On Growth Path

China’s favorable regulatory environment and stable demand for credit have helped the company in its transition to the low-risk business model. The prevalence of e-commerce and online banking have contributed significantly to the growth of consumer lending, which is an emerging segment. The good news is that the trend is expected to continue in the foreseeable future. 360 DigiTech’s main business units are:

- Shanghai Qiyu Information & Technology Co.

- Fuzhou 360 Online Microcredit Co.

- Fuzhou 360 Financing Guarantee Co.

- HK Qirui International Technology Company

- Shanghai Qiyue Information & Technology Co.

- Shanghai 360 Financing Guarantee Co.

Of late, the focus has been on the highly successful capital-light model, which is projected to grow in double digits this year – an outlook that underscores 360 DigiTech’s relevance in China’s changing regulatory environment that looks to reduce risk and ensure proper demand-supply balance in financial services. The demand for consumer credit has recovered notably, after being hit by the pandemic early last year, reflecting the improvement in market sentiment and overall economic activity. The positive trend prompted the management to raise its financial guidance.

Key Statistics

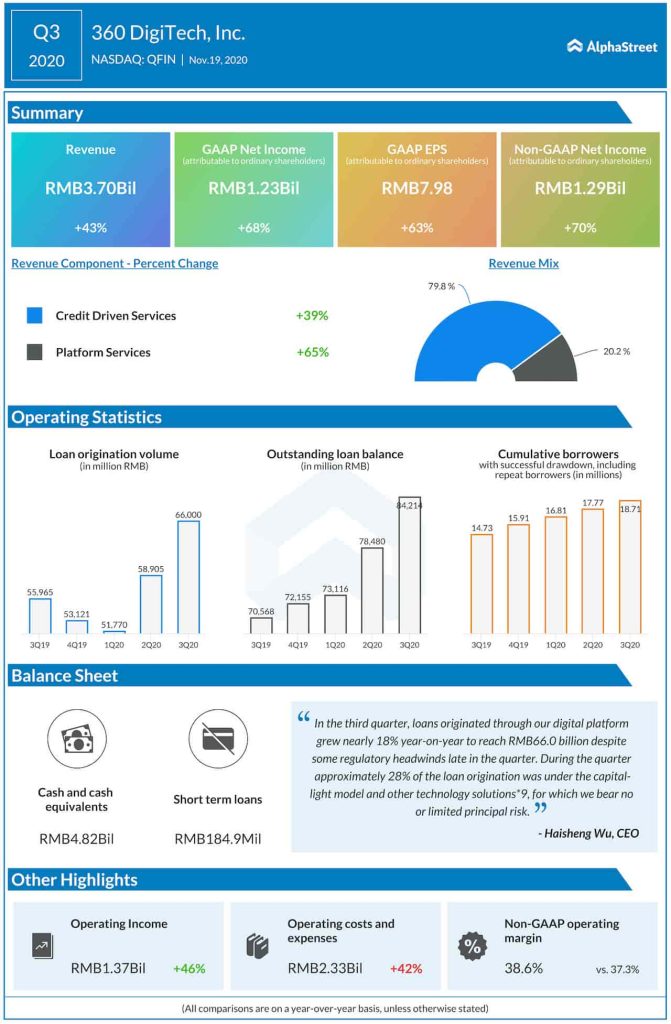

All the key operating metrics rose to record highs in the September-quarter, aided by the overall improvement in operating conditions. Revenues surged 43% annually to $545.5 million, with both the business segments registering strong growth. That, combined with a marked decrease in operating expenses, resulted in a 70% spike in adjusted profit to $190 million. Like in the previous quarter, the uptrend was led by the capital-light business. During the quarter, capital-light and other tech-based businesses grew to about 28% of total loan origination, while the asset quality improved to an all-time high.

Competition

360 DigiTech looks to beat competition through its risk management capabilities, competitive pricing, and innovations like the recently-launched virtual credit-card to attract customers in a market that is witnessing an influx of new players. With a huge repository of customer data at its disposal, the company enjoys an edge over its rivals. Customer credit technology firm Qudian Inc. (NYSE: QD), which operates in the domestic market under the two segments of Instalment Credit Services and Transaction Services, and Yirendai (NYSE: YRD) — with a diversified product portfolio that includes loans for education and home remodeling — are among the main rivals.

Concerns

When the company published the latest quarterly report, an operating metric that raised concerns was its high contingent liabilities that weighed on margins. On the positive side, the situation is expected to improve considerably once normalcy returns to the market and the broad economy even as the management stays vigilant on provisions. Though China recovered from the virus crisis to a large extend, before it could take a toll on the economy, uncertainty still lingers. Moreover, China’s non-traditional financial services sector is susceptible to macroeconomic fluctuations and credit cycles.

Stock

After slipping into the single-digit territory in the early weeks of the virus outbreak, when markets across the world witnessed a mass sell-off, shares of 360 DigiTech bounced back and stayed above the $10-mark during the rest of 2020. After a series of ups and downs, the stock ended the year on a positive note, with the value growing steadily in the last few sessions.

Important Updates

A few months ago, the brand was rechristened from 360 Finance, Inc. to 360 DigiTech, Inc. as the management expects that the new identity would help in representing the firm’s long-term strategic positioning in the market more effectively. Earlier, an affiliate of 360 DigiTech became the largest shareholder of Kincheng Banking Corporation (KBC) after securing approval from the China Banking and Insurance Regulatory Commission. As of September 2020, the company’s total cumulative loan origination volume stood at RMB504 billion, with total cumulative registered users of 156 million and financial institution partners of 97. The implementation of Embedded Fintech, a new business initiative wherein fintech companies provide their service in Infrastructure-as-a-Service, is on target.

Forecast

Having entered 2021 on a bright note, with an impressive cash balance and stable customer growth, the company looks poised to emerge stronger from the coronavirus crisis. The management has revised up its guidance for full-year loan origination volume in the final months of fiscal 2020, which also includes seasonal factors. Going forward, synergies and the products co-developed with KCB should add to revenue growth in the next fiscal year. In the Chinese market, it is not easy for banks to acquire the full capability to offer consumer credit on their own, rather they operate in collaboration with new-age loan facilitation platforms.

Read management/analysts’ comments on 360 DigiTech’s Q3 earnings

Conclusion

The Chinese fintech industry is witnessing major regulatory changes and some of them could pose challenges for companies operating in the sector. In response to the recent amendments, 360 DigiTech has tightened its policy in risk management and customer acquisition. Nevertheless, the future prospects of the industry look bright as the authorities are encouraging good practices and quashing the unhealthy ones.