For a large number of people, streaming videos and TV shows are the first preference when they want to keep themselves engaged during the lockdown. Streaming giant Netflix, Inc. (NASDAQ: NFLX) witnessed a spike in subscriptions during the pandemic, but the momentum waned as the market reopening gathered pace.

Buoyed by the COVID-induced tailwinds, the company’s stock hit a record high in November last year. But it pulled back soon and has been in a free fall since then, amid speculation that the boom is over. But the slowdown cannot last long, for Netflix is a market leader with strong fundamentals.

Buy the Dip?

The valuation remains high but the stock has become more affordable after the recent dip, which can be an entry point for many buyers. Experts are generally bullish on NFLX’s prospects this year. That said, it would be a good idea to wait until next week’s earnings, before investing.

Netflix, Inc. Q3 2021 Earnings Call Transcript

Creating hit series and films tops the company’s growth agenda. Of late, the management’s focus has been on reviving its content acquisition program and bringing production back to the pre-pandemic levels, after a long period of muted activity. The company is also making major inroads into gaming and is working on games based on its popular shows. Interestingly, free cash flow turned positive during the crisis due to a fall in production/content-related expenses.

From Netflix’s Q3 2021 earnings conference call:

“We are focused on delivering value every time, one of our members tries to figure out what they want to watch next, every time they figure out how much they want to spend to entertain themselves, we want to be in that equation. And we do that, I think if we focus on that, the way we have for films, where we have for series and then we will for games that we are going to be delivering hours and hours and hours of entertainment, and hours and hours of joy for our members.”

CapEx

The heavy capital spending would weigh on profitability during the remainder of the fiscal year and beyond. As a result, subscription growth and margin performance are likely to moderate. While the aggressive international expansion can have a positive effect on performance, it would be mostly offset by the relatively low margins in overseas markets.

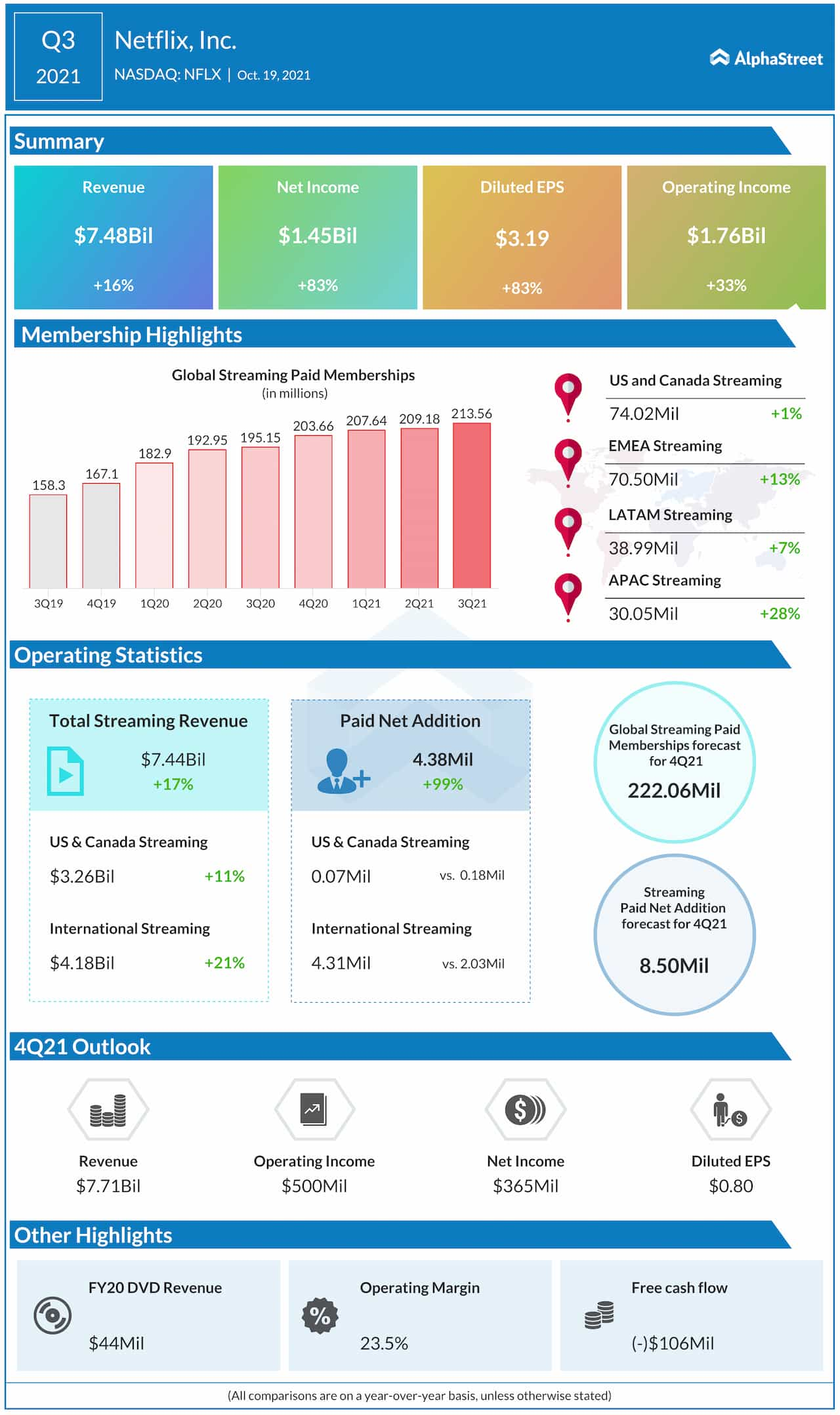

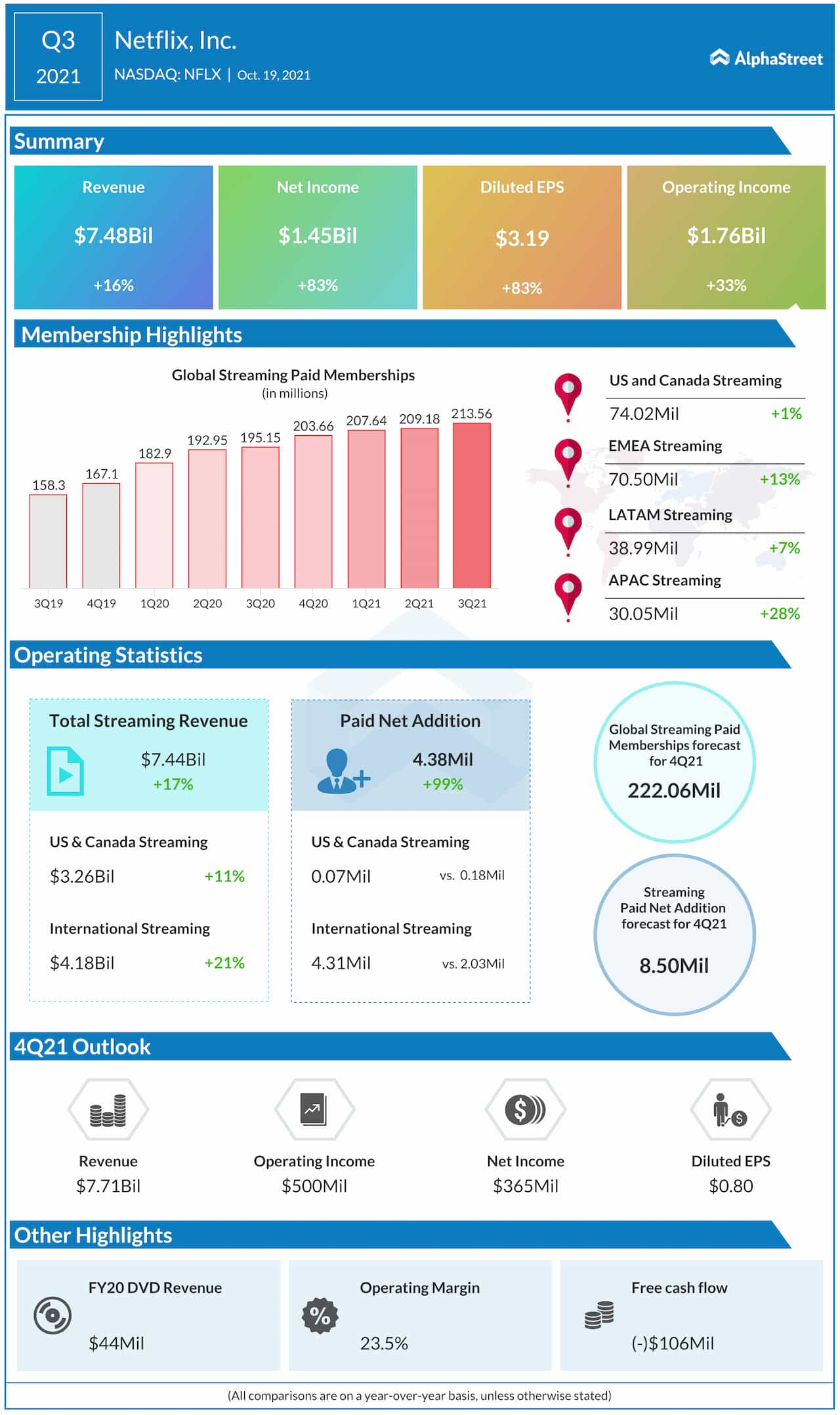

In the third quarter, the company’s subscriber base expanded to 214 million, with the Asian market contributing the most. The recent trend shows that the U.S and Canadian markets might be nearing saturation in terms of subscriber addition. However, the management has exuded confidence that there is enough room for further growth. Third-quarter revenues increased 16% annually to $7.48 billion, which was broadly in line with the estimates. Earnings jumped to $3.19 per share and beat the street view.

Q4 Report Due

Netflix’s fourth-quarter earnings report is expected on January 20, after the regular trading session ends. The event is likely to elicit significant investor interest since market watchers have warned that earnings would drop to $0.82 per share from $1.19 per share in the prior year. However, experts see fourth-quarter revenues growing in double digits to $7.71 billion.

Roku Stock: Why is it a good idea to buy the recent dip

NFLX has lost 14% so far this year, extending the downtrend that started after the last earnings release. The weakness persisted during Friday’s regular session and the stock traded slightly above $517 in the afternoon.