The retail industry has picked up at a healthy pace after being impacted by the pandemic last year. The distribution of vaccines and lifting of curbs have allowed people to resume their social lives and this in turn has brought them back to stores for shopping. A number of leading retailers reported their second quarter earnings results over the past two weeks and here are a few key trends that were visible within the industry during the period:

Rebound in weak categories

The pandemic confined people to their homes and with no need or means to go to offices or attend social events, the demand for items such as fancy apparel, jewelry, and accessories dropped. However, as people started venturing out and things began to normalize, the demand in these categories have picked up. In fact, some retailers have reported strong results in these categories as people are eager to pick up the latest trends as they get ready to socialize after a long hiatus.

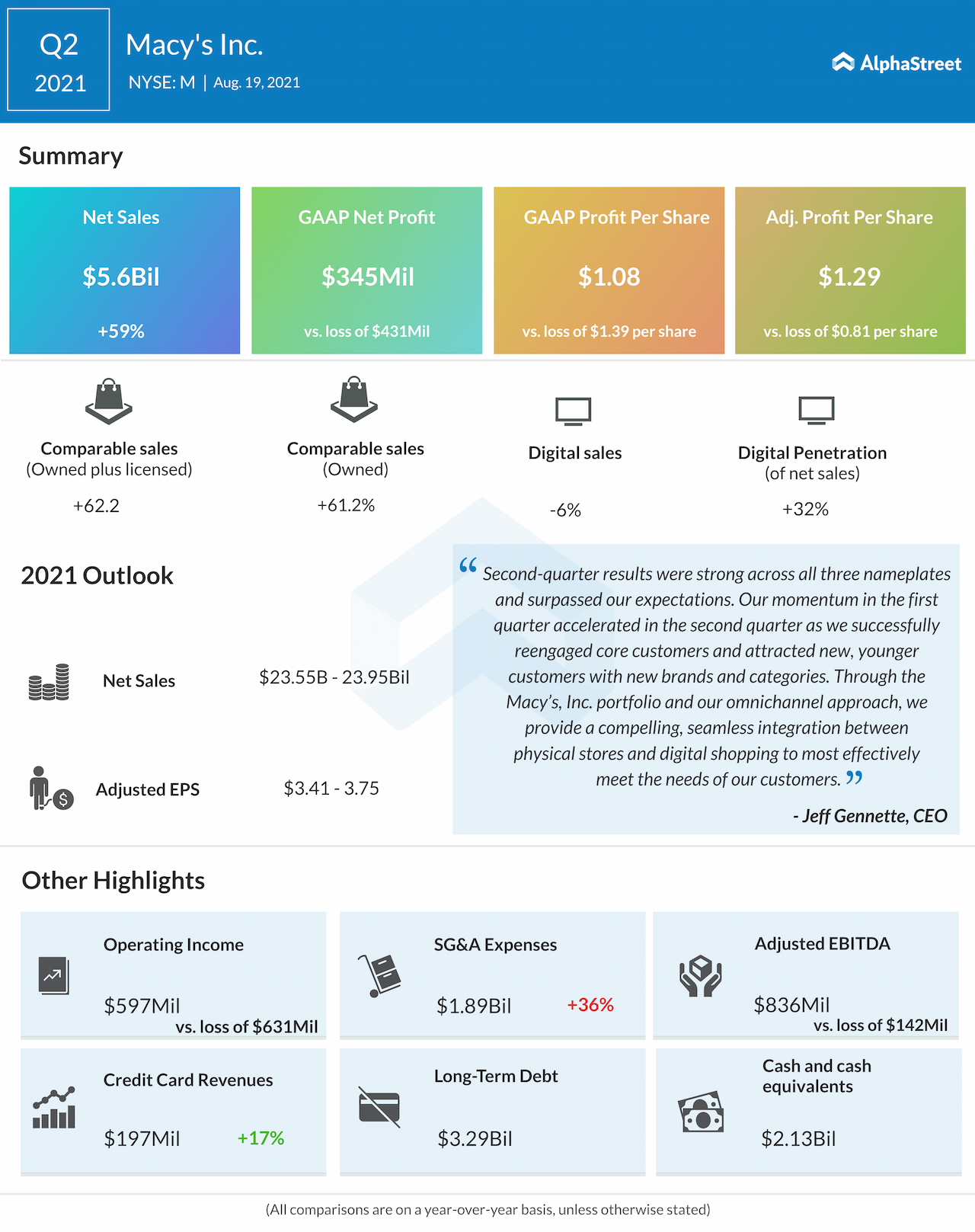

Macy’s (NYSE: M) witnessed strong demand for dressy apparel and fine jewelry during the second quarter of 2021 as shoppers prepared for social events and back-to-school. The retailer also saw demand for fragrances and accessories as people chose these as gifting options for missed occasions such as Mother’s Day and Father’s Day.

Nordstrom (NYSE: JWN) also saw an improvement in shoes, apparel and accessories in Q2 compared to Q1 as customers refreshed their wardrobes. The company saw sales in its designer offering increase over 2019 levels.

In Q2 2022, Urban Outfitters (NASDAQ: URBN) witnessed a rebound in its Nuuly subscription rental business as customers who had paused their subscriptions last year resumed their monthly deliveries.

Strength in ‘pandemic’ categories

Even as underperforming categories picked up pace, the sections that did well during the pandemic held their ground. Categories like casual and active wear witnessed strong momentum as people continued to work from home or just opted for comfortable clothing in general.

Nordstrom saw sales in its active and home categories increase over 50% in Q2 compared to 2019 levels. Macy’s and Kohl’s (NYSE: KSS) have also seen strength in the casual and active categories and Kohl’s continues to see opportunities to gain market share within casual.

Digital surge cools off

Retailers saw their digital channels gain significant traction during the pandemic due to the temporary closures of their stores. As restrictions eased and stores reopened, shoppers returned to their old pattern of in-store shopping which led to digital sales slightly slowing down from their peak levels last year.

Macy’s and Kohl’s saw digital sales decline 6% and 14% respectively, in Q2 2021 compared to the same period in 2020. Both retailers reported double-digit growth in digital sales compared to the second quarter of 2019.

In Q2 2021, Nordstrom’s digital sales increased 30% year-over-year and 24% over Q2 2019. Digital sales comprised 40% of total sales, which was slightly lower compared to the first quarter of 2021 as store traffic and sales trends improved across all regions.

In general, consumer demand and engagement are expected to remain at a healthy level going forward and consumer spending is expected to be driven by economic improvement and increasing consumer mobility. Nevertheless, there is caution around any possibility of resurgence in the pandemic caused by the variants of the virus.

Click here to access the full transcripts of the earnings conference calls of these retail companies