After closing the high-value acquisition of Celgene a few months ago, Bristol-Myers Squib (NYSE: BMY) will be publishing its fourth-quarter results on Thursday before the opening bell. The pharma firm is expected to report earnings of $0.94 per share, which is unchanged from the year-ago period. Analysts are looking for a 4% increase in revenues to $6.19 billion.

When the company releases the report, all eyes would be on the performance of products added to Bristol’s portfolio pursuant to the Celgene buyout, with the potential contributors being cancer drug Revlimid that witnessed double-digit sales growth in the third quarter. Celgene’s anemia drug Reblozyl, which was approved for additional indications a few months ago, is expected to have performed well this time.

Opdivo in Focus

Like in the past, the key revenue driver will be Bristol’s immuno-oncology drug Opdivo, which has been approved for additional use in the treatment of hepatocellular carcinoma, melanoma, and renal cell carcinoma. Among others, blood thinner drug Eliquis is estimated to have maintained the strong performance. The other promising products are Orencia (arthritis) and oncology drug Sprycel.

Updates

These positive factors will likely be partially offset by weakness in the mature products and virology businesses. Investors will also be looking for updates on the ongoing clinical trials of Opdivo, which keeps expanding market share outside the U.S. However, the recent withdrawal of EU application for Opdivo, in advanced non-small cell lung cancer, has come as a setback for the drug.

Q3 Performance

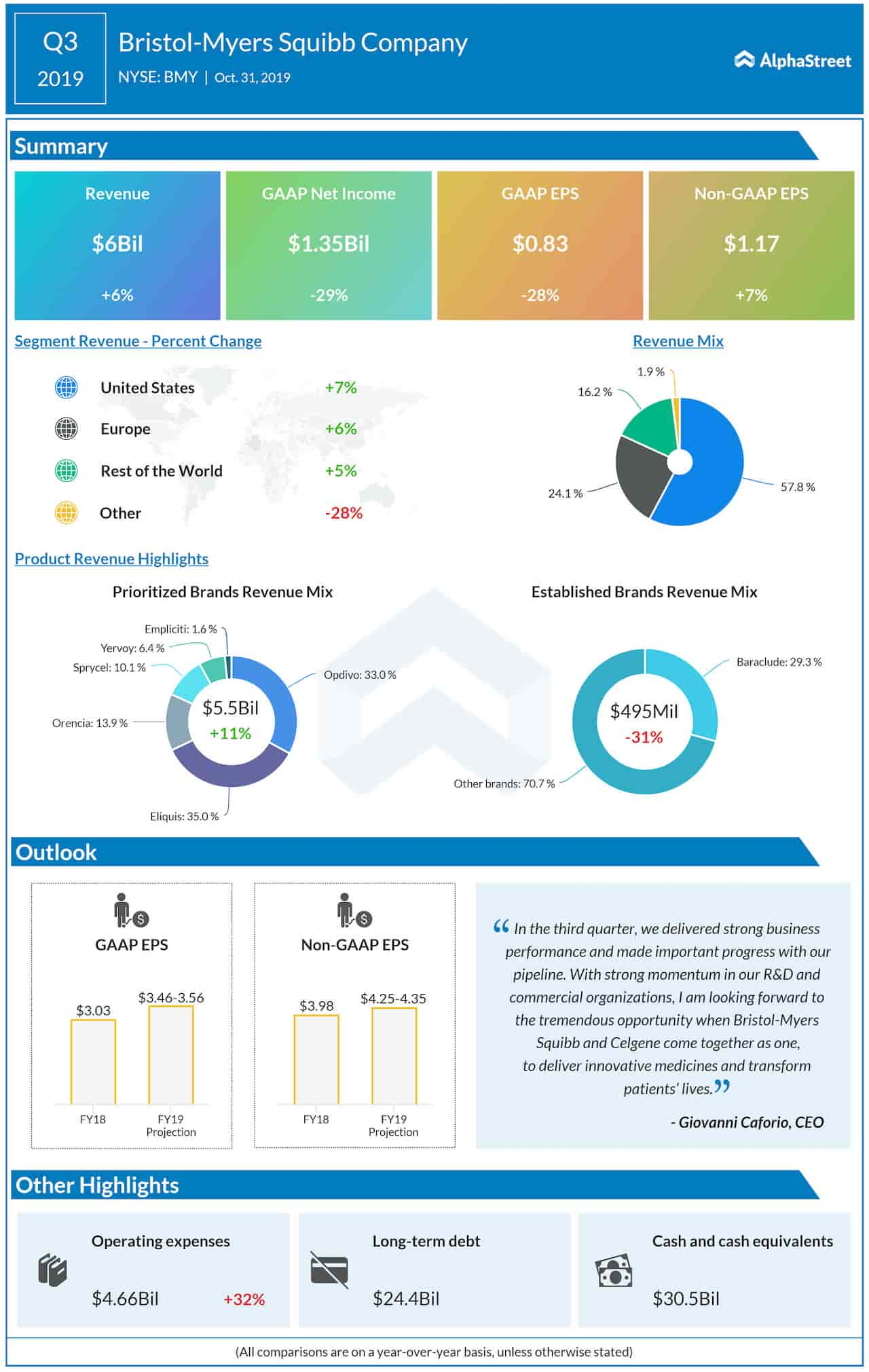

Earnings, excluding one-off items, increased to $1.17 per share and topped the estimates in the third quarter, reflecting the continued strong growth in product sales. At $6 billion, total revenue was higher by 6% from the year-ago period. Sales of Opdivo came in at $1.8 billion.

Merck & Co. (MRK) this week reported mixed results for its December-quarter. Earnings increased in double-digits to $1.16 per share and topped the Street view, while revenues missed. The company’s stock dropped after the announcement, reflecting the unimpressive top-line performance and weak guidance.

Related: Bristol-Myers Q3 2019 Earnings Conference Call Transcript

After falling to a six-year low in mid-2019, Bristol shares have been on a steady uptrend and gained 46% since then. The stock moved up 29% in the past twelve months.