For Medtronic plc (NYSE:MDT), the last two quarters were disappointing as healthcare institutions postponed routine medial procedures and channeled their resources into the fight against COVID-19. While speculation is rife about the long-term impact of the pandemic on the business world, the recent improvement in demand conditions suggests that Medtronic might get back on track sooner than expected.

Read management/analysts’ comments on Medtronic’s Q1 2021 financial results

Medtronic is the largest medical device manufacturer, serving healthcare professionals, patients and hospitals across the world. It has been enjoying stable market share for all the four business units – Cardiac and Vascular Group, Minimally Invasive Technologies Group, Restorative Therapies Group and Diabetes Group.

Growth vs. Competition

The rapidly growing medical device market is witnessing stiff competition nowadays, prompting the companies to innovate and adopt measures to retain market share. Medtronic’s new CEO Geoff Martha, who assumed office earlier this year, is working on a plan to achieve operational efficiency by allowing the business segments to function more independently.

The re-look at business model is of great significance at a time when the demand for medical devices and technology is at a record low due to postponement or cancellation of normal therapeutic procedures to give priority to pandemic-related activities. Having secured multiple FDA approvals, the company looks to overcome the present adversity on the strength of its pipeline.

Expansion Plan

There are strategic M&A deals on cards so that the company’s products and services would reach a wider market in the coming years. The latest move in that direction was the acquisition of Titan Spine last year, while insulin pen maker Companion Medical is all set to join the Medtronic fold before year-end.

The current liquidity position is comfortable enough for the company to pursue its development goals, mainly on the product front. Meanwhile, capital investments and elevated operating costs will put pressure on the bottom-line.

Addressing analysts at the post-earnings conference call, Martha said the business recovered since the early days of the pandemic at a faster-than-expected pace. “Our pipeline is kicking in and we’re increasing our cadence of tuck-in M&A. But most importantly, we’re finding a new gear at Medtronic and we’re becoming a more nimble and a more competitive organization. And in the coming weeks, you’re going to hear more from me on this topic as we begin to outline the new Medtronic,” he added.

Investor Day

The market will be looking for additional details on the business strategy and outlook when the company holds its Investor Day in mid-October — postponed from June due to the unfavorable business environment.

The ongoing improvement in procedure volumes, after the slowdown in recent weeks, should help Medtronic regain momentum during the remainder of the year. The recovery became more visible in the latest quarter, with sales picking up every month. Going by experts’ projection, the company is set to enhance shareholder value and investors would not want to miss the opportunity. Right now, the valuation is just right for investors to add the stock to their portfolios.

On the top-line, May was better than April and June was better than May. And that improvement has continued into July and August. While there is still uncertainty regarding the recovery, if these trends hold, we would expect our second quarter organic growth rate to improve at a rate similar to what we saw between the fourth and the first quarters, where the fourth was down 25% and the first declined 17%.

Karen Parkhill, chief financial officer of Medtronic

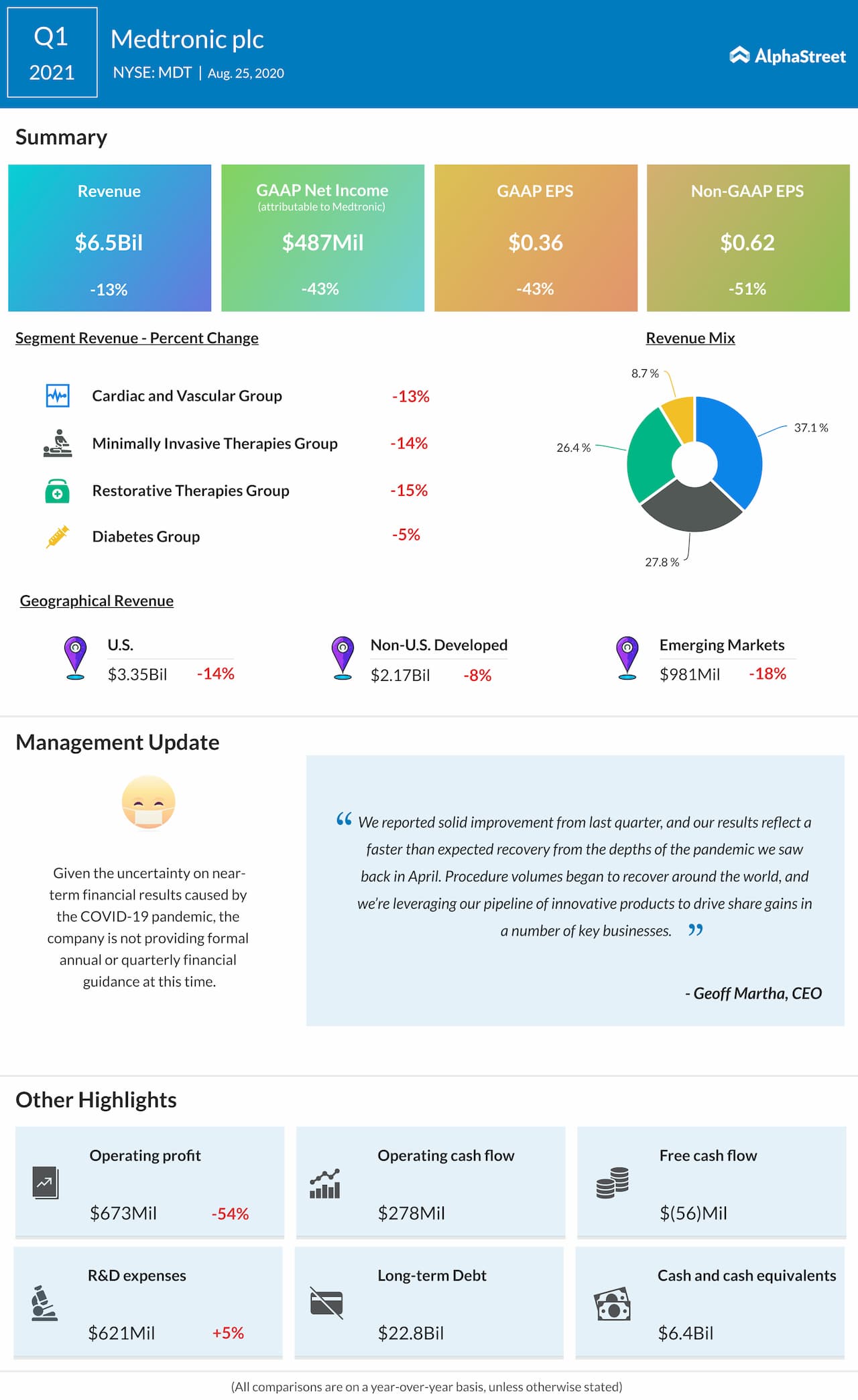

All the four business segments contracted in the first three months of fiscal 2021, resulting in a 13% fall in revenues to $6.5 billion. The top-line crash and an increase in expenses dragged down earnings to $0.62 per share. Overall, the outcome broadly matched the company’s performance in the fourth quarter but came in above analysts’ consensus forecast.

Sluggish Recovery

Medtronic’s stock is yet to fully recover after retreating from the peak a few months ago when markets suffered a big selloff. The shares got a major boost Tuesday after the company reported stronger-than expected first-quarter profit, but they are still trading down 10% from the levels seen at the start of the year.