And of course, one cannot ignore the

contribution of Ridley Scott and his Alien franchise!

Anyways, the emerging interest has given rise to a new market, one that is pretty much restricted to the super rich who are bored with regular aircraft and Hawaiian holidays – Space tourism. And billionaires like Sir Richard Branson and Jeff Bezos are grinding away to make this fiction-like project a reality at the shortest possible timeline.

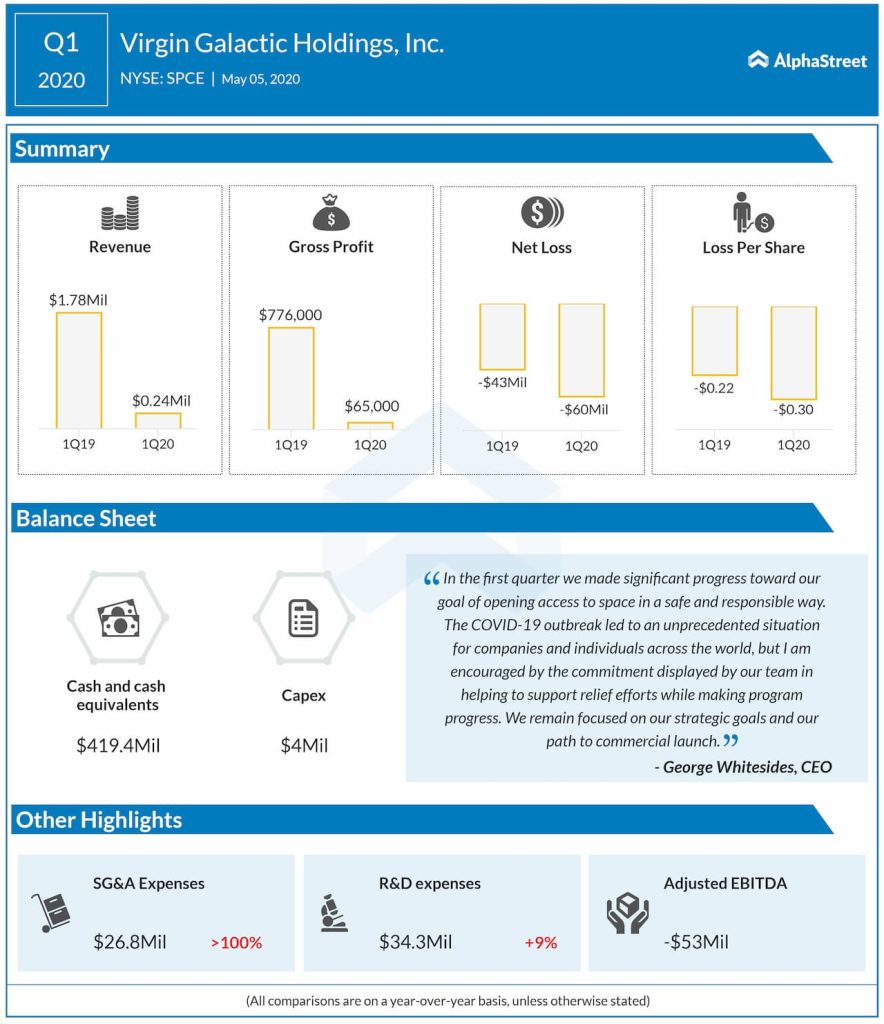

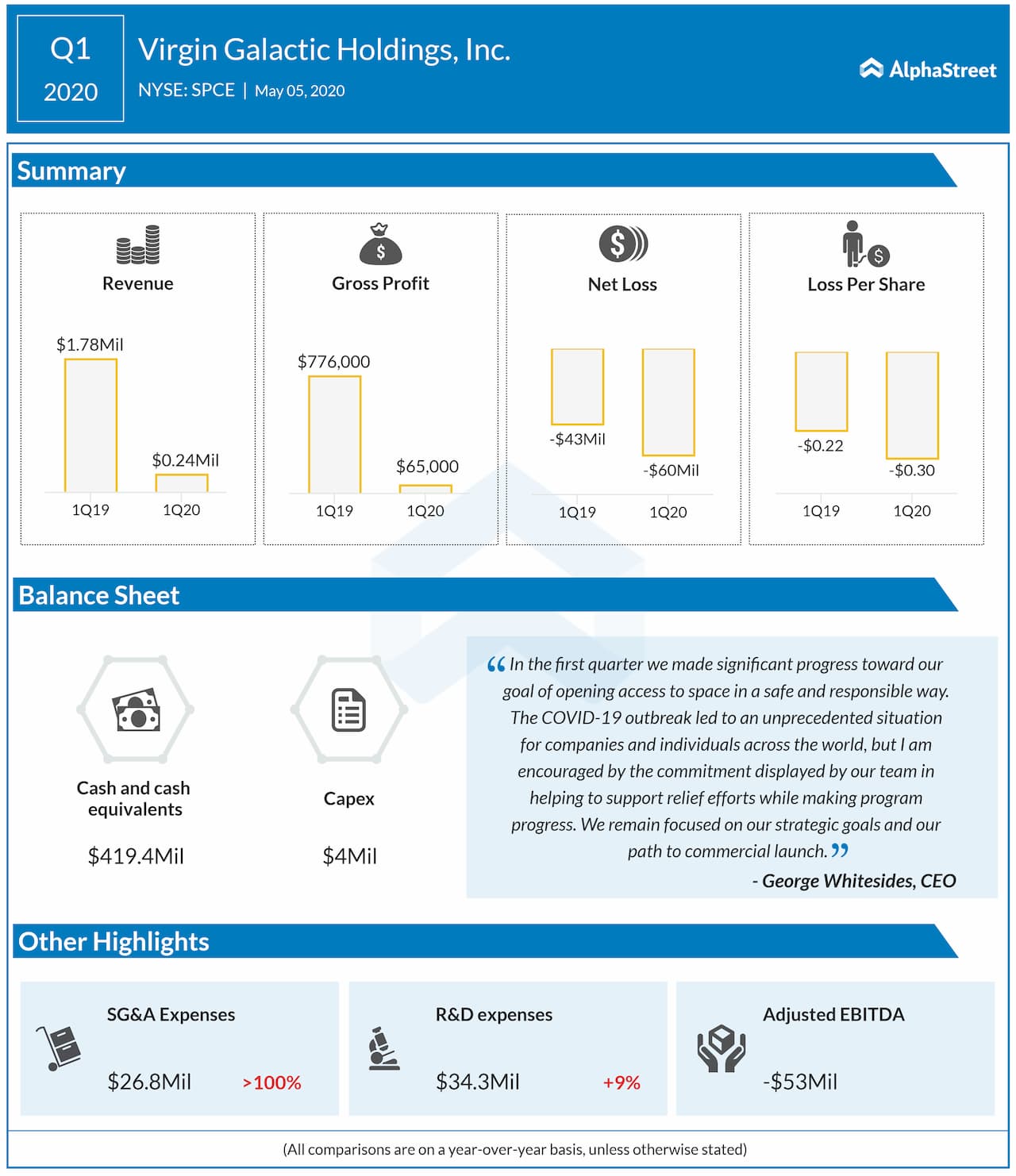

If you have great hopes on space tourism as an investor, your only option is Virgin Galactic (NYSE: SPCE). The space company’s stock gained about 9% after it reported quarterly earnings yesterday, despite missing earnings estimate by a wide margin. The market preferred to weigh more the operational updates, as well as an agreement with NASA.

[irp posts=”59756″]

A budding market

Firstly, the company said its operations have not been materially impacted by the COVID-19 pandemic. About 90% of the employees are currently working at the facilities, and last week the company conducted the first successful glide flight of its spaceship VSS Unity.

Notably, over 400 people have paid refundable

deposits to reserve their ticket to the stars. If all these reservations are converted,

it would mean over $100 million in future revenues for Virgin. One might think

the pandemic might have forced at least some of them to reconsider their decision

of an expensive space travel. Ticket costs between $200,000 and $250,000 per

person. Listen to what CEO George Whitesides has to say:

“We’ve seen no meaningful increase in refund requests from our future astronauts as a result of COVID-19. We think the major factor here is that the financial profile many of our customers helps limit the impact of economic downturns on our business.”

That’s right. Millionaires don’t forego

their dreams so easily.

NASA deal

Meanwhile, the Las Cruces, New Mexico-based firm has inked an agreement with NASA, which in turn, is expected to bolster the engineering and development of hyper-speed technologies. The deal is also expected to give credibility during the regulatory approval process. Whitesides said during the call:

“We already have our commercial launch license, which allows us to conduct spaceflight missions. We are continuing to go through the final process to fly paying customers by providing the FAA with data that verifies and validates elements of our commercial license. We have now cleared 24 out of 29 of the verification and validation elements.”

A debt-free balance sheet and a strong cash balance of $419 million place Virgin Galactic at a highly confident spot at the end of Q1.

Virgin vs Blue Origin

Praising the work done by Jeff Bezos’s Blue Origin, Whitesides said he believes space tourism is a market big enough for multiple players to thrive. While Virgin goes with a winged vehicle architecture that is aimed at the best experience to suborbital spaceflight, Blue Origin has chosen a model that may, later on, be used for interplanetary exploration.

So what’s the difference and how does a

customer choose between the two? Here is how the CEO explains:

“Ours is around 90 minutes and theirs about 11. But I do think that there’s going to be great experiences with both. And we wish the Blue team well as they embark on a very exciting thing, which is a focus on lunar exploration and that will be terrific as we pursue sort of point-to-point stuff back on planet Earth.”

[irp posts=”33708″]