Investing in INTC

In the absence of any positive cues, there is no reason to believe that Intel would create reasonable shareholder value in the near future. Though the long-term target price represents a 13% upside, it is advisable to hold INTC and put investment decisions on hold until a clearer picture emerges.

Recently, the chipmaker launched its new Core and Xeon processors. But it seems the company still lags behind rivals Advanced Micro Devices (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA) — which rolled out its high-end data center CPU Grace recently — on the data center front. That said, Intel has what it takes to emerge stronger in the long term, such as impressive production volumes, solid PC market reach, and a growth strategy that includes setting up two new foundries in Arizona at the cost of $20 billion. It is a key priority for Pat Gelsinger who took over as the company’s chief executive officer recently.

Long Term Strategy

The management is quite optimistic about the prospects of Meteor Lake, Intel’s first 7-nanometer CPU that is expected to hit markets in 2023, and the new-generation data center CPU Sapphire Rapids that is scheduled to go into production later this year.

“We plan to expand other locations and establish Intel Foundry Services as a major provider of committed foundry capacity in the US and Europe while ensuring a sustainable and secure semiconductor supply for the world. Since its announcement, the industry response to Intel Foundry Services have already been incredible. We are engaged with well over 50 potential customers today. We’re seeing excitement from some of the top technology giants in the world across industry verticals ranging from automotive to high-performance compute and cloud service providers.,” Gelsinger told analysts during a recent interaction.

Flat Q1 Numbers

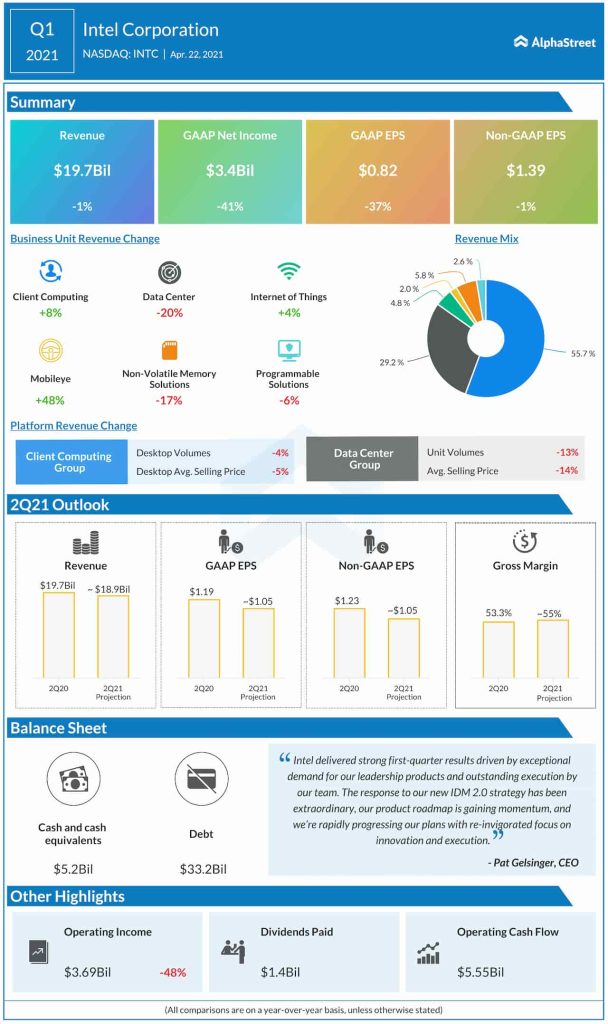

At $20 billion, first-quarter revenues were almost in line with the prior-year levels, while earnings edged down 1% to $1.39 per share. The numbers exceeded the market’s prediction, as they did in the past, while the management’s guidance for the second quarter fell short of expectations.

Earnings Infographic: Micron stock gains on strong Q2 results

Intel’s stock slipped 7% Thursday evening after the mixed earnings report failed to impress investors. Interestingly, the pull-back came after the stock bounced back to the pre-COVID levels from a one-year low. It has gained 19% since the beginning of the year but underperformed the sector and the Philadelphia Semiconductor index. The stock ended Friday’s session sharply lower.