Dollar Tree, Inc. (NASDAQ: DLTR), the retail chain that sells merchandise at heavily discounted rates, will not be as cheap as it used to be. Customers might find the store operator’s recent decision to raise prices disappointing, but it can be good news for investors.

Stock Peaks

The company’s stock rallied after it released third-quarter results this week and hit a new record despite the not-so-impressive performance, apparently reflecting the management’s move to expand the $1.25 price point to more stores. The initiative would mark Dollar Tree’s official exit from the one-dollar retail model. Recently, the market had responded positively after an activist investor acquired a significant stake in the company.

Read management/analysts’ comments on Dollar Tree’s Q3 2021 earnings

The new pricing strategy should translate into better shareholder returns in the future, but the high valuation calls for caution as far as investing in the stock is concerned. Though the latest target price indicates a modest uptick going forward, it seems the positive factors including price-related tailwinds have already been factored into the value.

Recession-proof Biz

The store operator has a history of staying resilient to market headwinds and it was no different during the coronavirus pandemic, which underscores the efficiency of its business model. Beyond the short-term fluctuations, the stock looks poised to scale new heights and that makes it a dependable bet for the long term.

“We are enthusiastic about the opportunity and improved performance of Dollar Tree by continuing to deliver extreme value to our customers at the new 1.25 price point, driving comp sales and improving store productivity, enhancing flexibility to better manage the overall business in an inflationary environment. And as previously mentioned, we are turning Dollar Tree gross margins back to the chain’s historical 35% to 36% annual range in fiscal 2022.”

Michael Witynski, chief executive officer of Dollar Tree

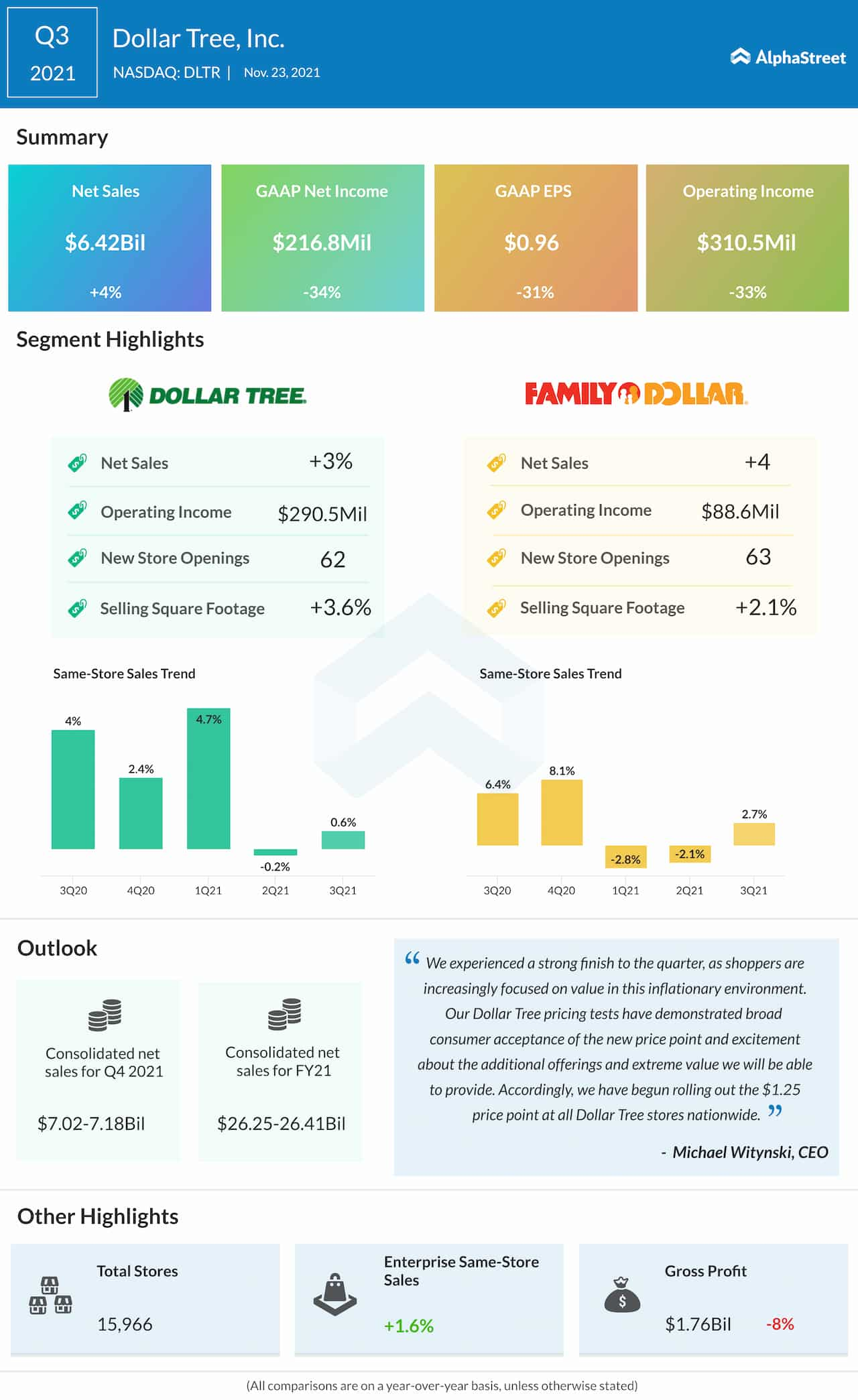

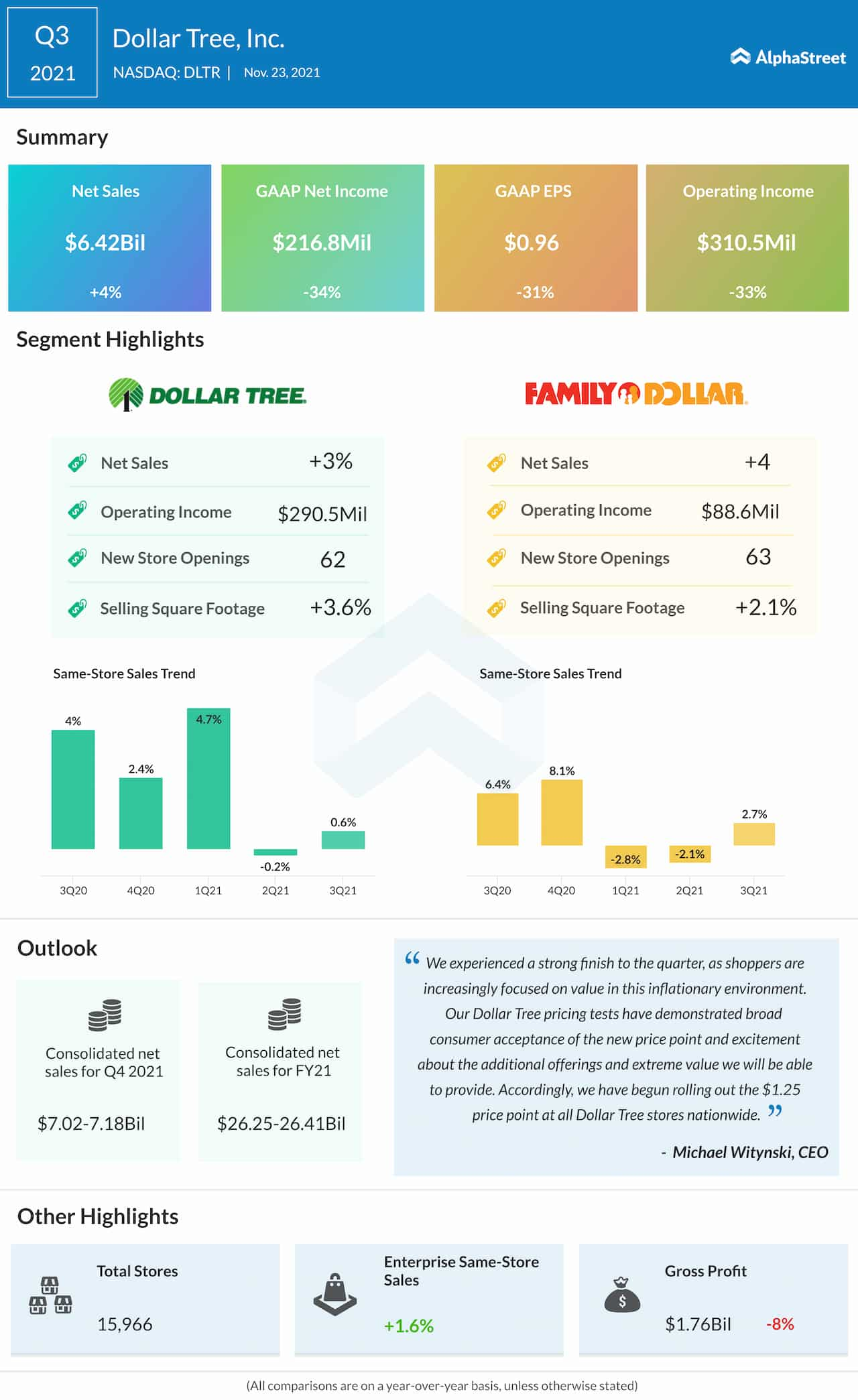

Dollar Tree has generated positive quarterly earnings consistently since early last year, with the numbers beating estimates each time. In the most recent quarter, revenues and earnings were almost in line with analysts’ forecasts. Third-quarter profit dropped 31% year-on-year to $0.96 per share, while revenues advanced 4% to $6.42 billion. Same-store sales at both the Dollar Tree and Family Dollar segments increased, after slipping into the negative territory in the previous quarter.

Focus on Price

The management expects the new price structure to offset the negative effects of cost pressure, mainly related to elevated logistics expenses. Freight costs have been sharply higher than expected in recent quarters, a trend that is likely to continue in the near term. It is estimated that once fully implemented, the price hike would lift gross margins to pre-pandemic levels.

DLTR traded slightly lower in Friday’s pre-market hours but stayed close to the recent peak. It has gained 73% In the past two months alone, all along outperforming the industry and emerging as one of the fastest-growing Wall Street stocks.