With the corporate world rapidly shifting to cloud-native computing after the virus outbreak changed work culture and the way businesses operate, technology providers are aggressively innovating their offerings. Hewlett Packard Enterprise Company (NYSE: HPE), a leading edge-to-cloud platform-as-a-service firm, is counting on the rapid adoption of the hybrid business model to drive future growth.

Though the company’s stock recovered modestly from last year’s lows, it is still languishing below the long-term average. Experts’ outlook points to stagnation, though the target price indicates a modest increase this year. Probably, it is not the right time to buy/sell HPE and it makes sense to adopt a wait-and-watch strategy until things improve.

As-a-service Pivot

Currently, the management’s focus is on strengthening the core businesses and accelerating the transformation to a as-a-service company. Uncertainties surrounding enterprise spending has been a concern even while the tech space thrived on the virus-driven digital transformation spree in the past several months. But Hewlett Packard executives are optimistic about achieving long-term growth goals because they see a gradual increase in customer spending as the year progresses.

From Hewlett Packard’s Q1 2021 earnings conference call:

“As a result of our cost optimization and resource allocation program, we are emerging from an unprecedented crisis as a different company, one that is much leaner, better resourced and positioned to capitalize on the gradual economic recovery currently at play. We are already seeing the benefits of our actions in our improved margin profile and free cash flow outlook.”

Last year, the company acquired Silver Peak, a leading provider of software-defined wide area network services, in a move aimed at expanding market share in the campus switching and wireless LAN segments. Another area of focus is edge cloud data centers, for which a new set of cloud-native and fully automated switching products were rolled out recently.

Mixed Q1 Outcome

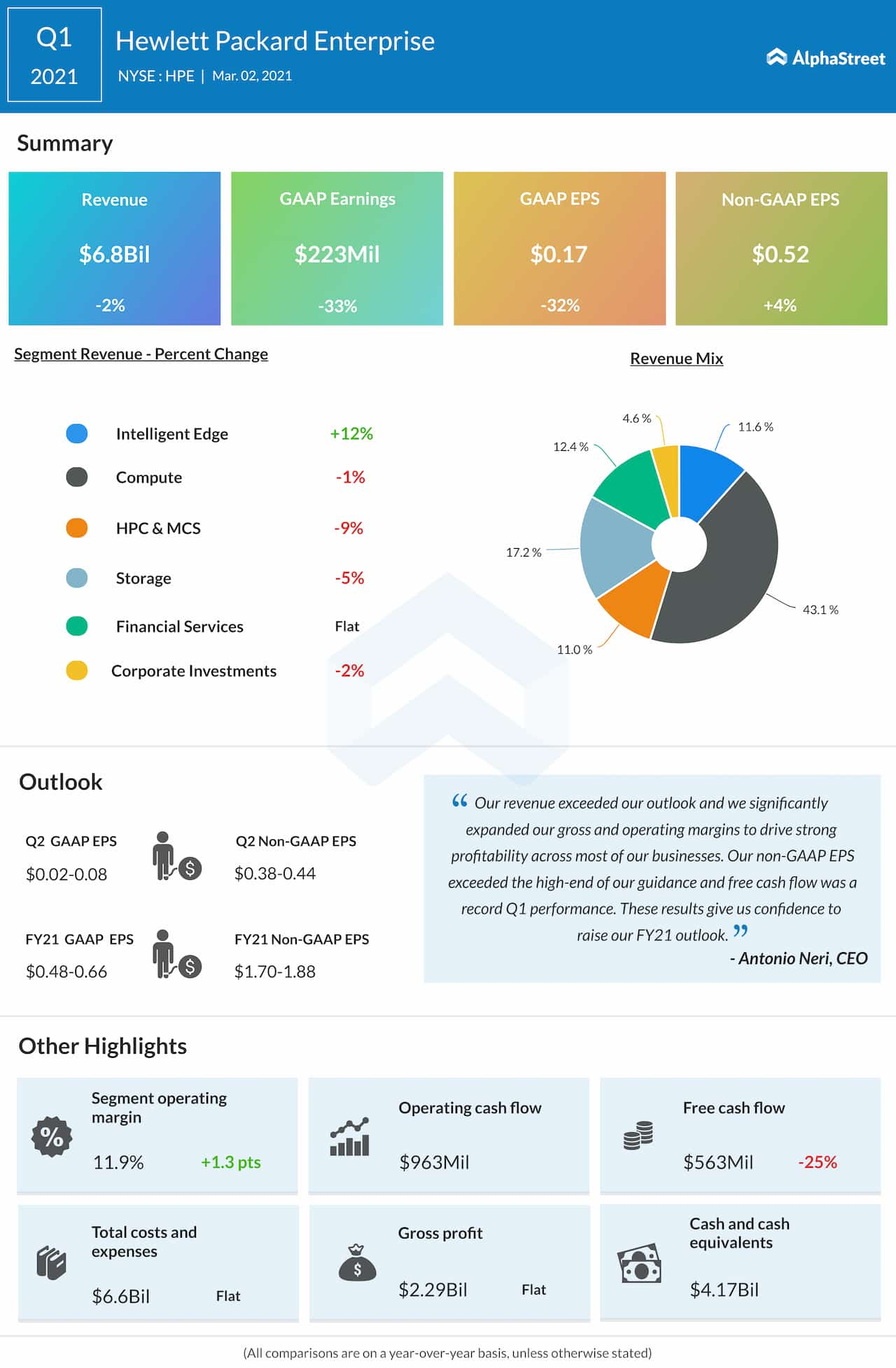

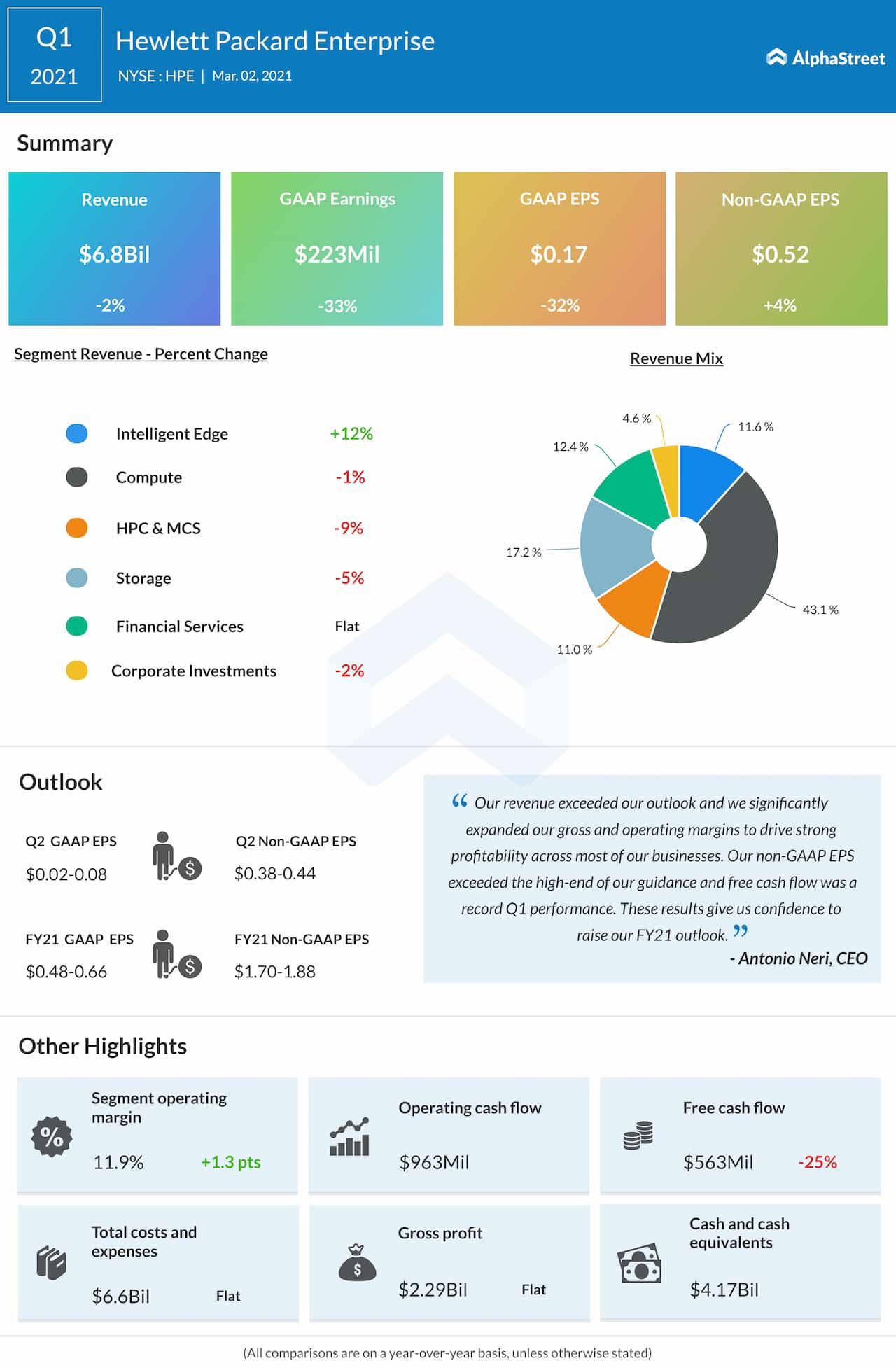

The continued slowdown in key areas of the business weighed on the top-line in the first quarter when total revenues dropped 2% annually to $6.8 billion. On the other hand, adjusted earnings increased 4% to $0.52 per share, reflecting the cost-management initiates. The numbers exceeded experts’ prediction, as they did in the previous two quarters. Encouraged by the positive outcome, the company raised its earnings and free cash flow outlook for fiscal 2021.

From a top-line perspective, we are pleased with the momentum we saw in Q1, and whilst we continue to see gradual improvement, we remain prudent as we and the rest of the world continue to navigate the pandemic and related macro uncertainties. More specifically for Q2 ’21, we expect revenue to be slightly better than in line with our normal sequential seasonality of down mid-single digits from Q1. This still represents double-digit year-over-year growth from the $6 billion-trough of Q2 of fiscal year ’20.

Tarek Robbiati, chief financial officer of Hewlett Packard

ADVERTISEMENT

Read management/analysts’ comments on Hewlett Packard’s Q1 report

At the Bourses

After being hit by the virus-related selloff early last year, Hewlett Packard’s stock stagnated and slipped into the single-digit territory. But it regained strength towards the end of the year and moved closer to the pre-crisis levels, though at a sluggish pace.