UBER TECHNOLOGIES, INC. Q4 2021 Earnings Call Transcript

The stock got a major lift this week after Uber reported a surprise profit for the fourth quarter aided by broad-based revenue growth, but the company is yet to achieve sustainable profitability. The encouraging performance in recent quarters, marked by strong results that consistently beat the estimates, has brightened turnaround hopes. A key factor that makes the stock a compelling buy is the low valuation.

Road Ahead

Uber was regaining the lost momentum when the spread of omicron derailed the recovery process. With the curbs being relaxed in various states, it is probably headed for a strong year. The delivery service witnessed a spike in orders in the early phase of the crisis and maintained the uptrend since then, which is likely to continue because customers are unlikely to go back to their previous shopping habits.

When it comes to profitability, the management is optimistic about achieving a turnaround in the near term, thanks to the cost-cutting initiatives and restructuring focused on the closure of nonperforming businesses.

But certain aspects of the business are yet to improve, like labor shortage and cost pressure. Also, the company’s lackluster performance at the stock market remains a concern for stakeholders, with the stock hardly making any gains since the 2019 IPO. While Uber enjoys a significant lead in the market, it might face stiff competition from rival ride-hailing platform Lyft, Inc. (NASDAQ: LYFT) and food delivery firms like DoorDash, Inc. (NASDAQ: DASH) in the future.

Impressive Numbers

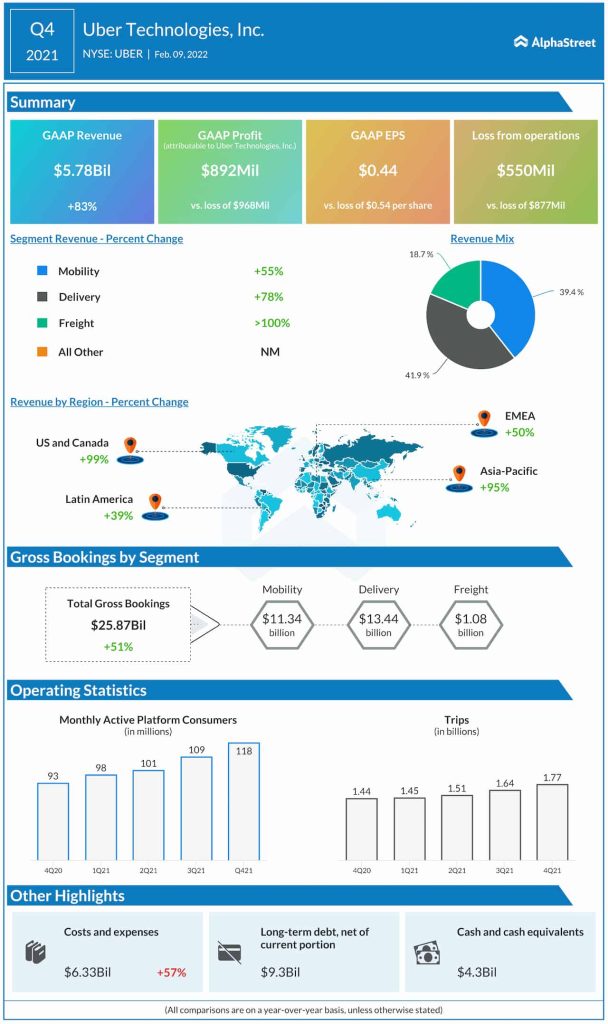

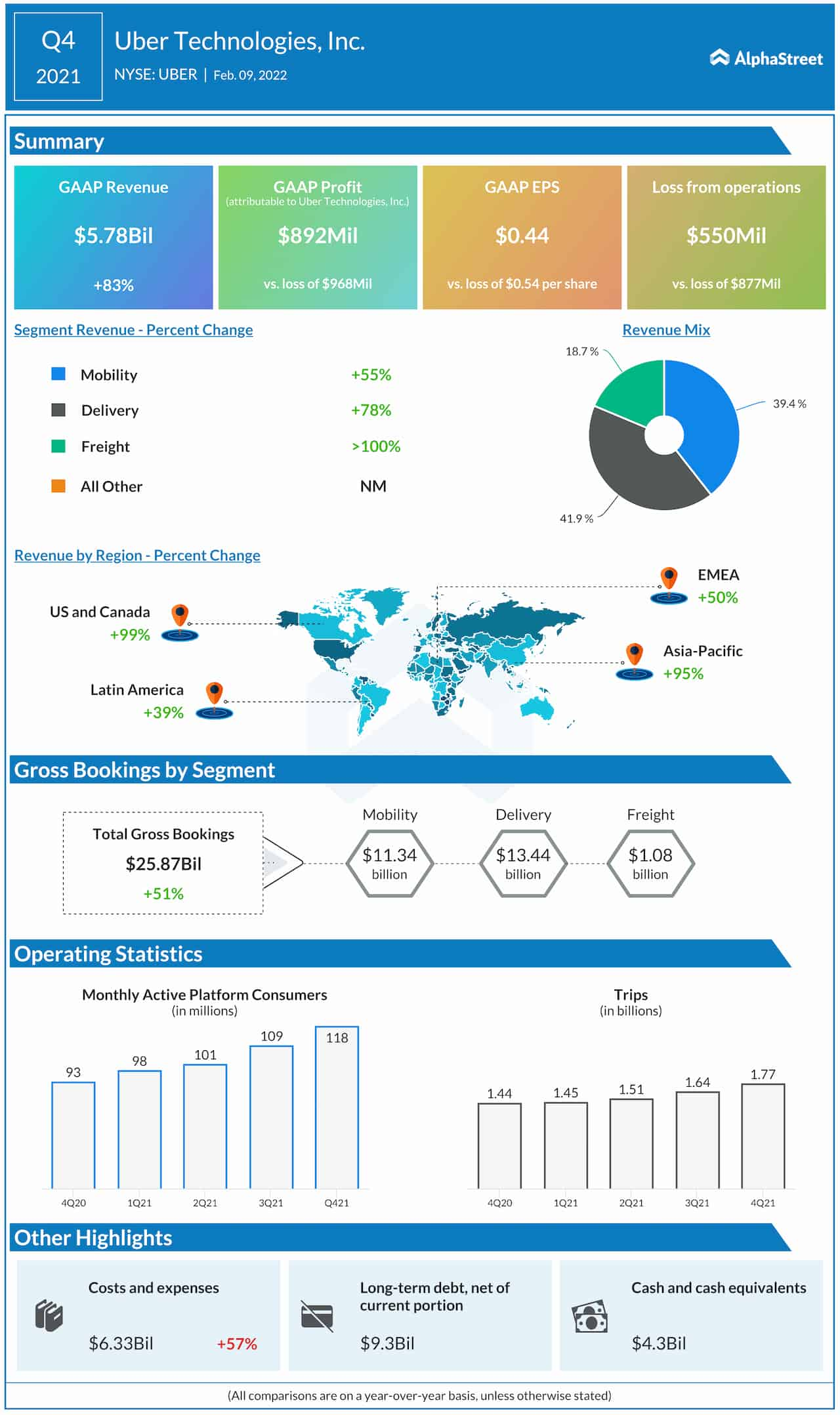

All the key business segments registered strong growth in the December quarter, which translated into an 83% surge in revenues to $5.78 billion. Consequently, the company turned to a profit of $0.44 per share from a loss of $0.54 per share in the prior year. At $25.9 billion, total gross bookings were up 51%. There were around 118 million monthly active consumers at the end of the quarter.

From Uber’s Q4 2021 earnings conference call:

“There are lots of ups and downs. But the really great thing that we’re seeing now is that the diversification within our portfolio of Mobility and Delivery and the geographic diversification allows us when something is weak we can lean in to help things out when one geo is particularly strong, we can take some of that strength and reinvest it in other areas. The diversification of our portfolio is really coming into play and we kind of thought in January. I mean, no one wants to go through another COVID wave or the Omicron wave.”

Lyft Earnings: 4Q21 Key Numbers

UBER lost about 36% in the past twelve months, but the trend seems to be reversing this year. The stock closed the last trading session lower after shedding a part of the post-earnings gains.