Shares of General Mills, Inc. (NYSE: GIS) were down over 3% on Wednesday, following the release of the company’s second quarter 2025 earnings results. The branded foods supplier beat expectations on both revenue and profits but lowered its earnings guidance for the full year of 2025, causing the stock to drop. Here are the key takeaways from the report:

Better-than-expected numbers

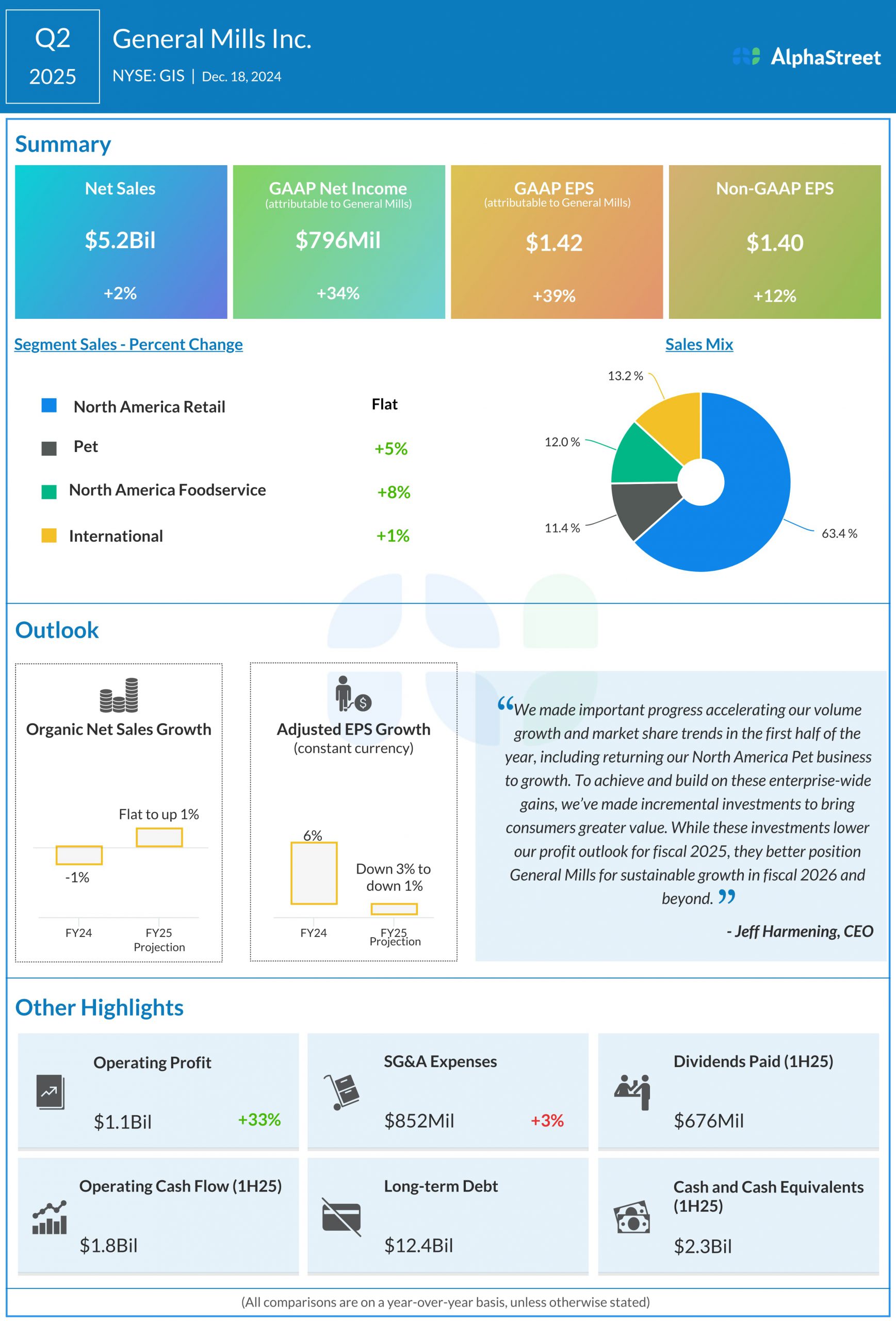

General Mills’ net sales for Q2 2025 increased 2% year-over-year to $5.24 billion, beating estimates of $5.14 billion. The growth was driven by higher pound volume, partly offset by unfavorable net price realization and mix. Organic sales rose 1%. GAAP earnings per share grew 39% to $1.42. Adjusted EPS increased 12% in constant currency to $1.40, beating projections of $1.22.

Business performance

In the second quarter, General Mills recorded sales increases across all its segments, except for North America Retail, where sales remained flat. Sales in North America Retail remained relatively unchanged compared to the prior-year period as favorable pricing and mix were offset by lower pound volume. Organic sales for the segment rose 1%. Sales grew in the US Morning Foods and US Snacks divisions while the US Meals & Baking Solutions division saw sales decline.

Sales in the North America Pet segment increased 5% year-over-year on a reported and organic basis to $596 million. The growth was driven by higher pound volume, partly offset by pricing and mix. The segment benefited from gains in the dry and wet pet food as well as the pet snacks categories.

The proposed acquisition of Whitebridge Pet Brands’ North American premium cat feeding and pet treating business will bring the Tiki Pet and Cloud Star portfolio of brands under the General Mills umbrella. The Tiki Cat brand is a leader in wet cat food, which is the fastest-growing segment within the US pet food category. Tiki Cat witnessed retail sales growth of over 20% in the past year, and with household penetration still under 2%, GIS sees vast opportunity for growth going forward.

Sales in the North America Foodservice segment grew 8% on a reported and organic basis to $630 million. Sales in the International segment rose 1% to $691 million while organic sales were down 3% due to declines in China and Brazil.

Guidance cut

GIS lowered its earnings guidance for fiscal year 2025 to reflect promotional investments made in certain categories to generate value for consumers. The company now expects adjusted EPS to be down 3% to down 1% in constant currency versus the previous outlook of down 1% to up 1%. GIS continues to expect organic sales to range between flat to up 1% but it now targets the lower end of the range due to these higher promotional investments.