Yum! Brands Inc. (NYSE: YUM) reported third quarter 2019 revenues that matched expectations but profits missed estimates, sending the shares tumbling over 5% in premarket hours on Wednesday.

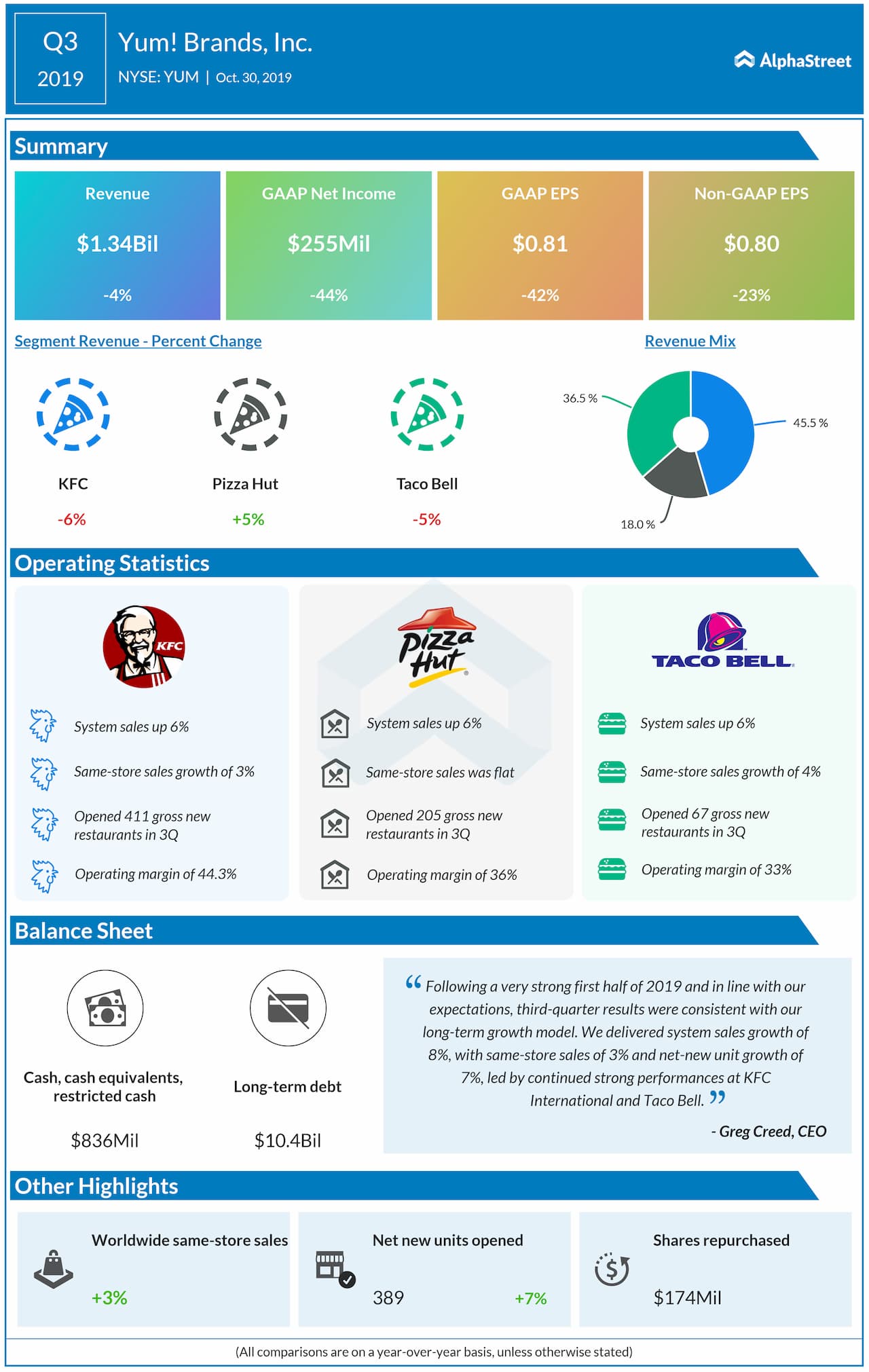

Total revenues of $1.34 billion was down 4% from the same period last year but were in line with consensus estimates of $1.34 billion.

GAAP net income fell over 40% to $255 million, or $0.81 per share, versus last year. Adjusted EPS fell 23% to $0.80, missing forecasts of $0.94.

Worldwide system sales, excluding foreign currency translation, grew 8%, helped by single digit growth at KFC, Taco Bell and Pizza Hut. Same-store sales grew 3%. Same-store sales grew in the single-digit range at KFC and Taco Bell while at Pizza Hut, it remained flat. The company opened 389 net units in the quarter. Net-new unit growth was 7%.

In the Pizza Hut division, total revenues grew 5% to $241 million. Taco Bell revenues fell 5% to $489 million and KFC revenues dropped 6% to $609 million.

During the quarter, the KFC division saw the highest growth of 20% in system sales in the Russia, Central and Eastern Europe market. This was followed by India, Latin America and Western Europe. KFC saw a 6% growth in restaurants on a global basis.

Pizza Hut saw the highest system sales growth of 86% in the Latin America/Spain/Portugal region, followed by a 33% growth in Africa. The segment reported a 9% growth in restaurants. The Taco Bell division reported a 4% growth in restaurants.

For fiscal year 2019, the company expects to achieve adjusted EPS of at least $3.75.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions