Shares of Pfizer Inc. (NYSE: PFE) were up on Tuesday despite the company delivering mixed results for the fourth quarter of 2022 and providing an underwhelming guidance for the upcoming year. Earnings beat expectations while revenues fell short. The pharma giant’s outlook for fiscal year 2023 represents a decline in revenue and earnings versus the previous year and were also below consensus targets.

Quarterly performance

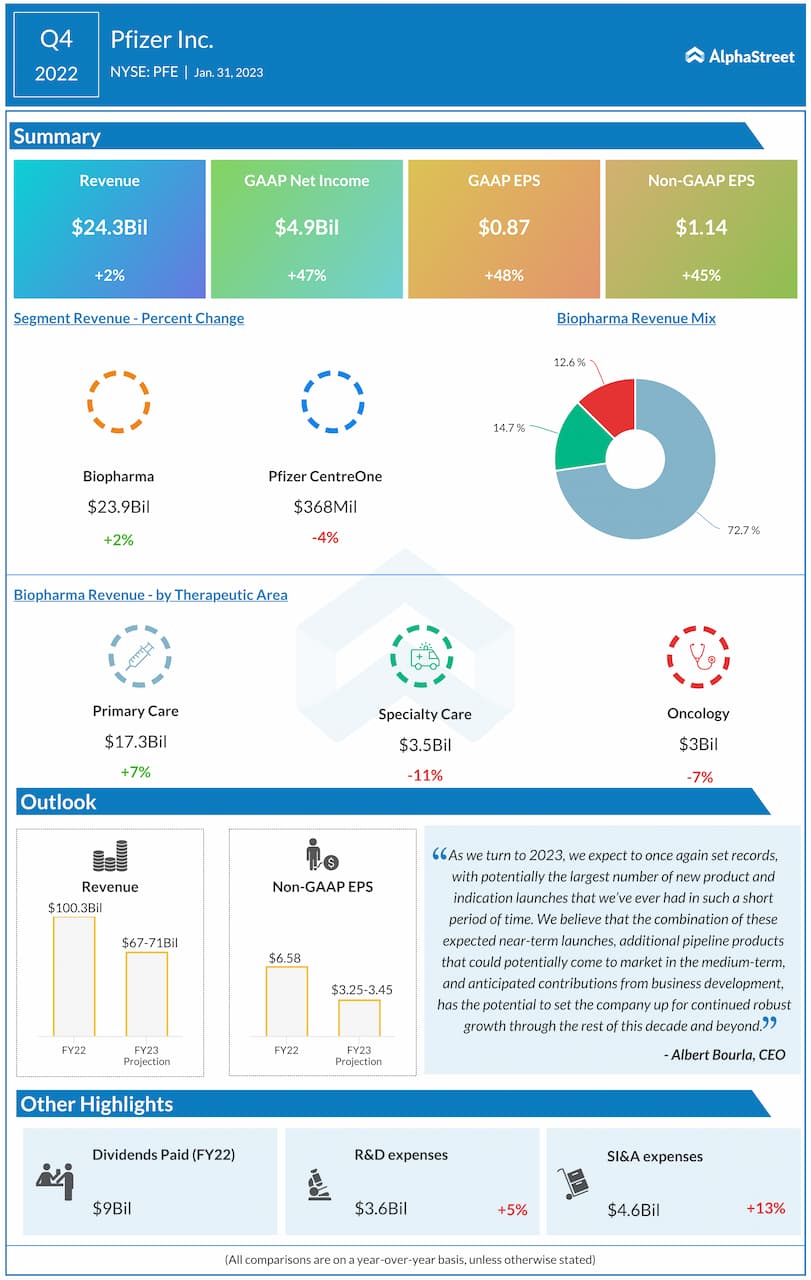

Pfizer generated revenues of $24.3 billion for the fourth quarter of 2022, up 2% on a reported basis and 13% on an operational basis, compared to the same period a year ago. Excluding contributions from Comirnaty and Paxlovid, revenues grew 5% operationally. The top line, however, marginally missed market estimates. Adjusted EPS rose 45% year-over-year to $1.14, surpassing projections.

Pipeline update

On its quarterly conference call, the company said it expects revenues from its business, excluding COVID products, to grow 7-9% operationally in 2023, with the growth expected to be split between new product launch contributions, recently-acquired products, and its in-line portfolio.

These projections include the launches of products such as the RSV vaccine for older adults, the Prevnar 20 pediatric indication, as well as products and candidates such as Nurtec and Oxbryta that Pfizer acquired through business development activities. The company is expected to have up to 19 new products or indications in the market over a period of 18 months. 15 of these products will be from its internal pipeline.

COVID franchise

In the fourth quarter of 2022, Comirnaty generated revenues of $11.3 billion, which was down 9% on a reported basis but up 3% on an operational basis. Paxlovid outside the US contributed $1.8 billion in revenues.

For the full year of 2023, Pfizer expects Comirnaty revenues to be around $13.5 billion, down 64% from 2022. Paxlovid revenues are expected to be around $8 billion, down 58% from last year.

Pfizer expects 2023 to be a transition year for its COVID products. In 2022, the doses and treatment courses for Comirnaty and Paxlovid that were sold at pandemic prices were not fully used up. This created a government inventory build that the company anticipates will probably be absorbed by the second half of 2023.

Around this time, Pfizer expects to start selling both products at commercial prices through commercial channels. The company expects the doses sold and used to align more closely from 2024 onwards thereby stabilizing the commercial prices.

Outlook

For fiscal year 2023, Pfizer expects total revenues of $67-71 billion, which reflects an operational decline of 31% at the midpoint from the previous year. This range is also below the $74 billion that analysts were predicting for the year.

The decline in revenue is entirely due to its COVID products which, as the company stated, are expected to go from their peak in 2022 to their low point in 2023 before potentially returning to growth in 2024 and beyond.

Pfizer expects adjusted EPS in FY2023 to be $3.25-3.45, which is down from the $6.58 reported for FY2022 and below the consensus estimate of $4.42.