Technology stocks took a beating from the government’s decision to restore net neutrality and weighed on the benchmark indexes mid-week. But, the S&P 500 index and Dow Jones Industrial Average bounced back and gained 50 points and 475 points, respectively, since then.

In what could be a setback for the labor market, jobless claims unexpectedly increased to 373,000, after dropping steadily and slipping to a one-year low last week.

The closely-followed acquisition of Alexion Pharma by British vaccine maker AstraZeneca moved closer to completion after European regulators approved the $39-billion deal.

Meanwhile, the market witnessed the closure of another important deal – network gear maker Cisco Systems enhanced virtual meeting platform Webex Events by adding Labs Buy to its fold. The Bank of New York Mellon is all set to buy fund management technology firm Milestone Group in a move aimed at providing better service to asset managers and owners.

In the tech space, IBM revealed plans to purchase Kubernetes container consulting startup BoxBoat Technologies for an undisclosed amount. Elsewhere, tobacco behemoth Altria Group inked a pact to sell its Ste. Michelle Wine Estates business to Sycamore Partners Management for about $1.2 billion.

Jeans maker Levi Strauss & Co. was probably the only major company that reported financial results in the holiday-shortened week. With the earnings season around the corner, the market is coming out of the sluggish phase and getting ready for the busy days ahead.

The upcoming events that can attract investors’ attention include the fourth-quarter earnings release of medical device maker AngioDynamics, which is due on July 13.

Kicking off the earning season, banking giants JPMorgan Chase and The Goldman Sachs Group will be publishing their second-quarter statements before the market’s open. On the same day, Packaged food company ConAgra Brands and soft drink giant PepsiCo will also be unveiling their latest financial data.

The spotlight will remain on bank earnings on July 14, when Citigroup, Bank of America, and Wells Fargo are scheduled to report. They will be joined by fund management firms BlackRock and Delta Air Lines. The next day– July 15 — Morgan Stanley and Bank of New York Mellon will report.

Key Earnings to Watch

Monday: KINNEVIK, Simulations Plus

Tuesday: Goldman Sachs Group, Angiodynamics, PepsiCo, JP Morgan Chase, Conagra Brands, First Republic Bank, and Aspen Group

Wednesday: BlackRock, Infosys, Citigroup, America Movil, Delta Air Lines, Wells Fargo, and Bank of America

Thursday: Taiwan Semiconductor Manufacturing, Bank of New York Mellon, WNS (Holdings), Morgan Stanley, UnitedHealth Group, US Bancorp, Wipro Ltd, American Outdoor Brands, and Alcoa Corporation

Friday: Autoliv, Atlas Copco, Kansas City Southern, and First Horizon National Corporation

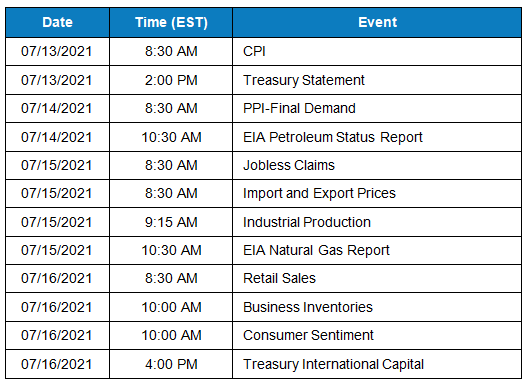

Key US Economic Events

Notable Transcripts

The following are notable companies which have reported their earnings last week. In case if you have missed catching up on their performance, click the respective links to skim through the transcripts to glean more insights.

Helen of Troy Q1 2022 Earnings Transcript

Levi Strauss Q2 2021 Earnings Transcript

SMART Global Q3 2021 Earnings Transcript

AZZ Q1 2022 Earnings Transcript

PriceSmart Q3 2021 Earnings Transcript

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.