CVS has an Edge

Also read: COVID-19 gave these companies an opportunity

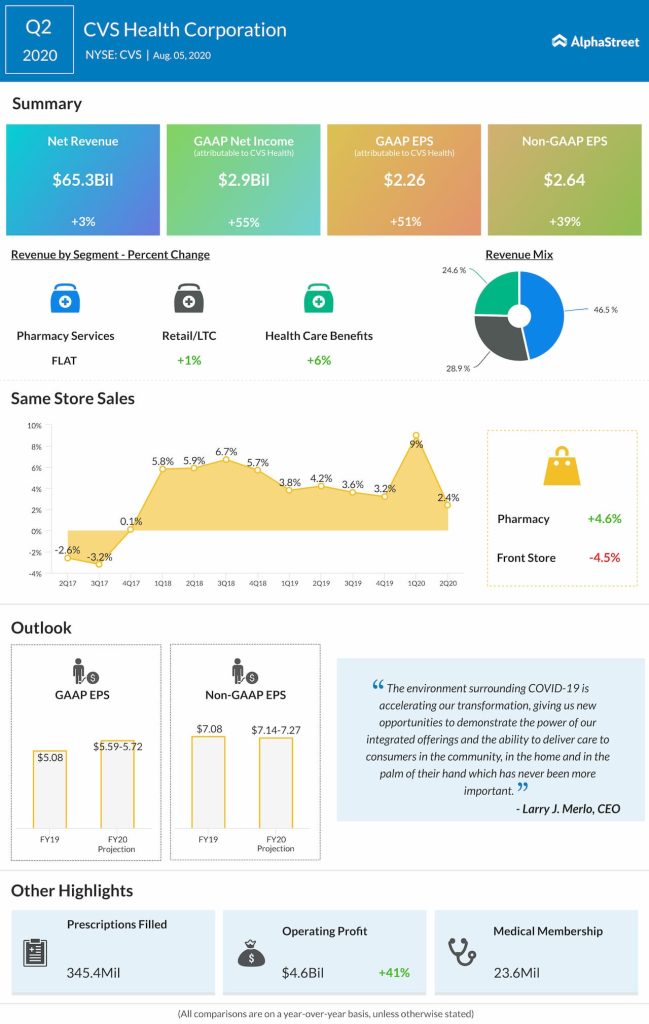

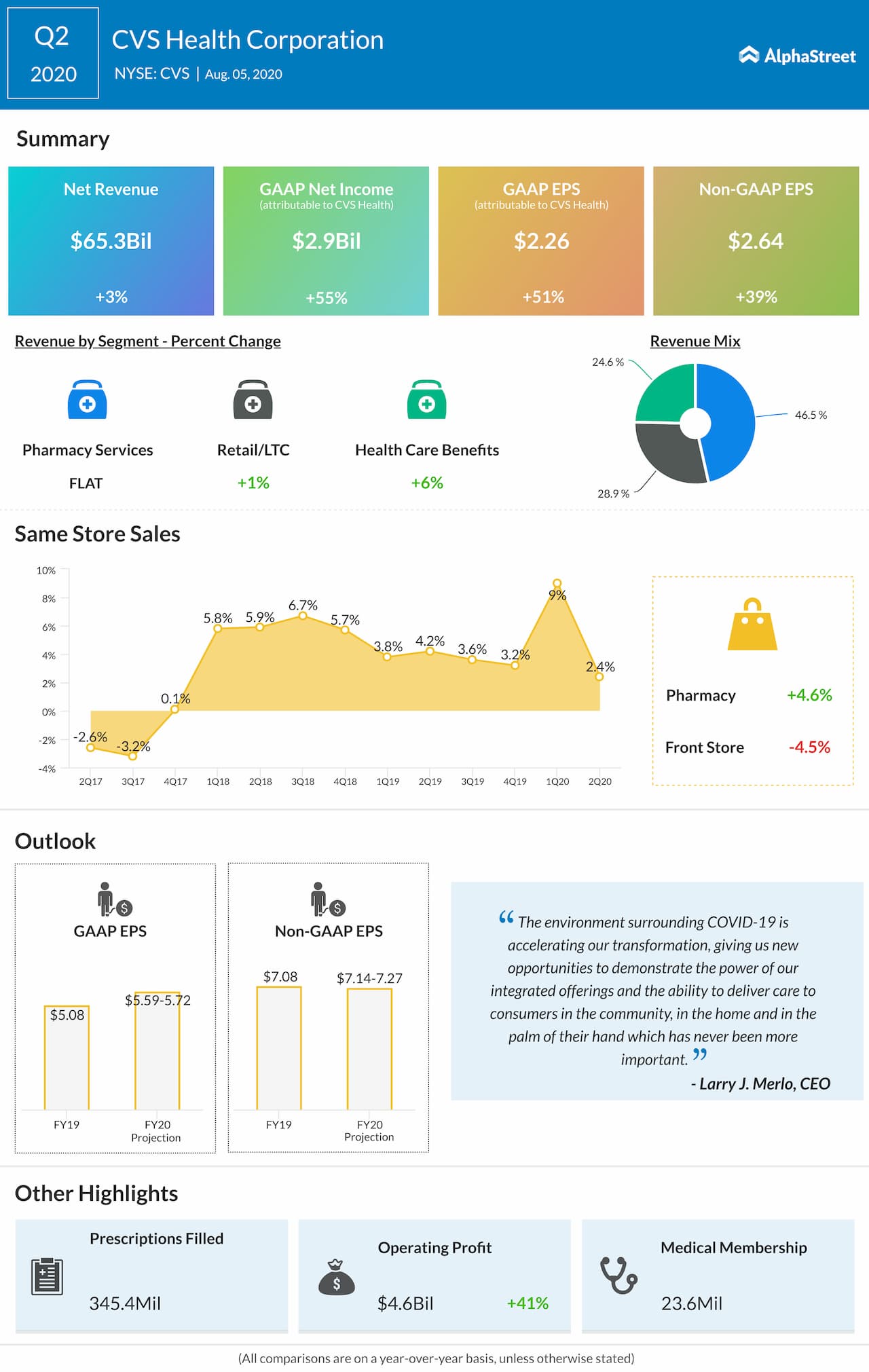

“The environment surrounding COVID-19 is accelerating our transformation and is providing new opportunities to demonstrate the power of our integrated offerings and the ability to deliver care to the consumer in the community, in the home and in the palm of their hand.” Larry Merlo, chief executive officer of CVS, told analysts during the second-quarter conference call.

In the case of Walgreens, the only business segment that remained unaffected in the third quarter is specialty pharmacy, but it is a trend that might help the company overcome the weakness in the other areas of the business — especially in the overseas market — in the final months of fiscal 2020. Meanwhile, encouraged by its strong cash position, the company has raised the dividend once again, as it did in the last four decades.

Growth Initiatives

Taking a cue from the dwindling store footfall, Walgreens has set investing in e-commerce and home delivery capabilities as its first priory. This strategy gels with the management’s assumption that ‘certain aspects of customer behavior may change permanently.’ Since the company has a long way to go before achieving its cost-reduction targets – SG&A expenses surged 32% in the last quarter — the expansion plan might put additional strain on liquidity.

We were faced with significant footfall declines across most of our markets in Retail Pharmacy International, and especially in the UK. This was only partly compensated by much faster growth from our online businesses. And finally, Pharmaceutical Wholesale delivered yet another strong performance. The other two bright spots in the quarter were cost management and cash flow.

James Kehoe, chief financial officer of Walgreens Boots Alliance

Going by the outlook, it seems Walgreens’ operating statistics would not be much different when it reports fourth-quarter results on October 15, with the continuing slump in the UK offsetting an estimated improvement in US operations. But things should change for the better next year when the retail healthcare sector, like most other businesses, is expected to pick up momentum. But it might not be a good idea to invest in the stock right now though analysts predict decent gains in the long-term. As of now, investors would find it safer to hold the stock at least until the next earnings.

CVS, on the other hand, looks like a more promising investment option, with an impressive price target and a consensus strong buy rating. When CVS reports its third-quarter results on November 4, market watchers will be looking for a 3% growth in sales and a contraction in earnings, compared to the year-ago period.

Quarterly Performance

Walgreens came directly under the firing line of coronavirus in the May-quarter. Sales suffered particularly due to the dismal show by the company’s UK unit, which made the management write off about $2 billion in impairment charges. The top-line remained broadly flat at $35 billion and earnings dropped in double digits to $0.83 per share. Sales beat estimates by a small margin, while earnings missed.

Unlike its rival, CVS reported a 39% growth in earnings in the most recent quarter when it generated $65 billion in revenues, up 3% from the prior-year quarter. The core pharmacy services business remained stagnant compared to last year, which was more than offset by strong performance by the other two divisions. The results also topped the Street view. Going forward, the divestiture of the Workers Compensation business is expected to have a modest drag on CVS’ earnings.

Need to Innovate

With the shelter-in-place orders still in place, people are getting used to the new trend and emerging technologies like telehealth are becoming increasingly popular. That puts the spotlight on the need for traditional pharmacy chains to boost their digital capabilities further and avoid being obsolete in the rapidly-changing and unpredictable market environment. In areas where restrictions have been lifted, the companies are seeing busy days ahead. It needs to be noted that drug stores are selling much more than medicines and also, people’s dependence on pharmacists for their daily healthcare needs is much higher these days than ever before.

In the Bourses

In the past, it often seemed that CVS was ending its losing streak but the optimism did not last as the stock pared its gains on each occasion. Similarly, it did not sustain the initial rally that followed the earnings report. At $58, the shares opened Monday’s session near the lows seen during the mid-March selloff triggered by COVID.

Read management/analysts’ comments on quarterly reports

Last week, Walgreen’s stock traded at an eight-year low, continuing the post-earnings slump that started a few weeks ago. The value contracted about 40% since the beginning of the year, all along underperforming the market. Meanwhile, the stock closed Monday’s regular trading higher.