Xilinx, Inc. (NASDAQ: XLNX) got a fresh boost after clinching a major partnership with Samsung recently to supply chips for the latter’s 5G infrastructure. Earlier this year, the semiconductor firm slashed its workforce by 7% as part of a drive to right-size the business, after ending 2019 on a dismal note.

[irp posts=”57912″]

The underlying weakness, mainly due to the exit of Xilinx’s largest customer Huawei from the US market, was evident in the lackluster financial performance in the early months of 2020. Investor sentiment took a beating after the management issued weaker-than-expected guidance for the first quarter and withheld the full-year guidance, in view of the unpredictable business environment.

Cautious Outlook

The cautious outlook mainly reflects the widespread uncertainty caused by the coronavirus outbreak, which continues to play havoc with financial markets across the world. The company’s shares dropped sharply during Wednesday’s after-hours trading, before regaining momentum early next day. The stock has lost about 15% since the beginning of the year.

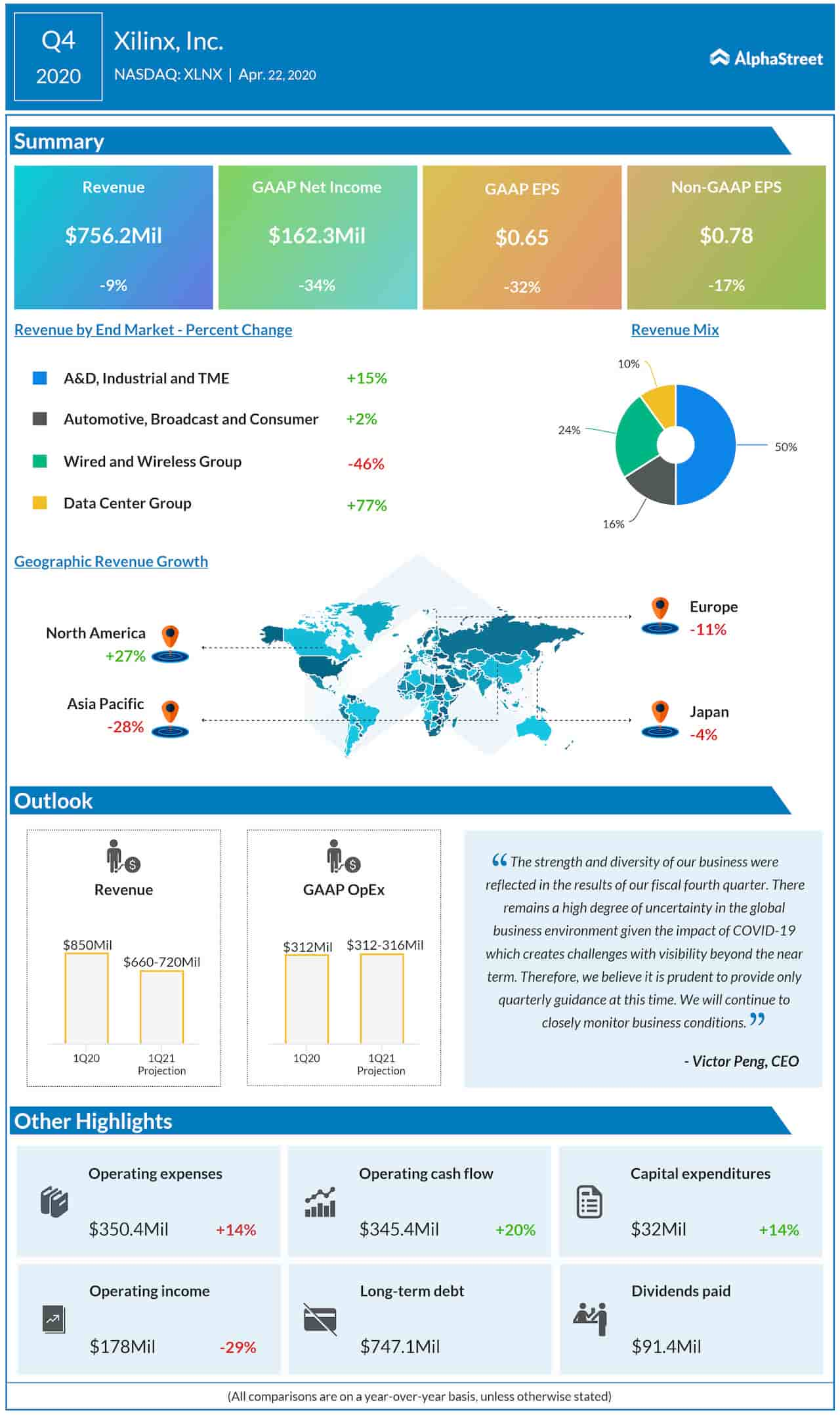

Check Xilinx Q4 2020 Earnings Infographic

ADVERTISEMENT

In the post-earnings conference call, CEO Victor Peng revealed a strategy focused on aggressive cost-reduction to tackle the ongoing slump, but ruled out any further workforce reduction. While the supply chain remains largely unaffected by the market disruption, there has been a progressive dip in demand since the trouble started, especially in the consumer, automotive and broadcast businesses.

Sees Weak Q1

In short, Peng expects a steeper than normal sequential decline in revenues in the current quarter, owing to the shutdown and the continuing export ban on Huawei amid trade-related tensions. The outlook calls for caution as the semiconductor industry is yet to recover from the slowdown witnessed in 2019, due to the unstable demand conditions.

“The strength and diversity of our business were reflected in the results of our fiscal fourth quarter with strong sequential growth in both revenue and profitability. There remains a high degree of uncertainty in the global business environment given the impact of COVID-19 which creates challenges with visibility beyond the near term.”

Victor Peng, CEO of Xilinx

Positive Sign

On the positive side, this year, the communications segment is expected to tide over the sluggish 5G deployment ramp in key markets aided by the expanding portfolio. The Samsung deal bodes well for Xilinx, considering the ongoing slowdown in the demand for 5G products. The company also sees significant long-term opportunity in the Compute segment, in general.

[irp posts=”57912″]

Xilinx considers China as a key market for 5G in the near term because the country is recovering from the grip of COVID-19 faster than any other region. Also, the company bets on the defence and aerospace markets, which are largely unaffected by the present crisis, to offset the softness in other areas like automotive and audio-video-bridging – in the absence of major events like Olympics.

Q4 Revenue Dips

Fourth-quarter revenues dropped 9% annually to $756 million as a sharp decline in the communications segment offset positive performance by the other divisions. As a result, earnings declined in double digits to $0.78 per share. The results, however, exceeded the markets projection. Recently, the tech firm’s board of directors hiked the dividend by 3% but eased up on share buybacks to preserve capital.

Peer Performance

Among others, chip giant Intel (INTC) this week reported strong earnings and revenue growth for the most recent quarter helped by broad-based growth across all segments. Meanwhile, it was a different story at Texas Instruments (TXN), which reported lower earnings and revenues, reflecting the ongoing down cycle in the sector.