Digital development

In response to the COVID-19 pandemic, Walgreens has significantly improved its fulfillment capabilities. The company has increased its online capacity to deal with the spike in demand seen in recent months.

During the fourth quarter, Boots.com sales rose 155% and Walgreens.com sales increased 39%. Walgreens picked up its technology transformation by converting 1,145 stores to retail SAP during the quarter, bringing the total to 3,500 stores. The implementation of SAP provides the company with a cloud platform which helps improve its local fulfilment and omnichannel capabilities.

As part of its many efforts to improve customer convenience, Walgreens is rolling out a new offering that will allow customers to order online or through its app and collect their orders in-store, curbside or by drive-thru. The company plans to increase its investments in digital development and omnichannel capabilities by $400 million bringing it to a total of $1 billion in fiscal year 2021.

Cost management

Walgreens is making progress on its Transformational Cost Management Program and the company aims to generate more than $2 billion in annual cost savings by fiscal year 2022. The company is optimizing its store fleet and revamping its store operating model in the US and in the UK, it is restructuring the Boots business model.

Walgreens is looking to reduce its Boots UK and Boots Opticians workforce by around 7%. The company is working on bringing down its costs and using the savings for investment in growth initiatives.

Outlook

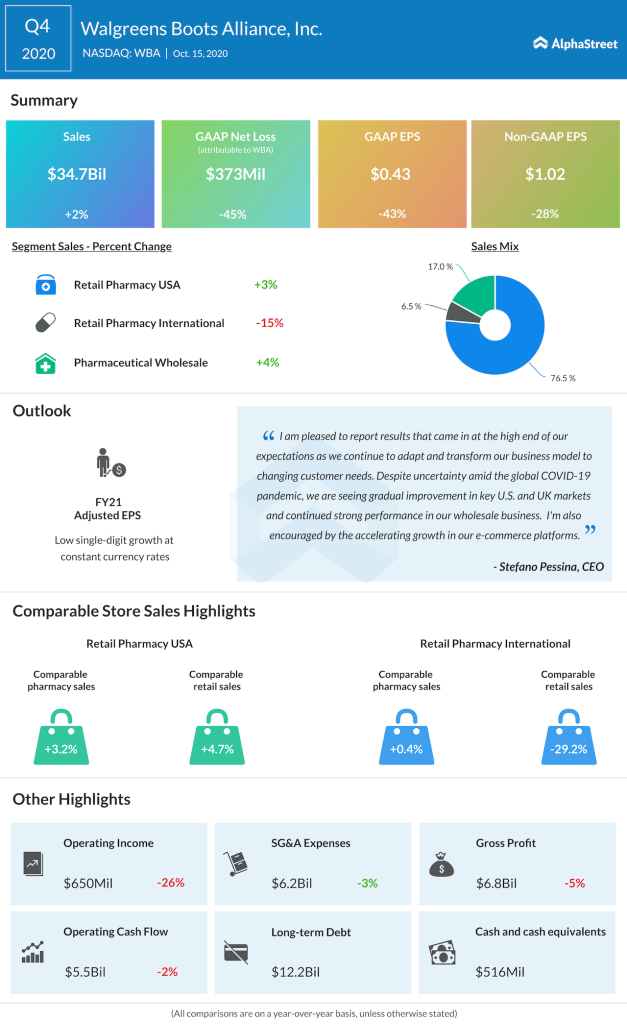

Looking into fiscal 2021, Walgreens believes that markets will continue to be negatively impacted by COVID-19 and that trading conditions will remain difficult over the next two quarters. However, the company expects to see a recovery in markets as the year progresses along with improvements in its own businesses during the second half of the year.

Walgreens estimates a low single digit growth in adjusted EPS on a constant currency basis for fiscal year 2021. The adverse effects from the pandemic are expected to cause a decline of 17-23% in adjusted EPS during the first half of the year but as the health crisis begins to subside and as growth investments start to pay off during the second half, the company expects things to pick up and adjusted EPS to grow 30-40%.

Click here to read the full transcript of Walgreens Boots Alliance Q4 2020 earnings call