Q2 results

Outlook

Similar to last quarter, the owner of the Snapchat social media app didn’t provide financial guidance for Q3. However, thus far in Q3, the company estimates year-over-year revenue growth to be 32% through July 19. Snap cautioned that operating conditions may remain volatile and economic conditions could further deteriorate in the future.

Historically, advertising demand in Q3 has been bolstered by the back to school season, film release schedules and the operations of various sports leagues. These factors are unlikely to materialize in the same way they have done in the prior years. Snap stated that it will be difficult to predict how these factors may impact advertising demand in the remainder of Q3.

Snap estimates full quarter revenue growth rate is likely to be below its quarter-to-date estimated actual growth rate and the company has built an internal investment plan based on revenue growth of approximately 20%.

Expenses

Snap forecasted combined cost of revenue and operating costs to grow in the low-to-mid 20s range in Q3. Given that a small minority of the cost structure varies directly with revenue in the short term, the company does not expect substantial variance in the cost growth estimate regardless of the revenue outcome in Q3.

Reasons for the downtrend

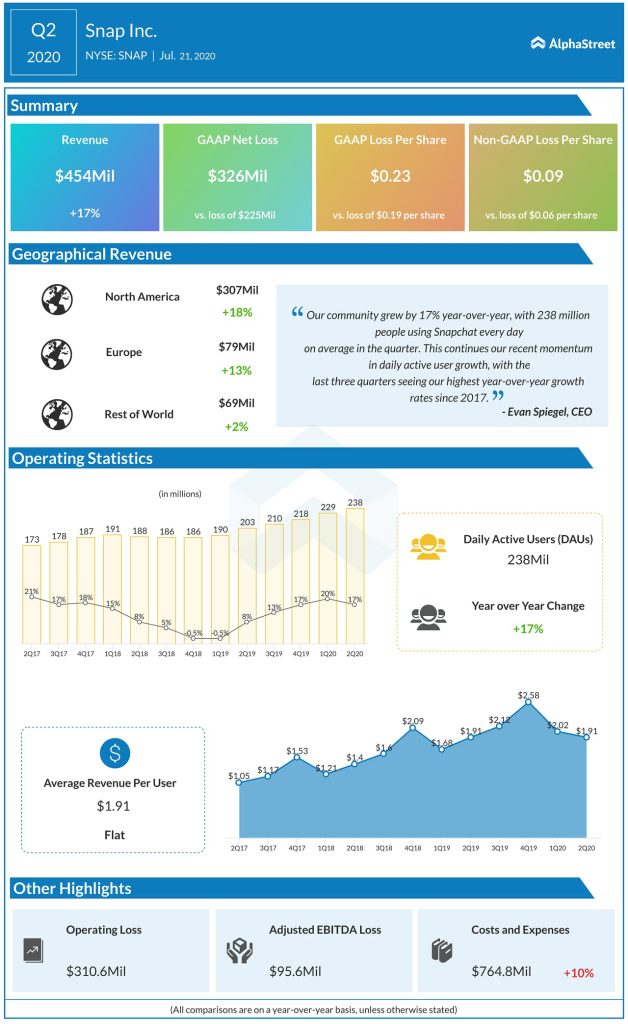

Snap’s daily active users of 238 million in Q2 was less than Wall Street’s estimates. Snap projected daily active users count to be between 242 million and 244 million in Q3. This implies year-over-year growth of approximately 15% to 16%, or 32-34 million daily active users.

Revenue growth of 17% in the second quarter was not impressive comparing the firm’s previous quarters’ growth rate.

During Q2 earnings call, CFO Derek Andersen said,

“The operating environment has remained challenging as COVID-19 continues to impact macroeconomic conditions and the businesses of our advertising clients. Many of our advertisers have seen interruptions in their businesses, especially those that rely on in-person interaction with their customers such as restaurants, entertainment venues, transportation services, physical retailers and hospitality providers among others.”

ADVERTISEMENT

Today, Snap’s rival Twitter (NYSE: TWTR) reported its second quarter 2020 results. The company swung to a loss with a topline decline of 19%. While advertising revenue declined 23%, monetizable daily active users rose 34% to 184 million in the quarter.