Shares of Twitter Inc. (NYSE: TWTR) traded in red territory on Tuesday. When the company reported its earnings results for the first quarter of 2021 last week, the Street was not impressed. The user numbers fell short of projections and the revenue forecast for Q2 did not meet expectations. Despite these challenges, the general sentiment on the stock appears to be bullish.

User growth

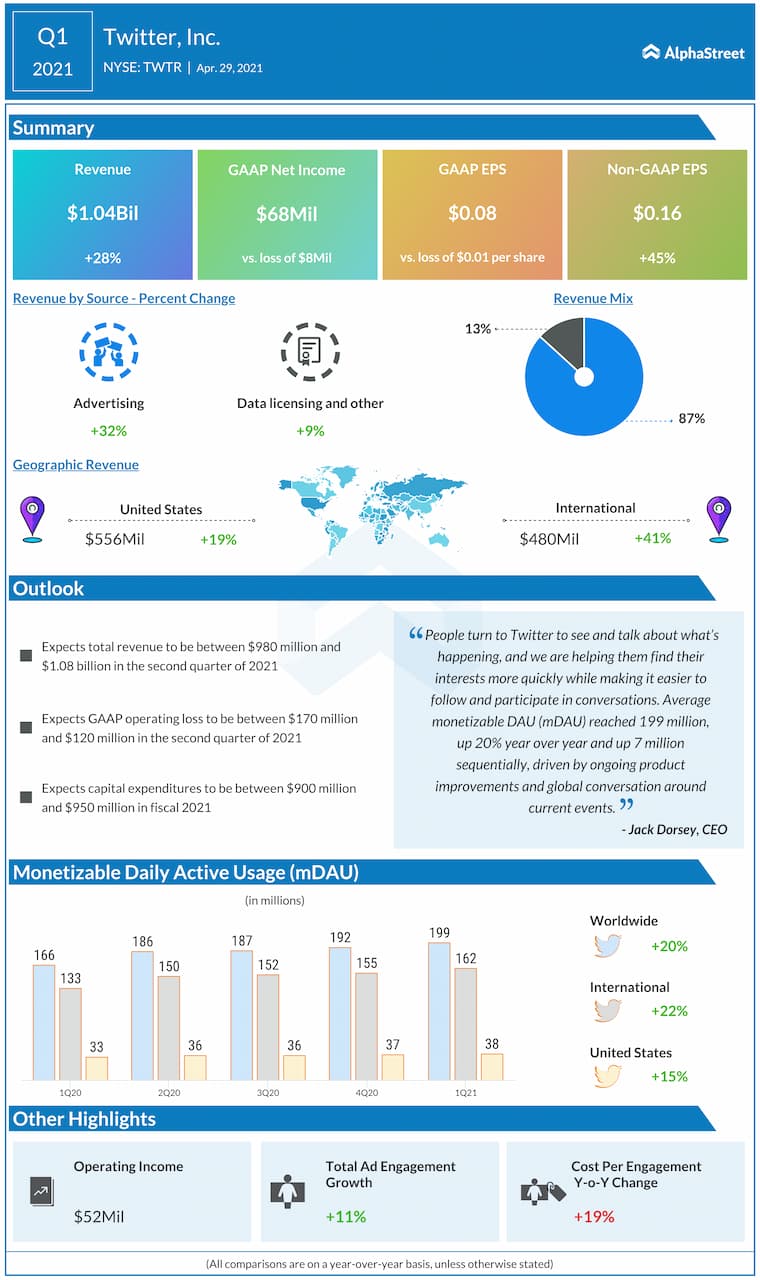

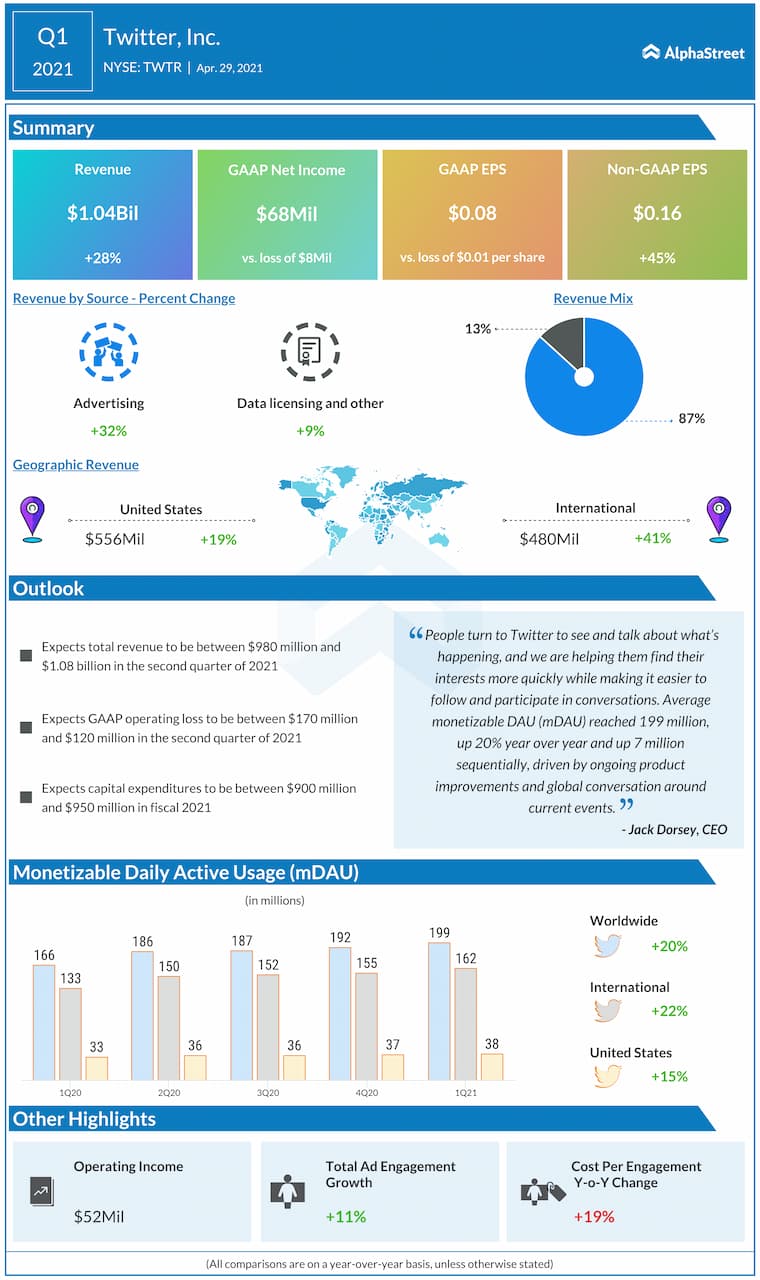

Even though it came shy of expectations, Twitter’s monetizable daily active usage (mDAU) of 199 million increased 20% year-over-year and 4% sequentially. mDAU was up 13% YoY in the US and 22% internationally. Twitter has its own audience – people who are interested in news and current events and it can count on this segment to continue to choose its platform.

The microblogging site’s features such as Topics and Interests show users what’s most popular and help them choose what they would prefer to see. This led to 33% of new customers following Topics in Q1. The company is also taking action against toxic content and has suspended several accounts for hate speech.

Although there is a concern that this kind of tough action could alienate many users who might deem it as an obstruction of free speech, this may not cause much of a dent in Twitter’s popularity. Social media is still very much popular and there are opportunities for Twitter to take advantage of the growth in this space.

Advertising growth

Twitter’s advertising revenue grew 32% YoY to $899 million in Q1. Ad revenues in the US grew 22% while international ad revenues rose 45% YoY. This growth was helped by strong brand advertising as well as growth in mobile app promotion revenue.

The company rolled out new ad offerings such as Curated Categories and Twitter Amplify during the first quarter. These features help advertisers target content that is unique to Twitter and help drive brand metrics. Early tests showed a 7% increase in brand favorability driven by Twitter Amplify.

New features and monetization

Twitter is adding new features and services to drive engagement and to pave the way for subscription and monetization opportunities. Features like Twitter Spaces, which focuses on audio, is expected to help drive interesting conversations and the company has been providing better tools for content discovery and moderation.

The acquisition of Revue, which allows people to publish and monetize editorial newsletters on Twitter is another budding opportunity. The company has also reportedly acquired Scroll, a subscription service that removes ads from news sites. These services are expected to provide Twitter with subscription opportunities going forward.

The majority of analysts have rated Twitter as Buy or Hold and the stock has an average price target of $71.25, which represents a 31% upside from its current price.

Click here to read the full transcript of Twitter’s Q1 2021 earnings conference call