The Stock

After being hit by the market selloff, Intuit’s stock regained strength this year aided by the market’s positive reaction to earnings reports for the first two quarters. Despite improving its position, the stock is trading below its 52-week average and the record highs of November 2021. To some extent, the weakness can be attributed to elevated inflation, interest rate hikes, and growing concerns over a potential economic slowdown.

Read management/analysts’ comments on quarterly reports

A part of the company’s revenue is cyclical due to the seasonal nature of its tax business, and fluctuates according to the timing of IRS filing. An important factor that needs to be taken into consideration before investing in the Mountain View-based fintech firm is the fact that often the stock is as cyclical as the business itself. Still, INTU is a safe bet since the factors that weigh on market sentiment at present are not specific to the company or the industry it belongs to.

Buy INTU?

Intuit’s unique business model and growing adoption of the company’s financial and tax filing solutions are the main advantages as far as its future prospects are concerned. It offers a great investment opportunity to those looking to hold the stock for the long term, and now is a good time to buy.

“Our company is in a significantly different position than it was during the last recession more than a decade ago. Our platform and cloud-based offerings have significantly expanded to become the platform of choice for consumers and small businesses. Therefore, Intuit is even more mission-critical for the customers we serve. We have highly predictable recurring revenue, and much of our business is subscription-based,” said Intuit’s CEO Sasan Goodarzi during a recent interaction with analysts.

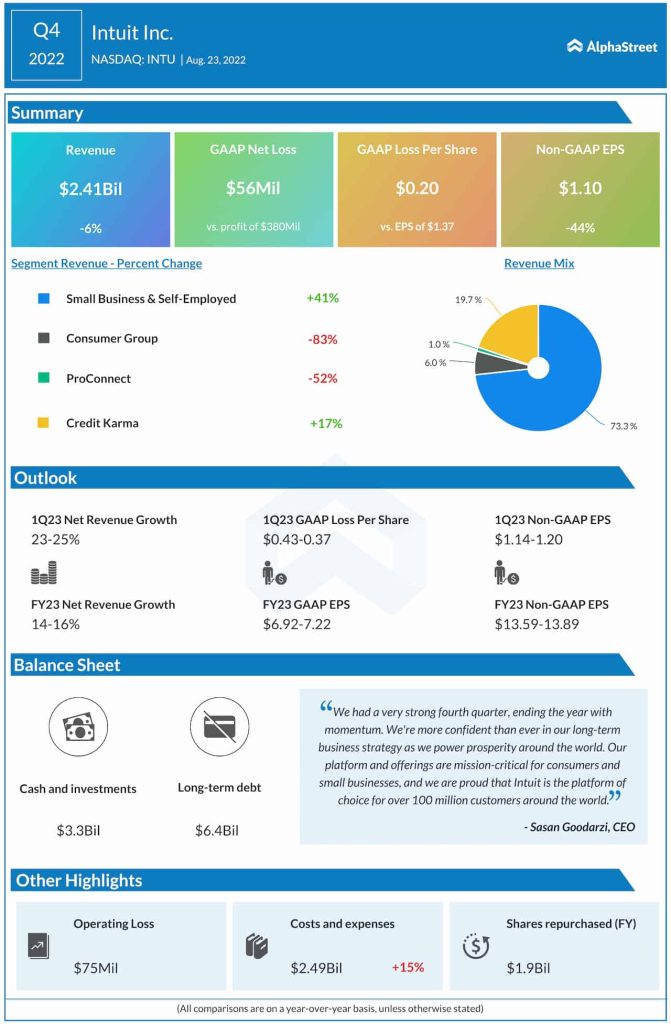

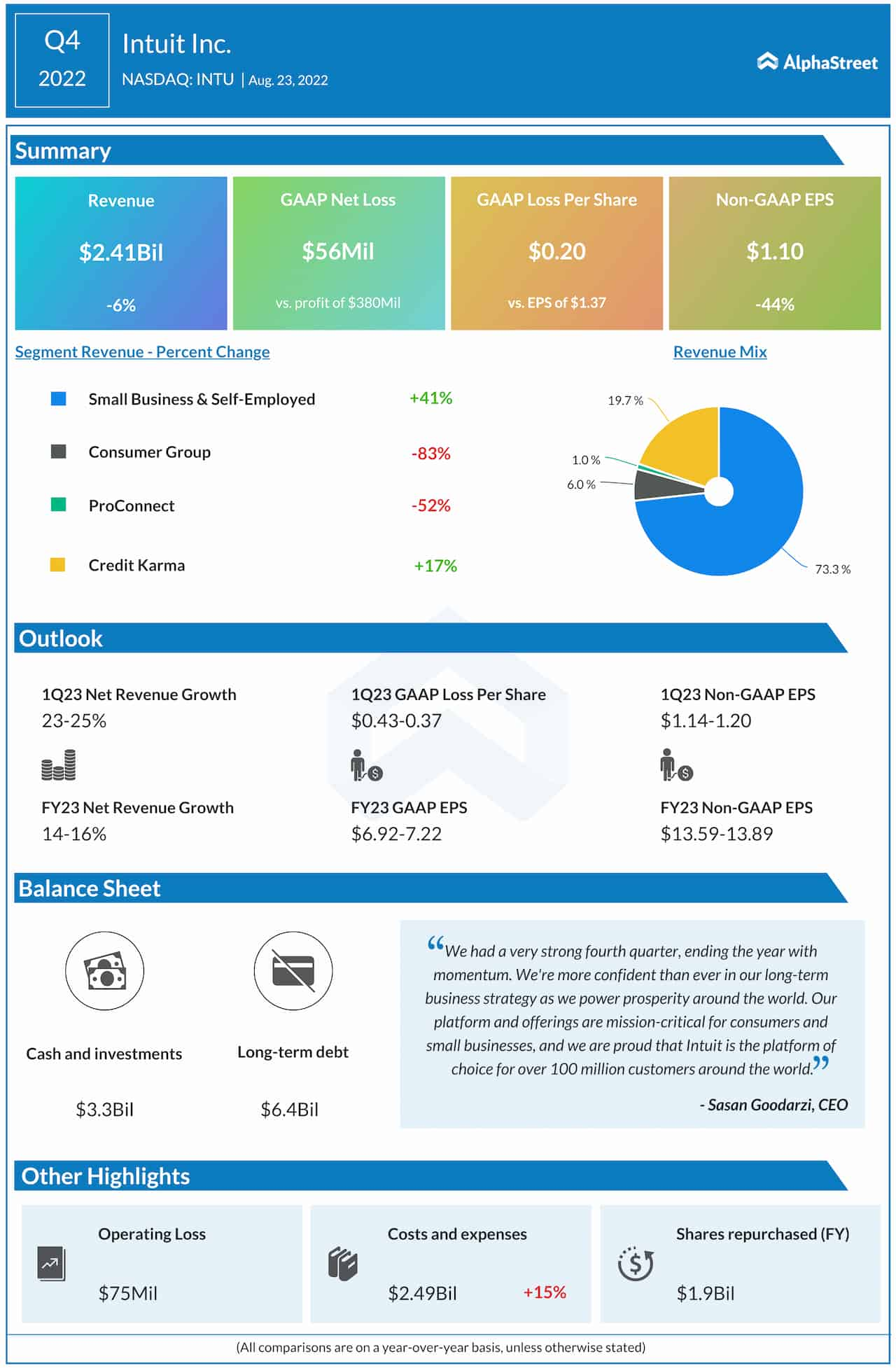

Key Numbers

Of late, the shift to the subscription model has made Intuit’s revenue performance more predictable. The company ended fiscal 2022 on a positive note, reporting better-than-expected earnings and revenues for the fourth quarter. However, the numbers declined year-over-year. At $2.41 billion, revenues were down 6% and that translated into a 44% fall in adjusted profit to $1.10 per share.

Infographic: Highlights of PayPal’s Q2 2022 earnings report

Intuit acquired Credit Karma a few years ago in a multi-billion-dollar deal that marked its entry into the personal finance space. More recently, the company bought email marketing firm Mailchimp as part of its efforts to enhance offerings for small-and-medium businesses.

Shares of Intuit closed the last trading session lower, after maintaining an uptrend throughout the day. In the past 30 days, it has gained about 11%.