CVS Health Corporation (NYSE: CVS), a diversified health services company, made an impressive start to the year after ending 2021 on a high note supported by the high demand for health insurance and COVID-19 vaccination drive.

The company’s quarterly profit beat consensus estimates consistently over the past six years amid stable sales growth, driving up its market value. However, when the market selloff rattled Wall Street recently, CVS Health was not spared. But the stock remained very stable compared to the broad market, reflecting the company’s strong fundamentals and scale of business.

The Stock

The stock has been hovering near the $100-mark for some time and is forecast to gain about 22% in the current fiscal year, which offers a rare investment opportunity investors wouldn’t want to miss. Market watchers overwhelmingly recommend buying CVS. The healthy valuation, which looks quite reasonable, is another factor that makes it attractive.

Read management/analysts’ comments on CVS Health’s Q1 2022 results

The company recently raised annual dividend by 10% and authorized additional share buybacks as part of its strategy to enhance shareholder returns, which is likely to attract more income investors. The move marks the resumption of dividend hikes that was halted a few years ago for managing the acquisition of health insurer Aetna.

Road Ahead

By adopting advanced technology to align the business with new trends in the market, CVS Health enjoys an edge over its peers. The strong balance sheet, with impressive cash flows, should help the management take forward its growth initiatives. The fast-growing healthcare benefits segment will be a key growth driver going forward, thanks to the steady membership growth and high health insurance premiums.

Similarly, the pharmacy services segment is gaining momentum aided by higher patient visits at healthcare facilities and the resultant growth in therapy prescriptions. That is expected to offset the slowdown in the administration of COVID-19 vaccines and the consequent drag on revenues. Also, like all consumer businesses, CVS Health’s retail segment might feel the heat of high inflation in the near future.

Why it’s a good idea to buy UnitedHealth stock and hold it forever

“Our specialty intelligent medication monitoring and adherence engine use machine learning to help our most at-risk patients by predicting the likelihood of individual patients becoming non-adherent to their medication. This approach then prompts ways in which we can coach and help them maintain their overall health. Also, using machine learning and robotics, we can now resolve a wide range of prescription drug claims which previously required the attention of our pharmacists,” said CVS Health’s CEO Karen Lynch during the post-earnings discussion this week.

Financial Performance

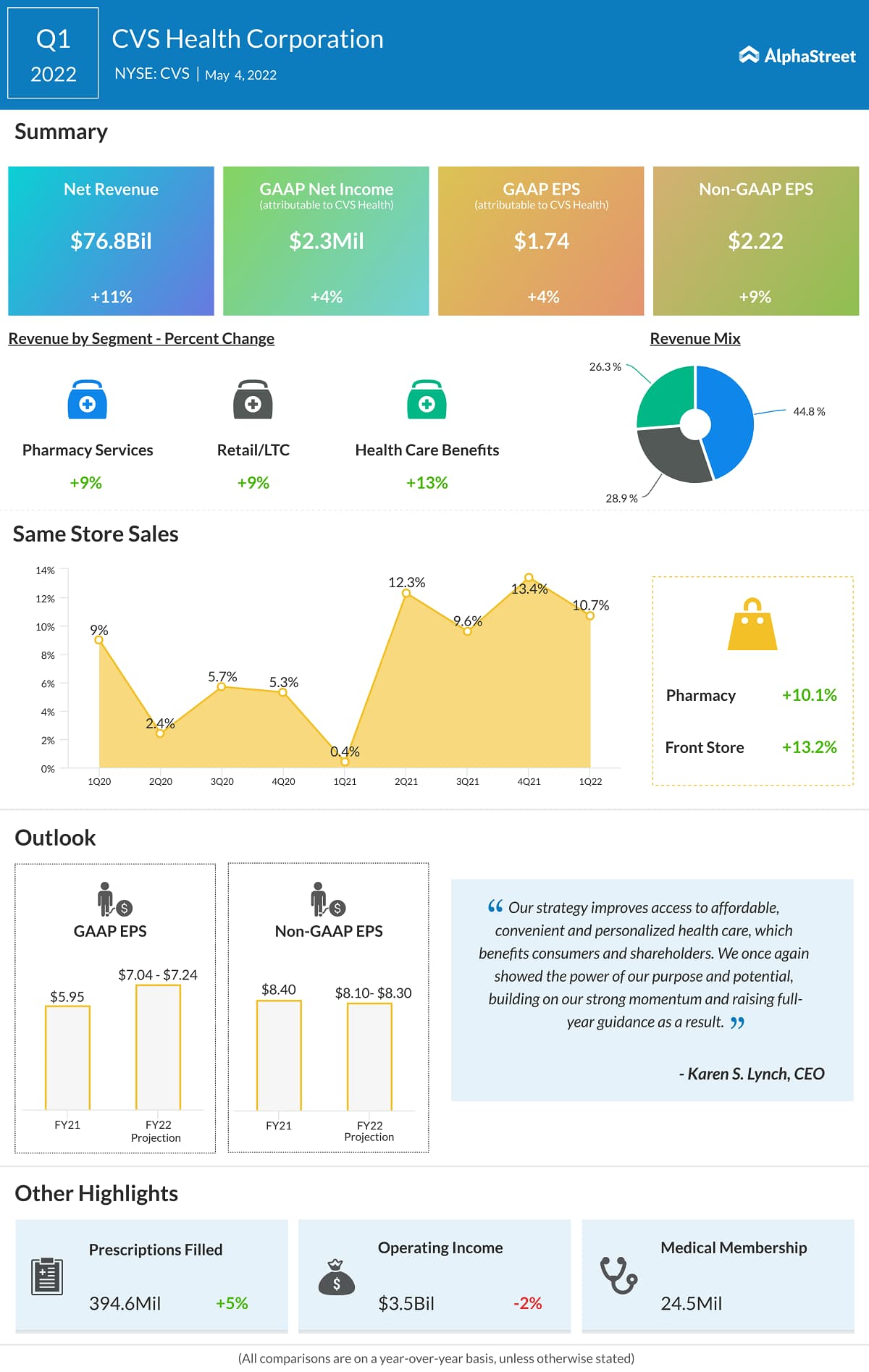

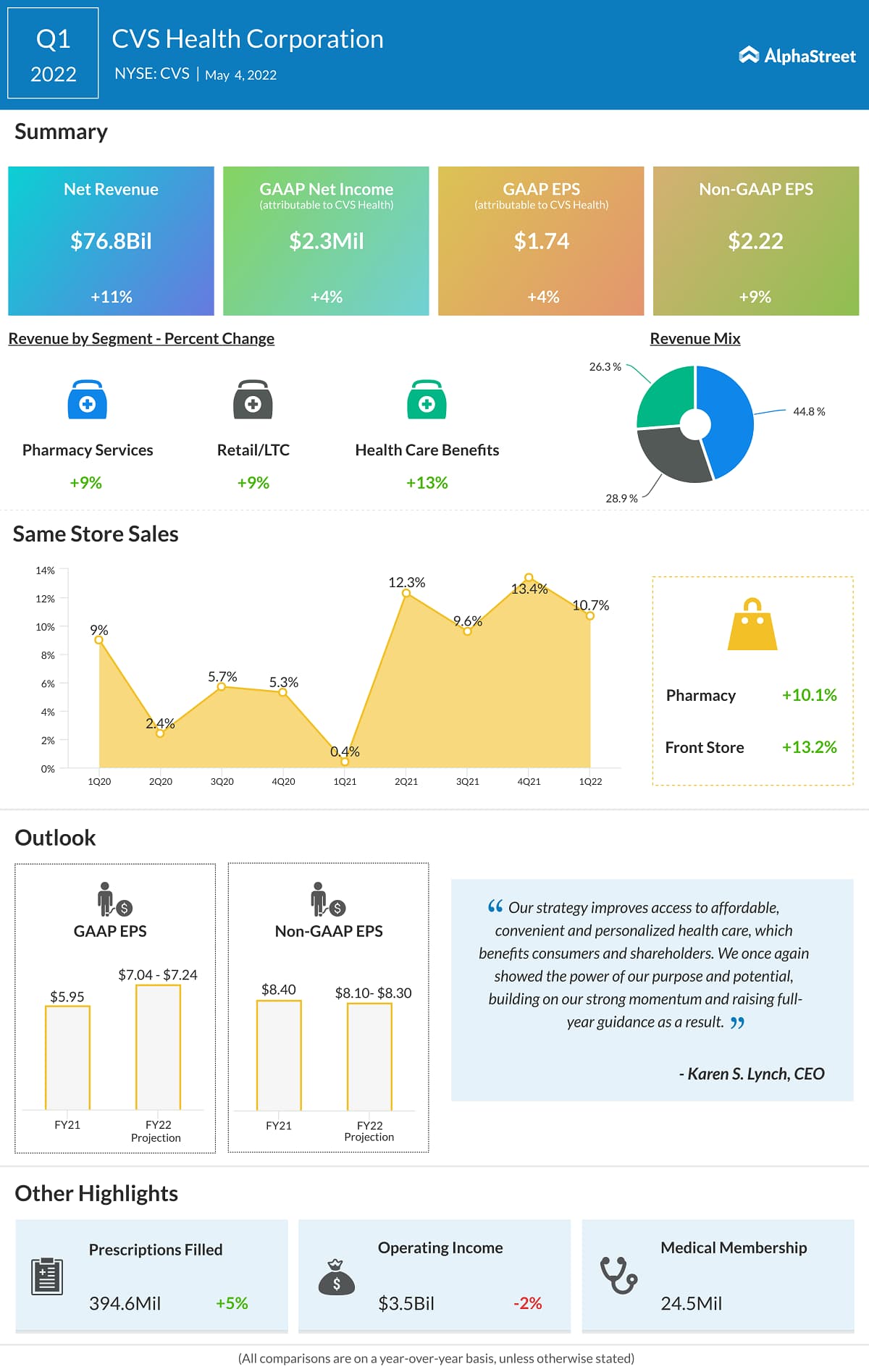

In the early months of fiscal 2022, both sales and earnings topped expectations, continuing the recent trend. All the three operating segments registered growth amid double-digit increase in same-store sales. At $76.8 billion, total revenues were up 11% year-over-year. Earnings, adjusted for one-off items, moved up 9% annually to $2.22 per share. Anticipating the uptrend to continue in the coming quarters, the management raised its full-year guidance.

CVS had an upbeat start to 2022 and mostly traded sideways since then, but it lost some momentum this week. The stock traded lower on Thursday afternoon.