Investing in Paychex

Shares of the company peaked in mid-August, before losing some momentum in the following weeks. Being a market leader, Paychex has what it takes to emerge stronger from the COVID crisis, which makes the stock a dependable long-term bet. However, going by analysts’ consensus outlook, it is not the right time to either buy or sell, but keeping the stock on the watch list will pay off in the long run.

Read management/analysts’ comments on Paychex’s Q1 results

Currently, the prospects of PAYX do not look very impressive due to market uncertainty. Also, it will take a while before the ongoing growth initiatives start yielding results. It is estimated that the top-line would gather further steam in the next few years and that will translate into stronger margin performance.

Paychex has made significant investments in technology, with focus on the mobile platform and incorporation of new features to serve customers effectively in the changing work environment characterized by mass adoption of remote work. After expanding its asset base with strategic acquisitions in the past, the company will be looking for more buyout targets in the coming months.

In Expansion Mode

Going forward, the management will likely continue with its growth initiatives, with stress on advanced technologies like artificial intelligence and machine learning, to help small and mid-sized businesses better deal with the challenging time. The healthy cash flow and ample access to credit should come in handy when it comes to funding.

From Paychex’s Q1 2022 earnings conference call:

“In addition to paying one in every 12 American private-sector employees, we are the country’s largest 401(k) record keeper, a top 30 US Insurance Agency, and among the largest providers of HR outsourcing in the US, supporting over 1.7 million worksite employees. While the size and the breadth of the Company have changed, we remain true to our original mission of serving the unique needs of small and mid-sized businesses. That mission was all the more important during the challenges faced over the past 18 months.”

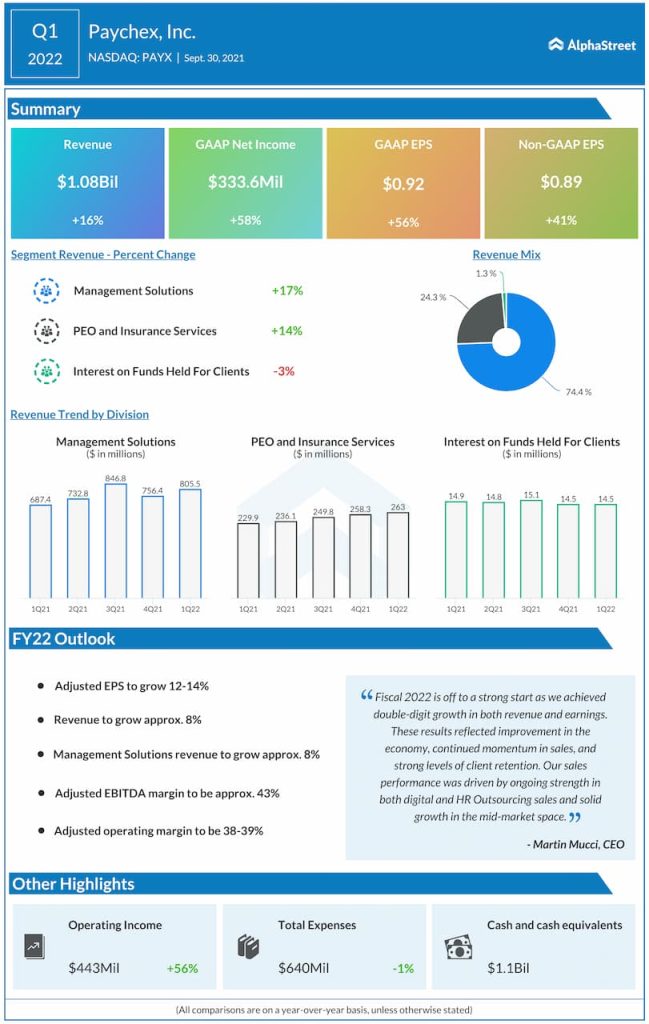

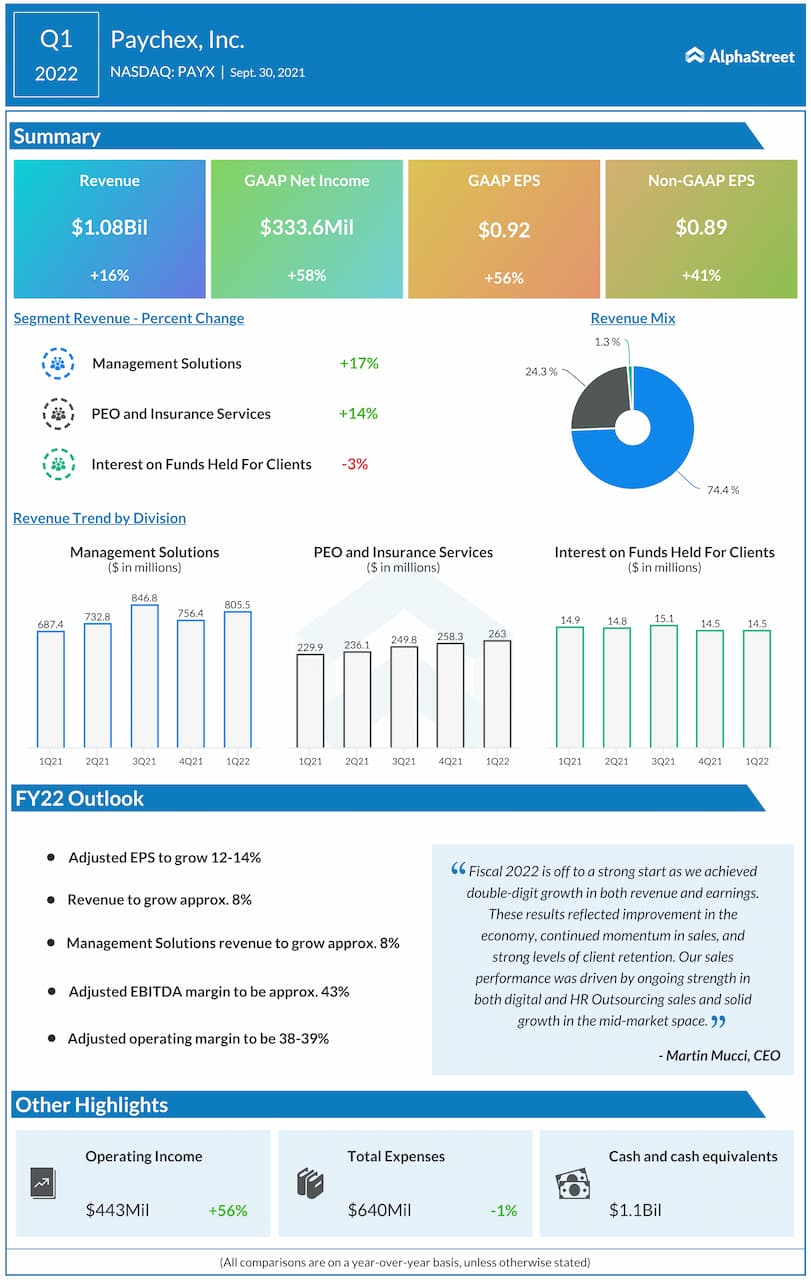

Good Start to FY22

Last week, an official report revealed that Paychex’s first-quarter revenues increased 16% from the year-ago period to about $1.1 billion, mainly reflecting double-digit growth in the core management solutions business. As a result, adjusted net profit climbed 41% to $0.89 per share. Earnings topped expectations, as they did in every quarter over the past two years.

Oracle fast tracks cloud expansion with more investment. Is the stock a buy?

Paychex’s stock has traded above its long-term average consistently in the last six months and gained about 15% during that period. It made one of the biggest intra-day gains last week soon after the earnings release and has maintained the uptrend since then. The shares traded slightly lower early Monday, after closing the last session higher.