Fast food chain McDonald’s Corp. (MCD) reported a 103% jump in earnings for the fourth quarter helped by a decline in operating costs and expenses as well as a drop in provision for income taxes. The bottom line exceeded analysts expectations while the top line missed consensus estimates. The company provided expenses guidance for 2019 and issued a long-term, average annual forecast.

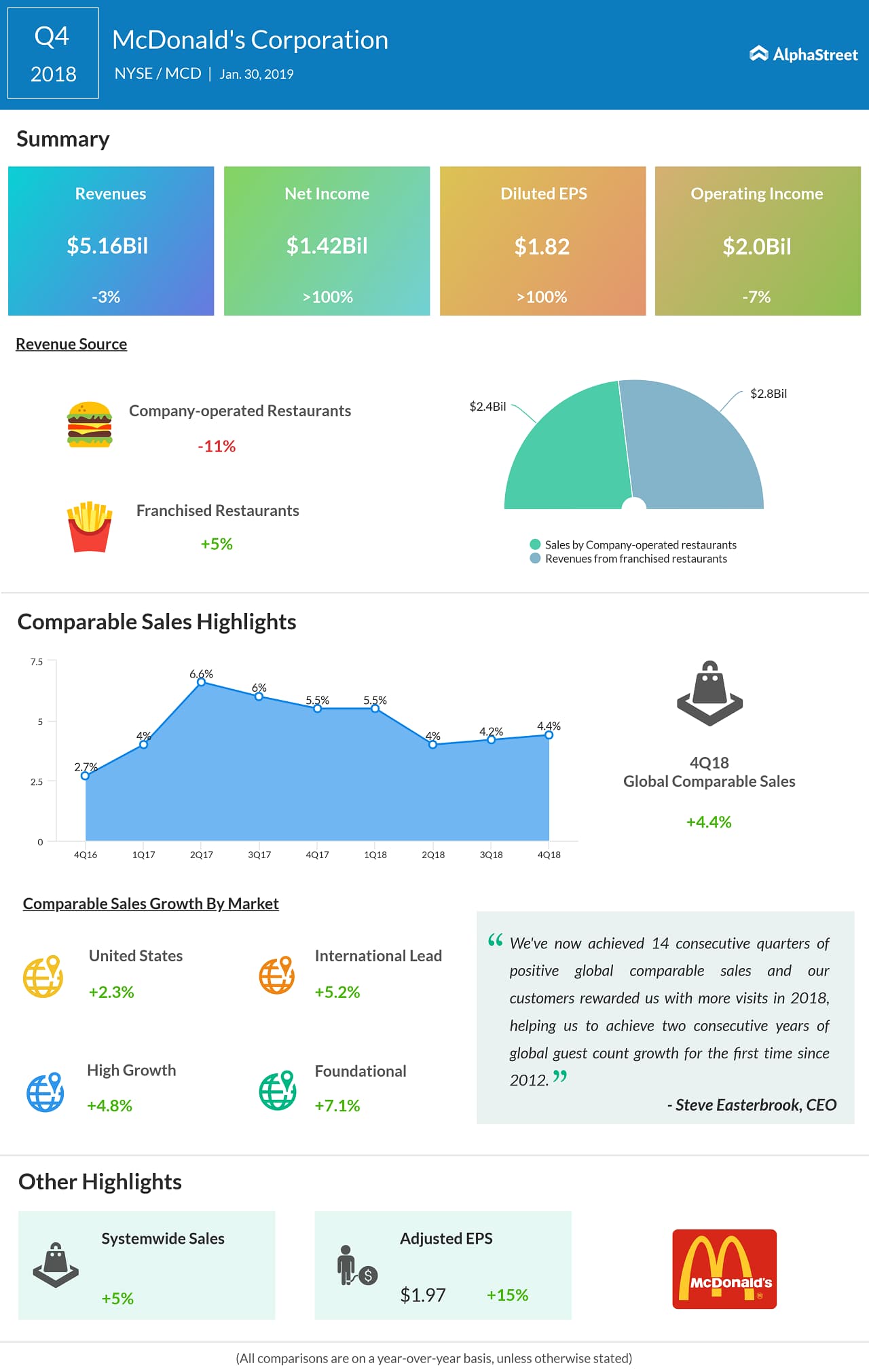

Net income climbed 103% to $1.42 billion and earnings soared 109% to $1.82 per share. The results reflected a lower effective tax rate and stronger operating performance due to an increase in sales-driven franchised margin dollars.

Foreign currency translation had a negative impact of $0.05 on diluted earnings per share for the quarter. Adjusted earnings increased 15% to $1.97 per share.

Revenue declined 3% to $5.16 billion due to the impact of its strategic refranchising initiative. Global comparable sales increased 4.4%, reflecting positive comparable sales across all segments. Systemwide sales increased 5% in constant currencies.

In the US, comparable sales for the fourth quarter rose 2.3% on growth in average check resulting from both product mix shifts and menu price increases. In the International Lead segment, comparable sales increased 5.2%, reflecting positive results across all markets, primarily driven by the U.K., Germany, and Australia.

In the High Growth segment, comparable sales increased 4.8%, led by continued strong performance in Italy and the Netherlands, as well as the positive results across most of the segment. In the Foundational markets, comparable sales grew 7.1%, reflecting positive sales performance in Japan and across all geographic regions.

The company returned $8.5 billion to shareholders through share repurchases and dividends. In addition, the company announced a 15% increase in its quarterly dividend to $1.16 per share beginning in the fourth quarter 2018 and increased the cash return to shareholder target for the 3-year period ending 2019 to about $25 billion.

On January 24, 2019, McDonald’s board of directors declared a quarterly cash dividend of $1.16 per share of common stock, payable on March 15, 2019, to shareholders of record on March 1, 2019.

Looking ahead into the full year 2019, the company expects costs for the total basket of goods to increase about 1% to 2% in the US and about 2% in key markets outside of the US. The effective income tax rate is projected to be 24% to 26% range.

Selling, general and administrative expenses are anticipated to fall about 4% in constant currencies for the full year 2019. Interest expense is predicted to rise about 10% to 12% due primarily to higher average debt balances. The company sees capital expenditures for 2019 to be about $2.3 billion. Globally, McDonald’s expects to open roughly 1,200 restaurants and predicts about 750 net restaurant additions in 2019.

Also read: McDonald’s Q4 2018 earnings conference call transcript

During 2019, the company projects to return about $9 billion to shareholders, which will complete its cash return to shareholder target of about $25 billion for the 3-year period ending 2019.

Beginning in 2019, the company expects to achieve long-term, average annual (constant currency) systemwide sales growth of 3% to 5%, and operating margin in the mid-40% range. Earnings per share growth are anticipated to be in the high-single digits range and return on incremental invested capital is projected to be in the mid-20% range.

Shares of McDonald’s ended Tuesday’s regular session down 0.78% at $182.17 on the NYSE. The stock has risen over 2% in the past year and over 5% in the past three months.