Shares of Procter & Gamble (NYSE: PG) gained 2.7% on Friday after the company reported better-than-expected results for the fourth quarter of 2021. P&G, however, warned that it would face a challenging environment during the upcoming fiscal year with regards to costs and operations.

Quarterly numbers

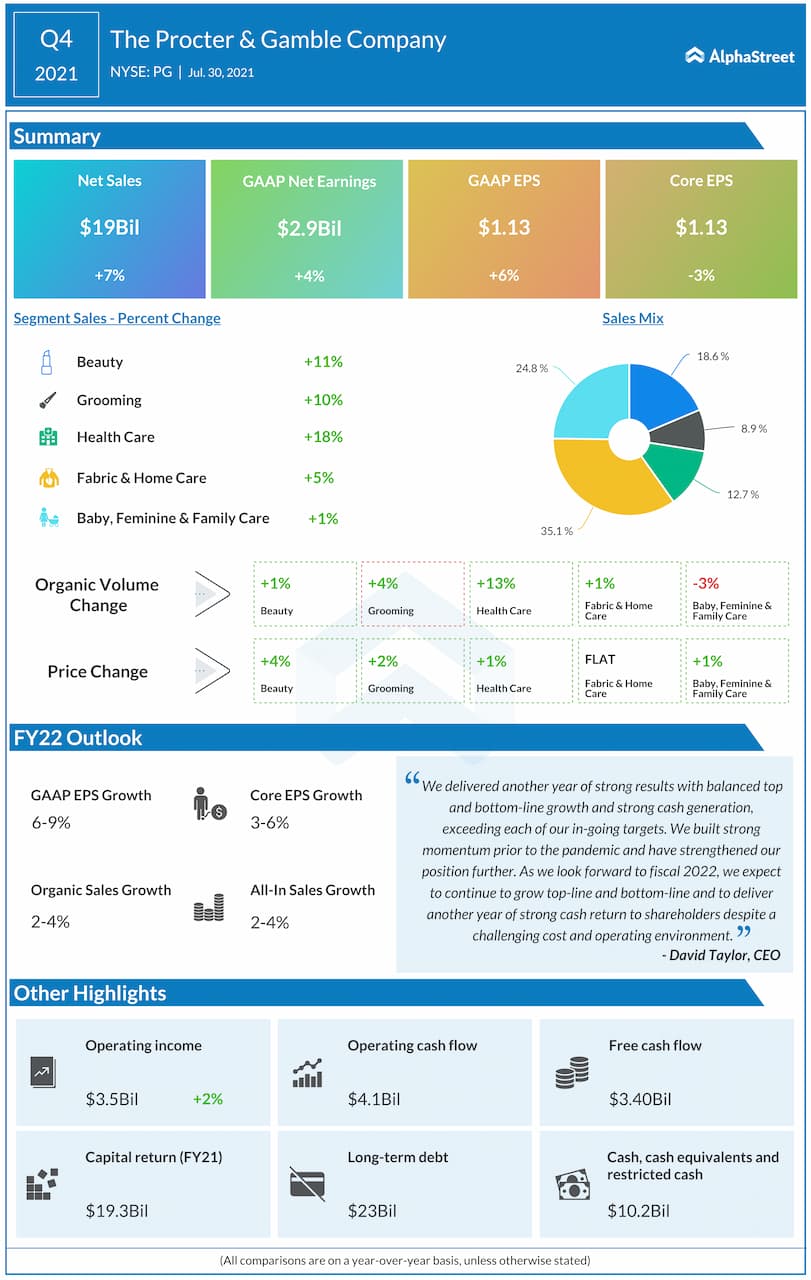

Consolidated net sales increased 7% to around $19 billion in Q4 2021. Organic sales rose 4% helped by increases in shipment volume and pricing as well as a positive mix impact. The company saw strong growth in the Health Care segment and the Skin and Personal Care category during the quarter helped by higher pricing.

Reported EPS rose 6% to $1.13 while core EPS fell 3% to $1.13 in Q4 compared to the year-ago quarter. Both the top and bottom line numbers exceeded expectations.

Trends

Sales growth was highest in the Health Care segment during the fourth quarter at 18% on a reported basis and 14% on an organic basis. This was driven by strength in the Oral Care and Personal Health Care categories fueled by innovation and higher pricing.

The Beauty segment witnessed strong growth as reported sales increased 11% and organic sales rose 6%. Within Beauty, Skin and Personal Care posted double-digit organic sales growth helped by higher pricing and a pickup in sales of the SK-II brand which was impacted by the pandemic last year.

Sales in the Grooming segment increased 10% on a reported basis and 6% on an organic basis. Organic sales rose mid-single digits in Shave Care and Appliances helped by pricing and the launch of premium products.

Shave Care saw volumes increase compared to last year when consumption was low amid the pandemic while Appliances saw a drop in volumes as the pandemic-related consumption increase evened out.

Fabric & Home Care saw reported sales increase 5% and organic sales increase 2%. In Baby, Feminine & Family Care, sales grew 1% on a reported basis but fell 1% on an organic basis.

Outlook

For the full year of 2022, P&G expects sales to grow 2-4% on both a reported basis and organic basis. GAAP EPS is expected to grow 6-9% and core EPS is expected to grow 3-6% versus the FY2021 GAAP and core earnings of $5.50 and $5.66 per share respectively. P&G expects headwinds of around $1.9 billion after-tax from higher commodity and freight costs.

Management change

Procter & Gamble will see a change in its management team as Chief Operating Officer Jon R. Moeller will succeed David Taylor as President and CEO, effective November 1. David Taylor will take over the role of Executive Chairman the same month.

Click here to access the full transcript of Procter & Gamble’s Q4 2021 earnings conference call