Mixed View

But, the Texas-based oil firm is probably poised to regain a part of the lost strength given the increase in oil prices that is expected to bounce back to the pre-pandemic levels this year. With costs under control and the company’s relatively huge debt improving, the balance sheet is stabilizing. Meanwhile, the management is planning to sell certain non-performing assets in the overseas market. The company generated enough cash in the most recent quarter to meet its investment and dividend payment requirements.

Read management/analysts’ comments on ExxonMobil’s Q1 results

In the long run, demand might come under pressure from the green energy campaign, though it is going to take a long time for the change to happen. However, any major shift in the demand trend would affect ExxonMobil’s business that depends on commodities and requires heavy capital investment.

Our successful response to the unprecedented challenges of 2020 has its roots in two critical initiatives started years earlier. The first with our focus on developing an industry-leading portfolio of advantaged investments recapitalize our businesses and increased capacity to generate earnings and cash. Prioritized investments in these opportunities last year are paying dividends this year, and we’ll continue to dwell into the future. Second initiative, which began in 2017 was completed in 2019 was a significant restructuring of our businesses. Darren Woods, chief executive officer of ExxonMobil.

Darren Woods, chief executive officer of ExxonMobil

Upstream Recovery

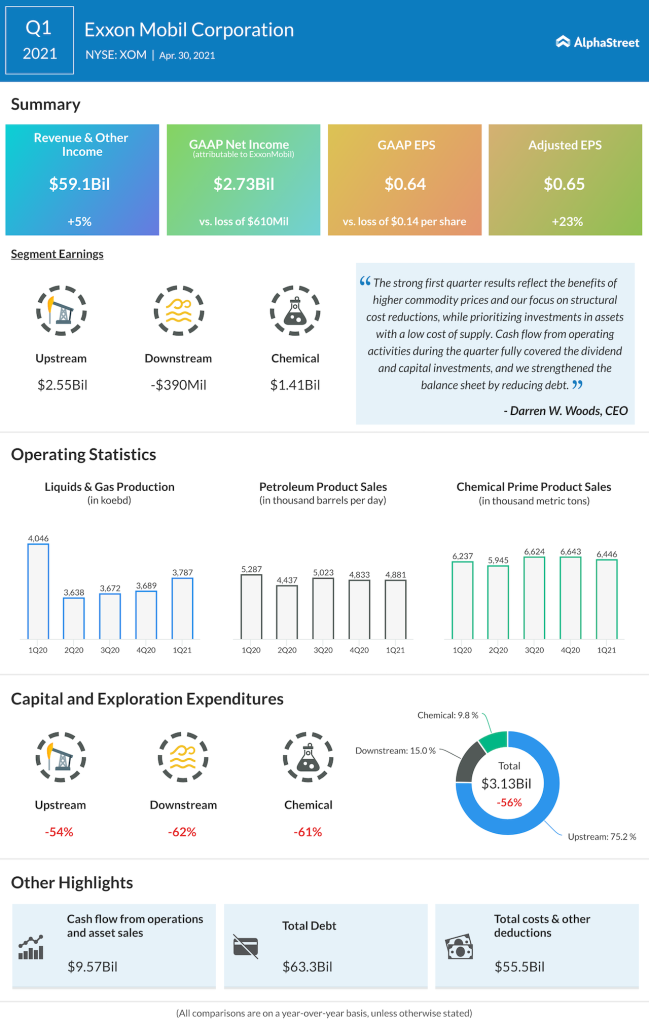

In the first quarter, the top-line benefited from the upstream segment that bounced back from the weakness experienced last year, helped by the removal of production restrictions and seasonal demand in some key markets. Revenues moved up to $59.1 billion, which translated into a 23% year-over-year increase in adjusted earnings to $0.65 per share. Analysts had forecast smaller numbers for the latest quarter.

Key highlights from Chevron Q1 2021 earnings results

The positive outcome can also be attributed to the restructuring program with focus on workforce reduction and cost-cutting. The downstream business remained under pressure due to the dismal demand conditions. The chemical business, which uses oil as the raw material, remained a bright spot with positive bottom-line performance.

Stock Performance

Things started to improve in the fourth quarter when ExxonMobil ended the brief losing streak and generated profit. The shares mostly underperformed the market over the past twelve months. However, they hit the recovery path in the second half of last year as oil prices started recovering. XOM traded higher early Monday after closing the previous session at $57.98.