Time to Invest?

Riding on the tailwinds that supported last year’s performance, the management has shifted focus to investing in the future of the business. Under its new growth strategy, the company plans to spend about $14 billion this year in different areas of the business, ranging from exploring more revenue streams to offering new financial services.

Tech Push

Naturally, a major portion of the investments will go into the company’s fast-growing e-commerce platform. The aggressive online push that started much before the crisis — focused on curbside pickup and quick delivery — came as a boon when the shelter-in-place orders came into effect. While continuing with the efforts to build an ecosystem of synergistic assets, efforts are on to reduce exposure to international markets where performance is not up to the mark and expand in the more rewarding regions like Mexico and India.

“We’re starting to drive the top and bottom line in more expensive ways. Our bottom line is becoming more diversified, which will enable us more operating income growth over time. We’re repositioning to be in different businesses and exiting some geographies so resources are shifted to our priorities. We’re building a better model, and it’s uniquely Walmart,” said Doug McMillon, chief executive officer of Walmart.

Slowdown in Cards

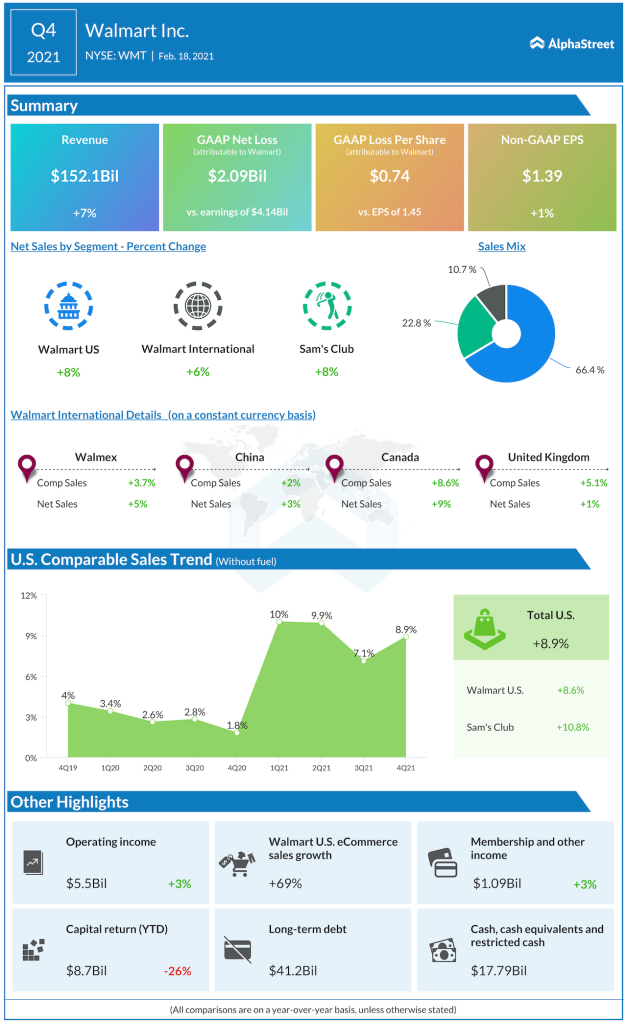

It is estimated that sales would moderate this year, dragging down the bottom-line that is expected to remain flat. Spiraling costs, including those related to the pandemic, will be the main drag on Walmart’s financial performance, partly offsetting gains from the strong sales. The overall weakness in key international markets resulted in the company incurring a loss of $0.74 per share in the fourth quarter, on a reported basis.

We expect continued strong growth in the U.S. businesses and expect even higher international growth rates as we focus on key markets and making money in new ways. We’ll continue improving margin mix through an enhanced general merchandise offering, new brands and marketplace growth with a greater push towards expanding fulfillment and other services for sellers. We’ll drive existing and new customer growth through initiatives like Walmart+.

Doug McMillon, chief executive officer of Walmart

ADVERTISEMENT

Earnings Miss

In the final months of 2020, adjusted earnings edged up 1% annually to $1.39 per share but fell short of expectations, after beating estimates in the previous three quarters. In the US, the largest market for the big-box retailer, e-commerce sales surged 69% to a record high, partly supported by the government’s stimulus package. Comparable store sales were up 8.6% in the local market.

Read management/analysts’ comments on Walmart’s Q4 report

Walmart’s stock dropped about 6% since last week’s earnings release, continuing its pull-back from the record highs seen a few months ago. After experiencing several ups and downs since starting the year flat, the shares traded lower early Monday.