Shares of PepsiCo Inc. (NASDAQ: PEP) gained on Tuesday after the company surpassed expectations on both revenue and profits for the second quarter of 2022 and raised its outlook for the full year. The beverage giant continues to deal with inflationary pressures which took a toll on its earnings for the quarter and which it expects to persist for the remainder of the year.

Quarterly performance

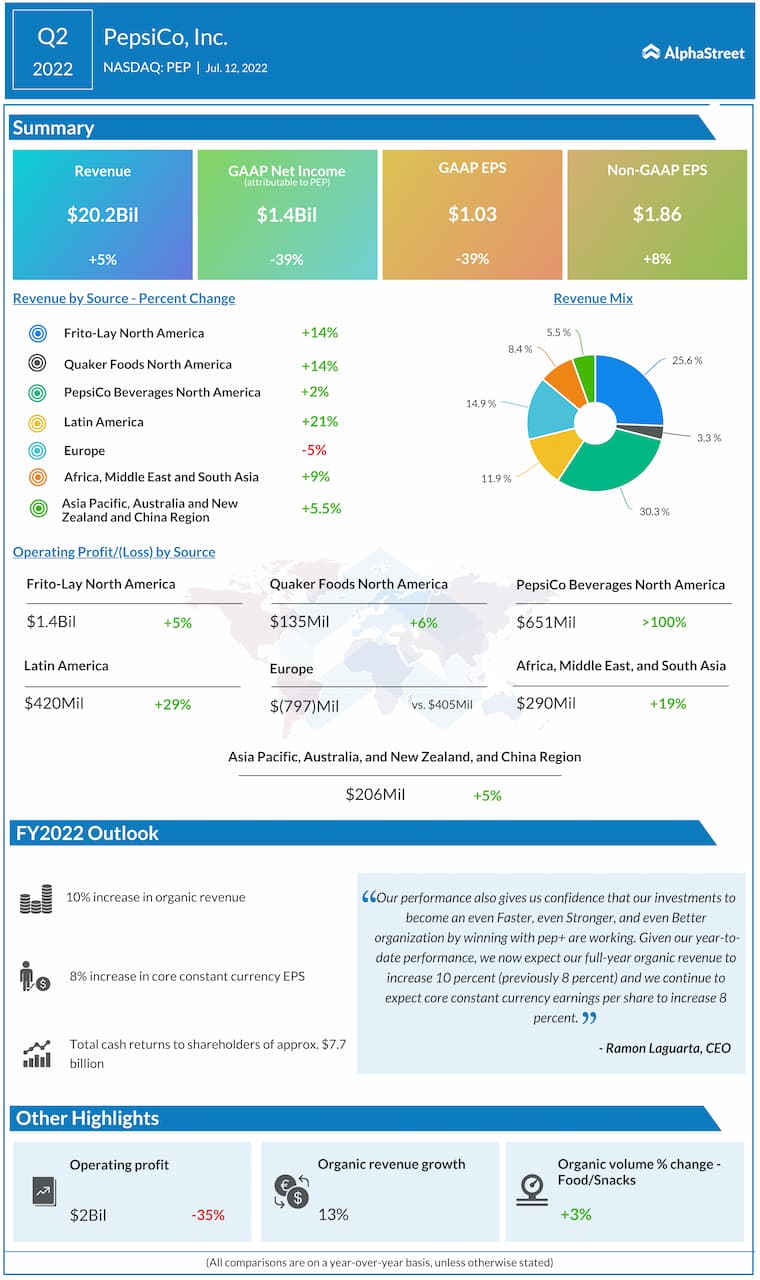

Net revenue for Q2 rose 5.2% year-over-year to $20.2 billion, beating estimates. On an organic basis, revenue grew 13%. Organic revenue growth was broad-based across regions with double-digit increases in the North America and International markets. While GAAP EPS fell 39% to $1.03, core EPS rose 8% to $1.86, exceeding market expectations. Core gross margin dropped 45 basis points due to inflationary pressures.

Trends

During the quarter PepsiCo benefited from a diversified product portfolio and strong positions in its largest markets. The company recorded organic revenue growth of 17% in its global convenient foods business and 8% in its global beverage business in Q2.

The Frito Lay segment gained market share in the macro-snack and savory snack categories with brands such as Doritos, Cheetos and Ruffles delivering double-digit revenue growth. Brands such as PopCorners, Smartfood and SunChips, which are aimed at health-conscious customers, also witnessed double-digit revenue growth.

Within the Quaker Foods division, the company recorded double digit revenue growth for rice and pasta, lite snacks, cookies, snack bars, oatmeal and ready-to-eat cereal categories. Within PepsiCo Beverages, brands such as Gatorade, Aquafina and LIFEWTR delivered double digit revenue growth while Pepsi and Mountain Dew saw growth in single digits. The company continues to invest in its Zero Sugar offerings to offer more healthy choices to customers.

PepsiCo witnessed double digit organic revenue growth in developing and emerging markets such as Mexico, Brazil, India, Saudi Arabia, Turkey and Poland. Its international convenient foods business saw growth with a 20% increase in organic revenue while its international beverages business delivered organic revenue growth of 7%.

Outlook

Looking ahead, PepsiCo believes it is well-positioned to operate in this challenging environment as it holds a strong footing in growing categories. It expects its North American businesses to remain resilient and most of its international markets to remain strong despite the macroeconomic and geopolitical volatility.

The company expects higher input cost inflation for the latter half of the year and it is focusing on managing these expenses through various initiatives. PepsiCo raised its organic revenue growth outlook for FY2022 to 10% versus the previous guidance of 8%. The company continues to expect core constant currency EPS growth of 8% for the year. Core EPS is expected to grow 6% YoY to $6.63.

Click here to access the full transcripts of the latest earnings conference calls