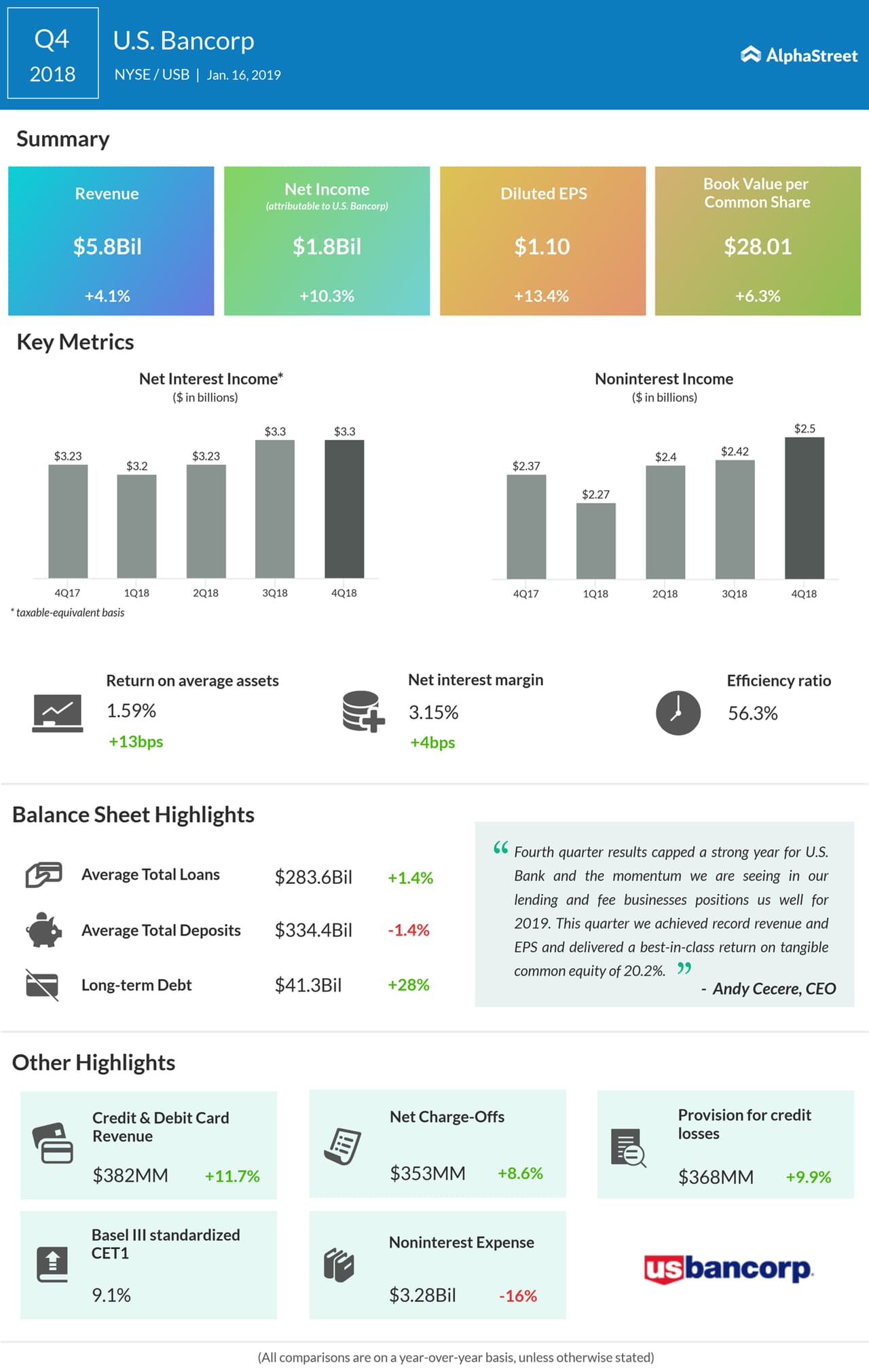

Net interest income, on a taxable-equivalent basis, increased 3.2%, mainly a result of the impact of rising interest rates on assets, earning assets growth, and higher yields on reinvestment of securities. Non-interest income rose 5.4% driven by strong growth in payment services revenue as well as trust and investment management fees.

During the quarter, non-interest expense fell 15.9%. Included in latest quarter results are expenses related to severance charges and accruals of legal matters. Excluding items, non-interest expense rose 1% on increase in compensation expense driven by the impact of hiring to support business growth and compliance programs, merit increases, and higher variable compensation related to business production.

Non-performing assets dropped 17.6% year-over-year due to improvements in non-performing residential mortgages, total commercial loans, total commercial real estate and other real estate owned. Increases in interest rates drove net interest margin up to 3.15% from 3.11% last year, partially offset by deposits and funding mix, lower loan spreads, higher cash balances, and the tax reform.

The bank’s average total loans increased 1.4% driven by growth in residential mortgages, total commercial loans, credit card loans, and retail leasing. Average total deposits dropped 1.4% from last year due to decreases in business deposits within Corporate and Commercial Banking and corporate trust balances within Wealth Management and Investment Services.

The company’s peers like Goldman Sachs (GS) and Bank of America (BAC) is expected to report their fourth-quarter earnings today with both firms are likely to beat market expectations.

Shares of US Bancorp ended Tuesday’s regular session up 0.38% at $47.97 on the NYSE. The stock has fallen over 15% in the past year and over 5% in the past three months.