Read management/analysts’ comments on Kroger’s Q1 2021 results

It seems a pullback from the current levels is inevitable, which is the primary factor to be considered before investing. The stock is probably poised to retreat to its pre-peak position in the coming months. In short, it is not the right time to buy KR, neither to sell it because the long-term prospects look bright.

Healthy Cash Flow

The grocery chain’s healthy cash position, even after boosting the stock-repurchase and dividend programs, should come in handy while executing growth initiatives like store upgrades and strategic acquisitions. For the management, extending the company’s e-commerce reach would be a key priority in the future, after making significant inroads into the digital realm and ramping up omnichannel capabilities. Currently, pick-up delivery is available to most American households, thanks to the efforts to extend the facility to new locations and the growing distribution network.

From Kroger’s Q1 2021 earnings conference call:

“The thing that I think is very important is that very few of our customers actually only shop online, and most shoppers shop online and in our stores. And when they shop, both our retention rate is incredibly high and our ability to gain share within that household is very high as well. And those are the major trends that we would expect to continue and those are the trends that we believe will drive our ability to double our online business along with expanding with the sheds and other pieces.”

Road Ahead

The changing retail scenario calls for measures to stay relevant in the post-COVID era and to deal with competition effectively. In what could be a game-changing move, Amazon.com, Inc. (NASDAQ: AMZN) is reportedly planning to launch a chain of physical department stores. Meanwhile, there is continuing uncertainty about how consumers’ shopping behavior would play out once the market reopening gains momentum.

The slowdown in bottom-line performance seen at the beginning of the year is estimated to have persisted in the most recent quarter — the results will be published on Friday before the market opens. Experts predict a 14% year-over-year decrease in second-quarter earnings to $0.63 per share, on revenues of $30.6 billion.

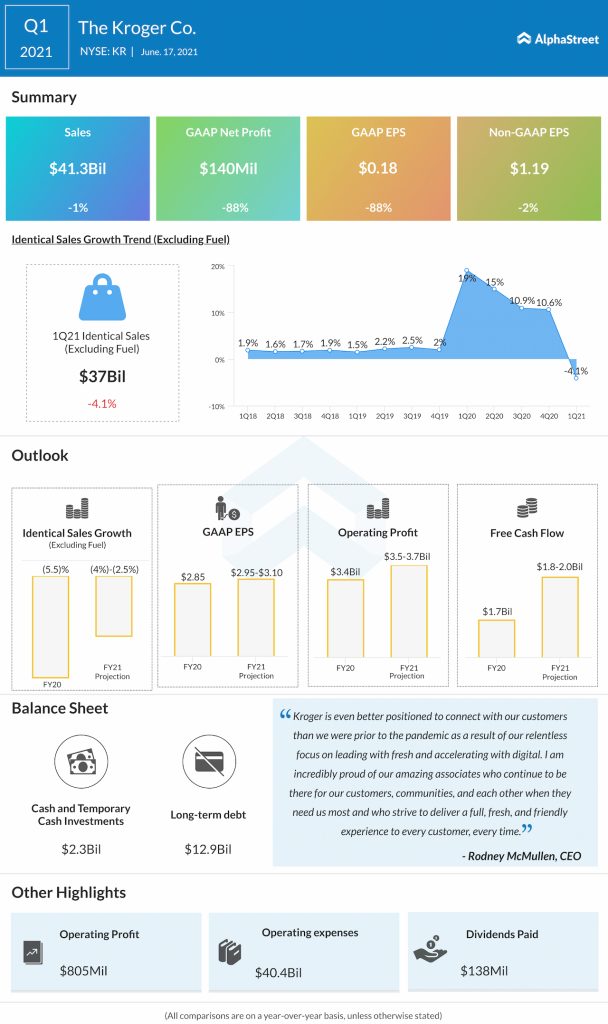

Q1 Profit Dips

In the first quarter, adjusted earnings dropped to $1.19 per share from $1.22 per share a year earlier, but topped the Street view. Comparable sales dropped 4.1%, after decelerating in each of the trailing three quarters. Consequently, total sales edged down to $41.3 billion yet outpaced the consensus estimates. Interestingly, Kroger’s earnings beat the forecast throughout the pandemic period.

The management’s outlook points to a pickup in margins for the remainder of the year and an annual increase in full-year earnings. The real bright spot is Kroger’s impressive cash flow, which is expected to expand further going forward.

Stock Peaks

Kroger’s shares gained about 34% in the past six months alone, outpacing the industry average and the S&P 500 index. The stock traded almost flat during Tuesday’s session but stayed above its long-term average, after closing the last session slightly lower.