Stock Dips

Read management/analysts’ comments on Oracle’s Q1 report

Meanwhile, analysts’ cautious rating and target price point to continued weakness, which makes ORCL an unattractive investment, at least until the next earnings release. Also, the stock looks overvalued after growing about 35% this year alone.

Buy ORCL?

But investors wouldn’t want to ignore Oracle, rather they would prefer to keep it on their watch-list for now. However, long-term investors can still consider buying the recent dip since the relevance of the company’s broad portfolio of offerings is likely to increase in the coming years.

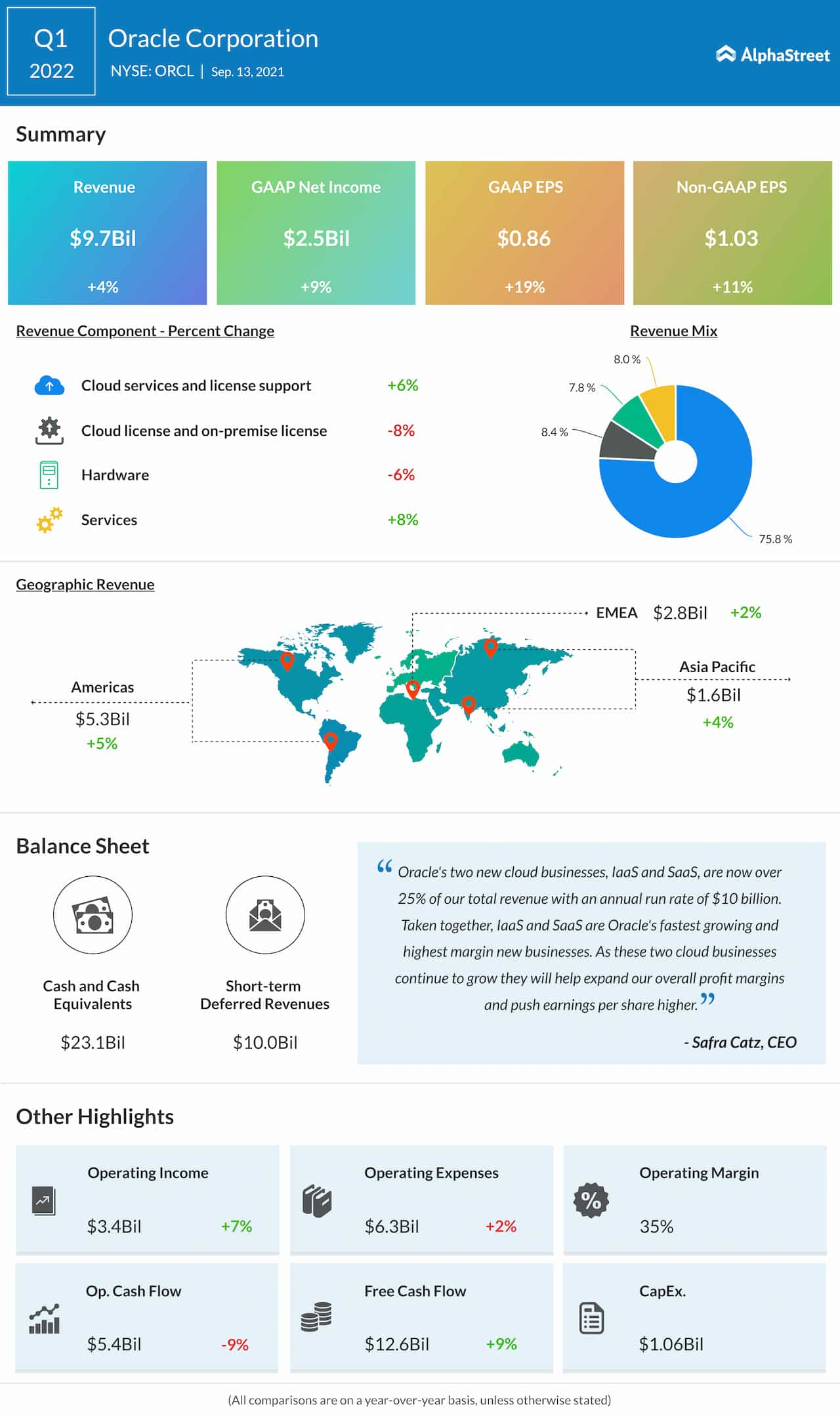

It is estimated that cloud spending would grow in double digits in the next few years, which bodes well for Oracle because the company’s market share in that segment is very low compared to rivals like Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG) and Amazon (NASDAQ: AMZN).

Investing in Biz

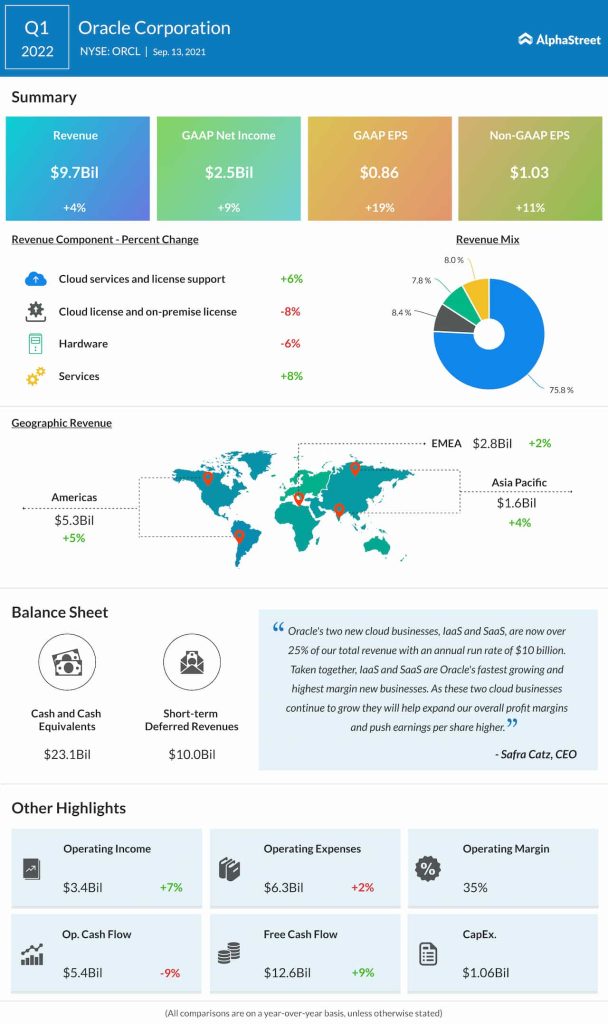

The management hiked capital expenditure to about $1 billion in the first quarter, which is more than double that of last year’s amount. Currently, the focus of capital investment is the expansion of cloud infrastructure to meet future demand. However, it might take a while before those efforts translate into profit.

…I remain highly confident that fiscal year ’22 revenue growth will accelerate because our fast-growing cloud businesses are becoming a larger portion of our total revenue. I see total revenue growth for fiscal year 2022, which is the one wherein, somewhere in the mid-single-digits in constant currency and accelerating. Cloud is fundamentally a more profitable business compared to on-premise. And as we look ahead to next year, we expect company operating margins will be the same or better than pre-pandemic levels.

Safra Catz, chief executive officer of Oracle

ADVERTISEMENT

After hitting an all-time high in August, Oracle’s stock almost stabilized but changed course and dropped following the mixed first-quarter report. In the past 30 days, the shares lost about 5%. They traded lower throughout Tuesday and closed the session down 3%.