Meanwhile, the company’s upbeat third-quarter results failed to impress the market as the key metrics experienced weakness sequentially, raising concerns that the virus-driven boom is starting to fade.

Stock Falls

The weak sentiment, catalyzed by renewed hopes of offices resuming operations amid positive reports on the vaccine front, spurred a sell-off and the company’s stock suffered a big loss following the announcement. Also, at the current price, the stock is believed to be overvalued in relation to earnings.

The ongoing volatility calls for caution as far as investing in Zoom is concerned, with analysts’ outlook sending out mixed signals. However, the long-term target price indicates the stock might recover in the coming months and bounce back to its recent peak. On the positive side, there is no reason to think that the demand for video conferencing services would decline, but the entry of new players will intensify competition. Of late, even tech majors like Cisco (CSCO) and Microsoft (MSFT) have been vying for a slice of the video-chat pie.

Customer Retention

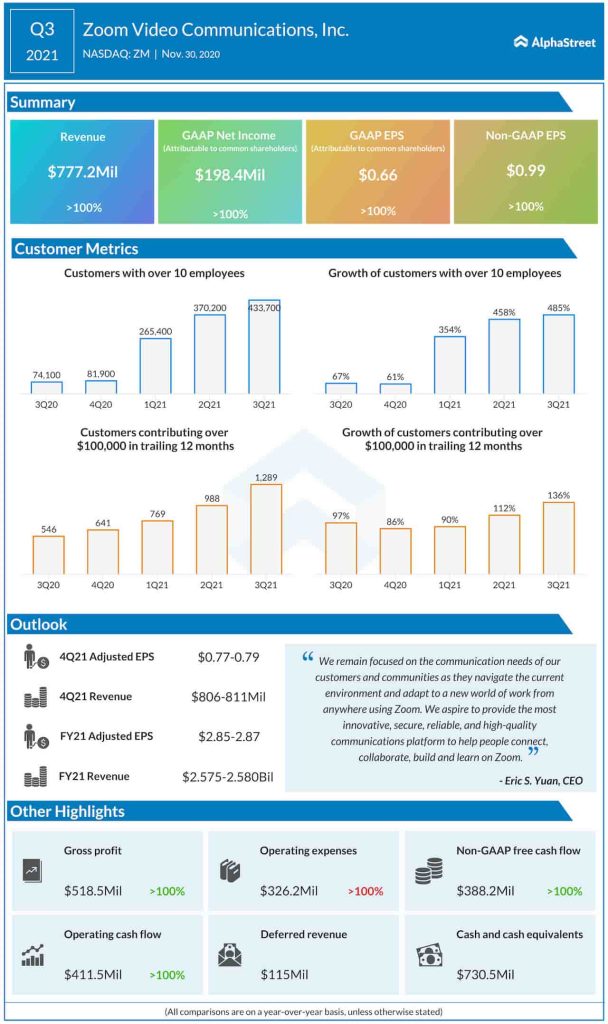

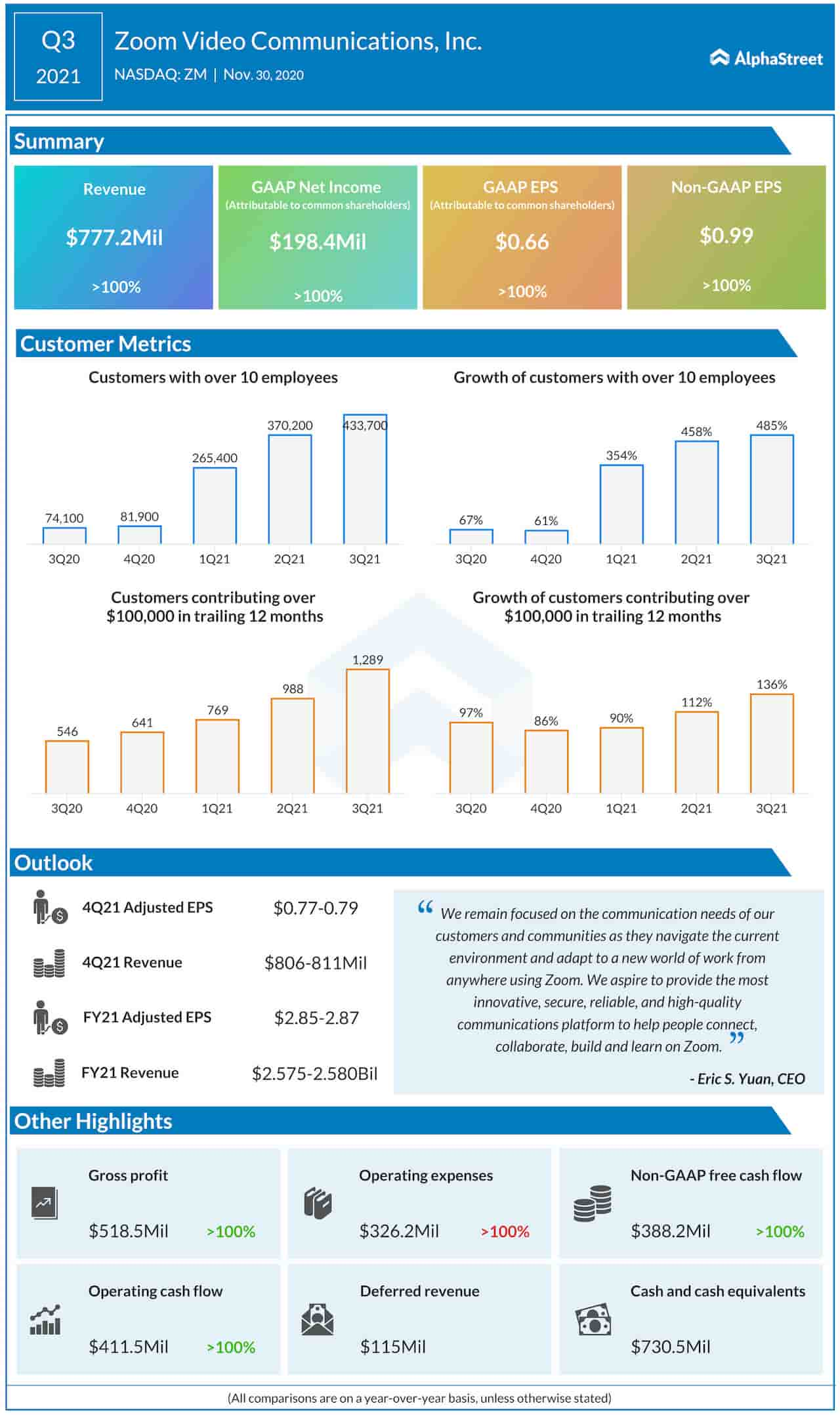

Encouraged by the low churn rate, Zoom’s management is working to convert monthly users into annual customers. “We see the most volatility of course in the segment of customers with 10 or fewer employees, but even that was at an improved level than what we were originally forecasting. As I talked about before that due in part to these actions where we’re having success in converting customers from monthly to annual contracts,” said chief financial officer Kelly Steckelberg.

Another Strong Quarter

The number of big customers – those employing more than 10 persons – surged to 433,700 in the third quarter, resulting in a three-fold growth in revenues to $777 million. Consequently, earnings climbed to about one dollar from last year’s nine cents. However, margins and cash balance dropped quarter-over-quarter as they came under pressure from high costs and investments in infrastructure. Overall, there was a sequential slowdown in some of the key metrics this time. It is estimated that gross margins would continue to be impacted by higher usage of public clouds and an increase in free users, especially educational institutions.

Facebook reports stellar results for Q3

From Zoom’s third quarter earnings conference call:

“This top-line result exceeded the high-end of our guidance range of $690 million due to strong sales and marketing execution in both our online and direct businesses as well as lower than expected churn. For the quarter, the year-over-year growth in revenue was primarily due to subscriptions provided to new customers, which accounted for approximately 81% of the increase while subscriptions provided to existing customers accounted for approximately 19% of the increase. This demand was broad-based across products, industry verticals, geographies, and customer cohorts,”

On the Bourses

The stock climbed to a record high in mid-October, reflecting the upbeat sentiment over the growth the company achieved during the pandemic. However, the momentum waned since then and it entered a volatile phase. The stock traded down 14% in the early hours of Tuesday’s session, after doubling the value in the past six months.