will continue to benefit from news related to the pandemic and vaccines. In addition, the resumption of major events cancelled during the pandemic and the related content will drive engagement levels further as well as open up monetization opportunities for the company.

Partnerships and acquisitions

Twitter recently made an acquisition and struck a partnership, both of which are driving hopes for the company’s future performance. Last week, TechCrunch reported that Twitter announced the acquisition of Squad, an app which allows users to share their screens while simultaneously video chatting.

This feature aims to expand screen-sharing beyond formal business meetings and bring them to daily conversations. Squad has a large user base made up primarily of teenage girls. The app was shut down the day after the announcement and Twitter might integrate it with its core application.

At the same time, Twitter also announced a partnership with Snap (NYSE: SNAP) which will allow users to share tweets directly to Snapchat through an integration. This one-of-a-kind deal is expected to drive usage and engagement levels for both companies.

Better content

Twitter’s toxic content has always been a bone of contention. However, the company has been taking measures to ‘improve the health of its platform’ as it terms it by trying to stem the spread of false news and by weeding out fake accounts.

Twitter rolled out more conversational controls during its most recent quarter and began experimenting with a feature that asks people to read an article fully before retweeting it. This has received good response from users who have begun actively using them.

The company is also organizing content around topics and interests thereby helping users find information that is more relevant to them thereby driving engagement.

All these factors are likely to drive strong performance for Twitter in 2021. The stock has gained 62% since the beginning of this year.

Click here to read the full transcript of Twitter’s Q3 2020 earnings conference call