Cloud Power

The San Francisco-headquartered cloud service firm has a long history of beating the market’s quarterly earnings estimates – the bottom-line beat in every quarter since 2016. In the most recent quarter, remaining performance obligation, a measure of the forward demand for the company’s services, grew by a fifth from the year-ago period. While the flagship Sales Cloud platform continued to accelerate, the popular Customer 360 platform witnessed strong adoption as more and more businesses wanted to use it for connecting with their customers.

Read management/analysts’ comments on quarterly earnings

The tech firm is a favorite among income investors also, though it does not pay dividends currently. When compared to its peers in the cloud space, the stock is very cheap. Interestingly, the ongoing economic uncertainties have had minimal impact on Salesforce’s business so far, thanks to the unique business model that has helped the company stay resilient to market headwinds on many occasions in the past.

Resilience

Encouragingly, the adverse economic conditions have not slowed down the ongoing digital transformation, which bodes well for Salesforce. The company’s growing partner network and broad-based growth across geographical regions benefited from the digital boom. After the acquisition of MuleSoft, Tableau, and more recently Slack, Salesforce is better positioned now to grow the business and explore new revenue streams.

“We became more strategic and more relevant to our customers because we focus on their success and that continues today. And that’s why we’ve been able to grow our revenue for 72 consecutive quarters through every cycle, a focus on customer success, and it’s why Salesforce remains the No. 1 in CRM now for the ninth year in a row, growing in share in all CRM segments yet again according to the IDC Software Tracker,” said Marc Benioff, chief executive officer of Salesforce.

Q1 Outcome

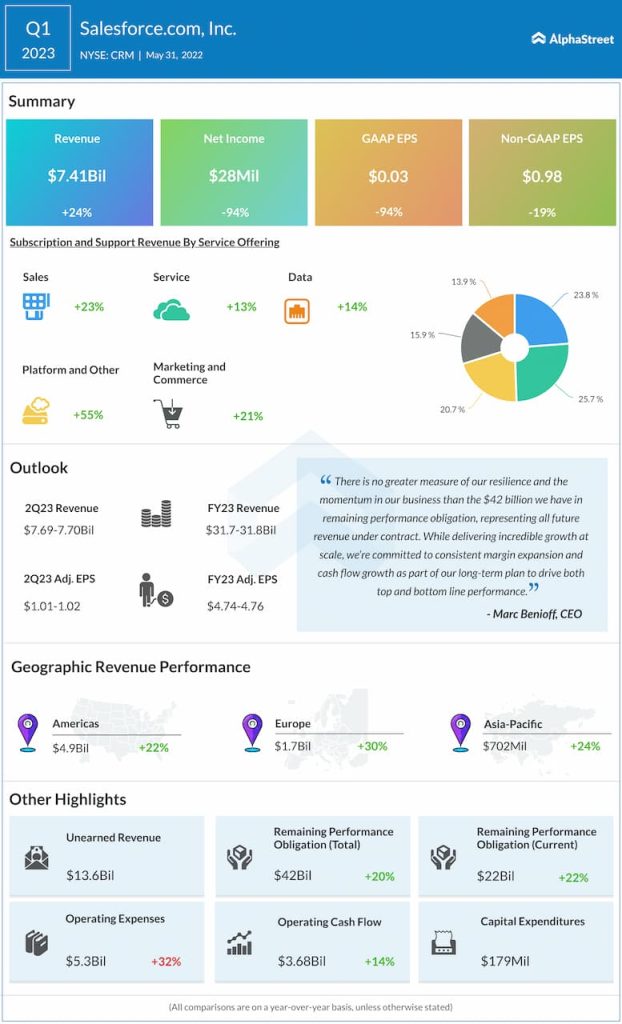

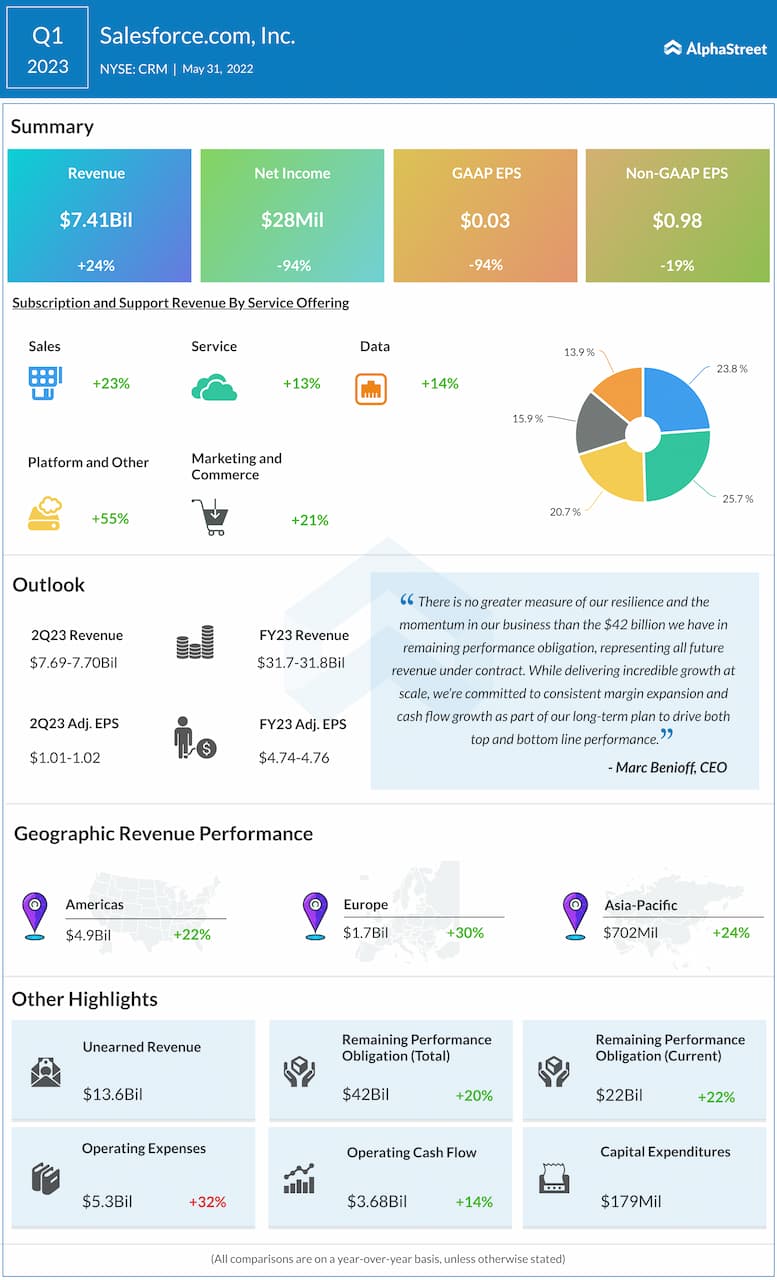

The company this week posted better-than-expected profit for the first quarter of 2023, as it did in every quarter over the past five years, though earnings declined year-over-year to $0.98 per share. Meanwhile, all operating segments and geographical divisions registered double-digit growth, driving total revenues up 24% to $7.41 billion. The management also provided positive guidance for the second quarter and full fiscal year.

All you need to know about Oracle’s Q3 2022 earnings results

After peaking in November last year, the company’s shares withdrew and kept heading south. They have lost about 29% since the beginning of the year. However, the stock made strong gains in early trading on Wednesday and maintained the uptrend throughout the session.