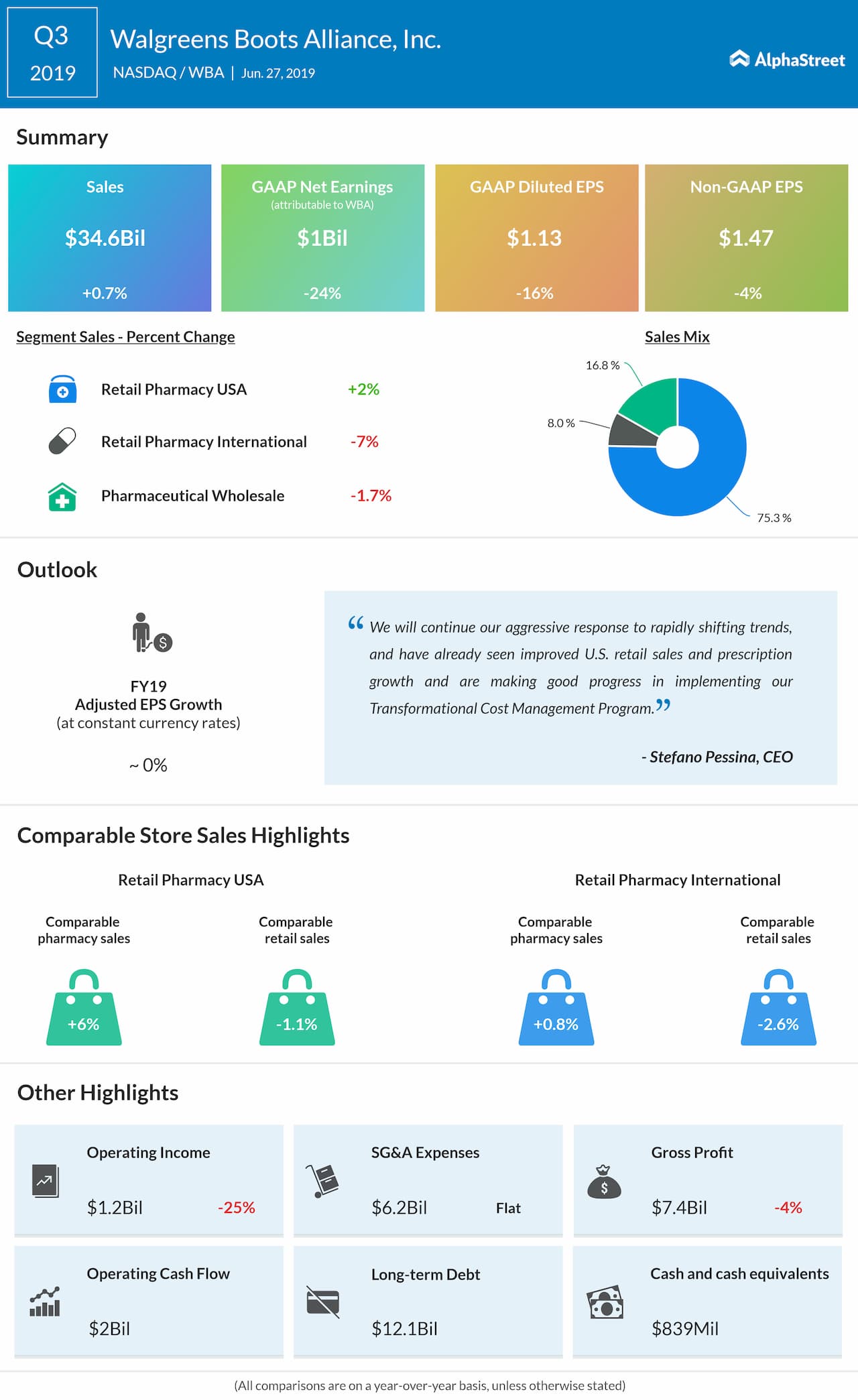

Walgreens Boots Alliance Inc. (NASDAQ: WBA) topped analysts’ forecasts on both revenue and earnings for the third quarter of 2019. Shares were up by 0.61% in premarket hours on Thursday. The consensus target was for earnings of $1.43 per share on revenue of $34.5 billion.

Sales increased 0.7% year-over-year on a reported basis, and 2.9% on a constant currency basis, to $34.6 billion. The increase was driven mainly by growth in the Retail Pharmacy USA and Pharmaceutical Wholesale divisions.

Reported net earnings attributable to Walgreens Boots

Alliance decreased 23.6% to $1 billion while EPS fell 16.5% to $1.13 versus

last year. Adjusted earnings dropped 12.1% to $1.3 billion while EPS declined

4% to $1.47.

Sales in the Retail Pharmacy USA segment grew 2.3%

to $26.5 billion from last year. Excluding store optimisation impacts related

to the Rite Aid stores acquisition, organic sales rose 2.9%. The majority of

the division’s sales came from pharmacy sales, which grew 4.3% year-over-year,

helped by higher brand inflation and prescription volume as well as strength in

central specialty. Retail sales fell 2.9% in the quarter.

Retail Pharmacy International sales fell 7.3% to

$2.8 billion versus the prior-year period, reflecting an adverse currency

impact of 5.7%. The Pharmaceutical Wholesale unit saw a drop of 1.7% in sales

to $5.9 billion, due to a 10% adverse currency impact.

Walgreens maintained adjusted EPS guidance for

fiscal 2019 of roughly flat, at constant currency rates. On a reported currency

basis, the company anticipates approx. $0.06 per share of adverse currency

impact.

During the quarter, the company declared a quarterly dividend of $0.44 per share, payable on June 12, 2019 to stockholders of record as of May 18, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.