Low Valuation

What’s happening on the COVID-19 front? Here are a few updates

The Massachusetts-based biotechnology company’s pipeline got a boost last year after it advanced a number of clinical programs and ventured into new disease areas. The blockbuster launch of lead drug Trikafta — a triple combination regimen for cystic fibrosis — a couple of years ago was a major milestone for the company. While it continues to cash in on Trikafta’s dominance in the segment, with hardly any competitor out there, the party will likely be over once its patent expires in 2037. But, that’s a long time.

Untapped Market

Since Vertex’s key products were approved and launched only in the recent past, they have a great potential to further expand market share, which bodes well for the company. Being confined to the cystic fibrosis arena – Kalydeco, Orkambi, Symdeko, the only other approved drugs, are also indicated for cystic fibrosis – could become both an advantage and disadvantage in the long run.

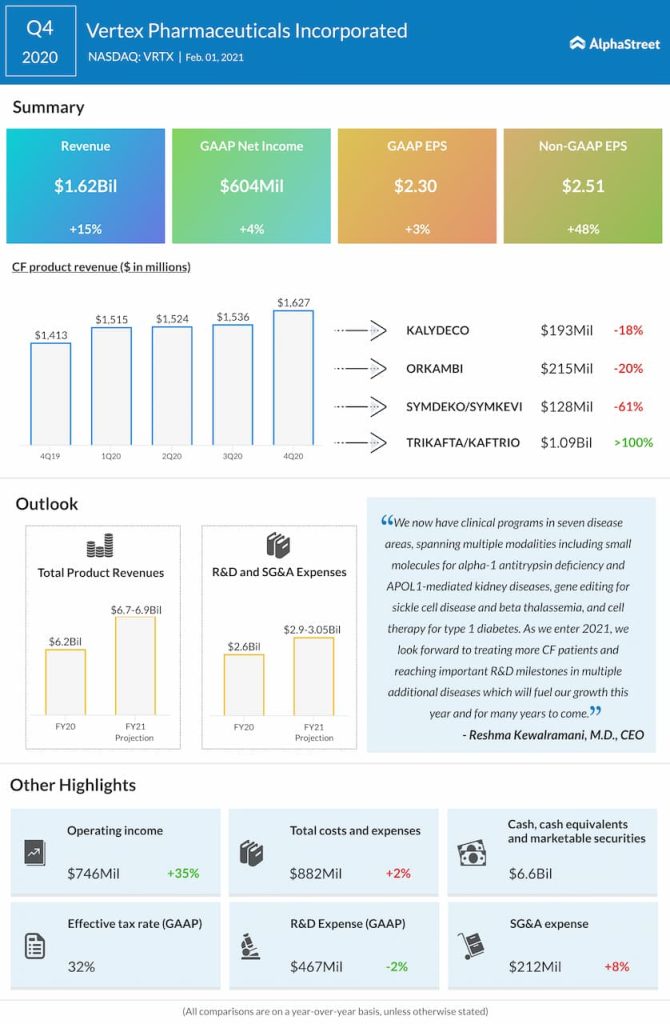

After the stable revenue performance in recent years, Vertex now has a strong balance sheet – cash balance stood at $6.7 billion at the end of 2020, up 75% from the previous year. A significant portion of the cash will be used for investing in innovation.

From Vertex’s Q4 2020 earnings conference call:

“In 2021, our commercial focus now turns to maintain the very high rates of persistence and compliance that we have seen to date. And we anticipate that these rates will normalize over the coming months. We expect the majority of near-term growth for TRIKAFTA in the US to come from approvals in rare mutations and younger age groups. TRIKAFTA was recently approved for patients 12 and older with rare mutations. And the FDA recently accepted the sNDA for six to 11-year-olds and granted it priority review. We expect approval around mid-year. In Europe, enthusiasm and interest in KAFTRIO amongst the CF community are high.”

Trikafta Leads

There was disappointment among Vertex’s shareholders when it posted weaker-than-expected earnings a few weeks ago, after beating experts’ forecast consistently for several years. Adjusted earnings jumped 48% year-over-year to $2.51 per share in the fourth quarter but fell short of expectations. Revenues advanced 15% to $1.63 billion and exceeded the projection. The top-line benefited from stable sales of Trikafta both in the domestic market and Europe.

Read management/analysts’ comments on Vertex’s Q4 earnigns

Shares of Vertex have been in a downward spiral for a long time, losing about 20% in the past twelve months. The downtrend continued in the early weeks of the year, but the stock stabilized later raising hopes of a recovery. It traded slightly higher early Tuesday.