Over the past two years, the transport sector has been hit by COVID-induced disruption that led to widespread flight cancellations and shipping delays. But leading freight companies like United Parcel Service, Inc. (NYSE: UPS) witnessed stable demand for parcel delivery during the crisis, mainly due to the mass shift to online shopping.

Stock Peaks

After an initial slowdown, the operations of UPS remained largely unaffected, rather the company saw an increase in shipment volumes during the pandemic. It has entered fiscal 2022 on a high note, with the stock hitting an all-time high this week following the release of fourth-quarter results. The market was particularly impressed by the management’s bullish outlook.

Read management/analysts’ comments on UPS’ Q4 2021 earnings

UPS has grown as much as 13% since Monday, marking one of the biggest short-term gains in its history. But the current valuation is on the higher side and that calls for caution when it comes to buying the stock. There is room for further gains, though at a moderate rate, but a pullback is very much in the cards. As of now, the best thing one can do is to keep an eye on the stock and wait for the right opportunity. Experts have assigned moderate buy rating.

Buy UPS?

UPS’ long-term prospects are as strong as ever. The company recently hiked its quarterly dividend by 49% to $1.52 per share, after raising it on regular intervals over the past several years and drawing the attention of income investors. It is worth noting that earnings and revenues beat estimates in every quarter for nearly two years.

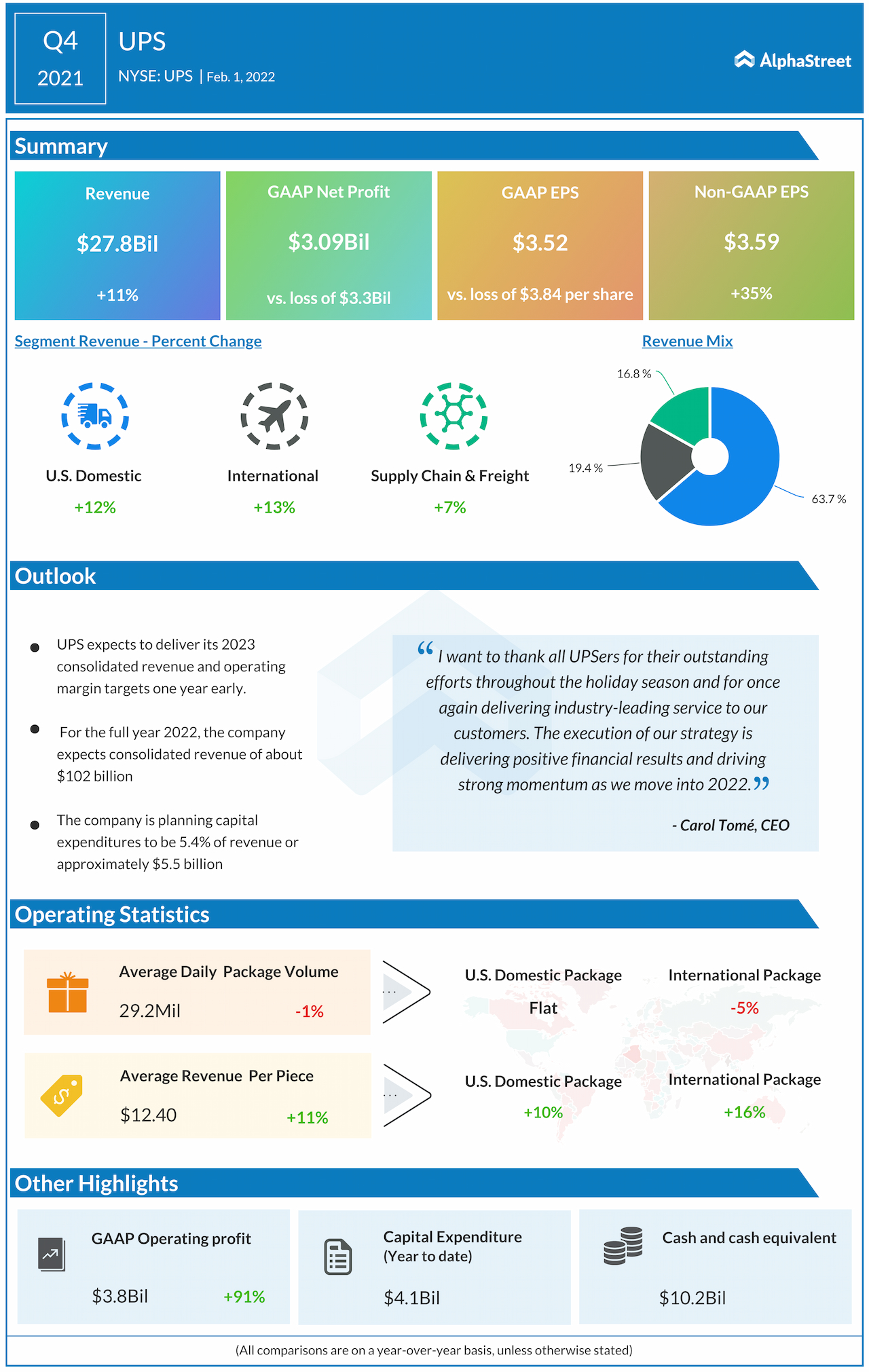

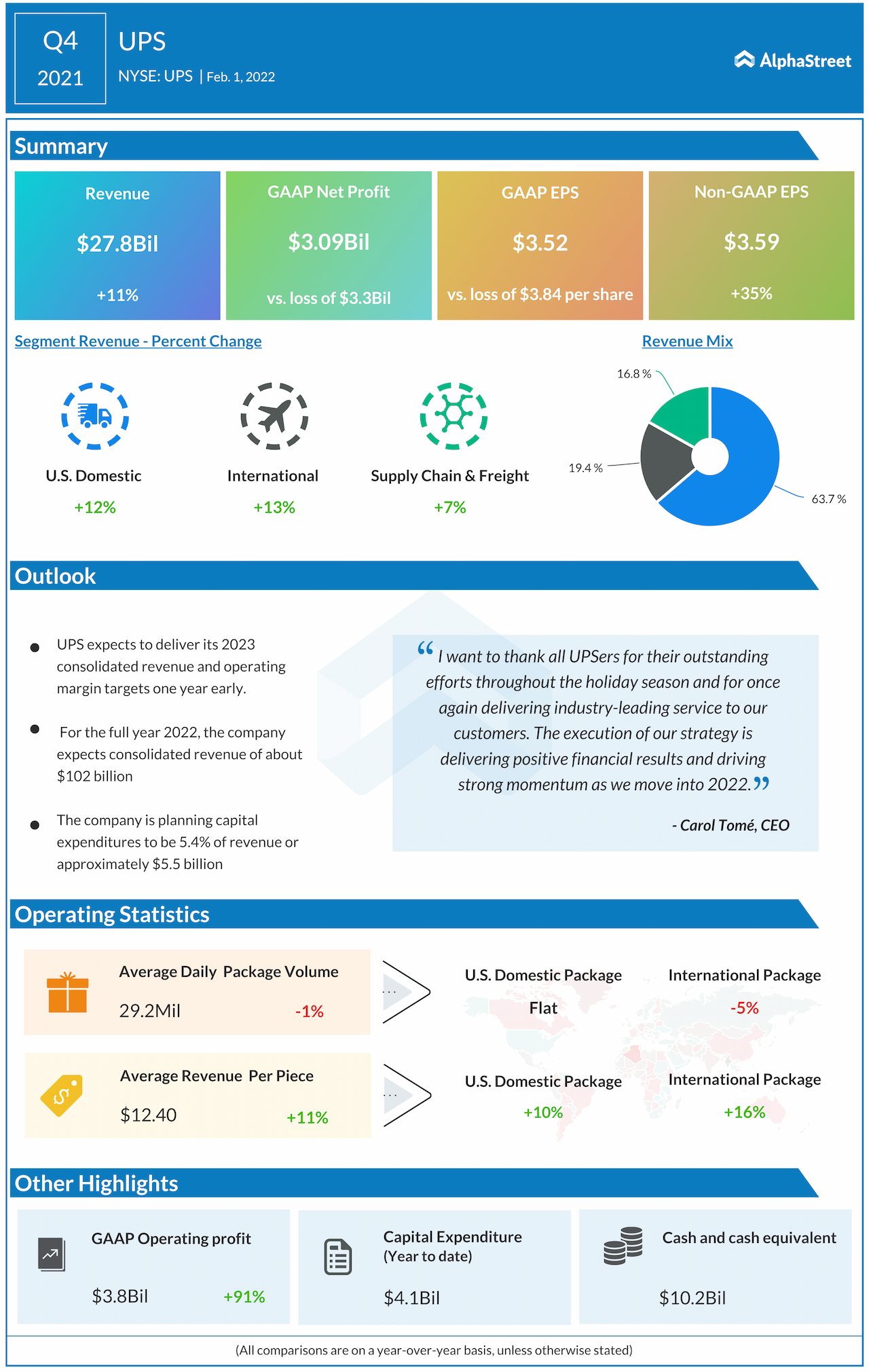

In the final three months of fiscal 2021, all the three operating segments registered growth, driving up total revenue to $27.8 billion. The double-digit revenue growth, supported by strong e-commerce demand and higher freight fees, translated into a 35% increase in adjusted earnings to a record high of $3.59 per share. The numbers also topped expectations. Meanwhile, UPS executives expressed hope that full-year margins would come in above the prior-year levels despite elevated payroll and fuel costs.

FDX Earnings: All you need to know about FedEx’s Q2 2022 earnings results

“Building on the record results we delivered last year, we anticipate delivering our 2023 consolidated revenue and operating margin targets one year ahead of our plan. In 2022, consolidated revenues are expected to be about $102 billion. Operating margin is expected to be approximately 13.7%, and return on invested capital is anticipated to be about 30%. Brian will provide more details on our outlook. I’m excited about the many opportunities in front of us,” said UPS’ CEO Carol Tome during the post-earnings conference call.

Challenges

But the strain on logistics networks and the need for greater capacity to deal with high volumes pose a major challenge for the company in meeting the demand. Since the recent demand growth – especially for business-to-customer package deliveries – was driven by the closure of physical stores and widespread adoption of online shopping, there is concern that the trend might reverse when normalcy returns to markets.

After making strong gains in the previous sessions, the stock cooled off on Wednesday and traded lower in the early hours. The value has increased by a fifth in the past six months.