Archegos Crisis

But, the pull-back is temporary and the stock looks poised to scale new heights in the coming months, thanks to the positive macroeconomic cues and strength of the trading business. Rather, the recent dip offers an entry point for those looking to enhance their portfolios. Market watchers see a double-digit gain and overwhelmingly recommend investing in the stock.

Tailwinds

The bank’s trading business will continue to benefit from the upbeat stock market, while the ongoing economic recovery is expected to drive growth for the investment banking division. The management is working on its ambitious target of raising total assets to $10 trillion, by broadening the client base and further expanding the new cryptocurrency trading service.

All you need to know about Goldman Sachs Q1 2021 earnings results

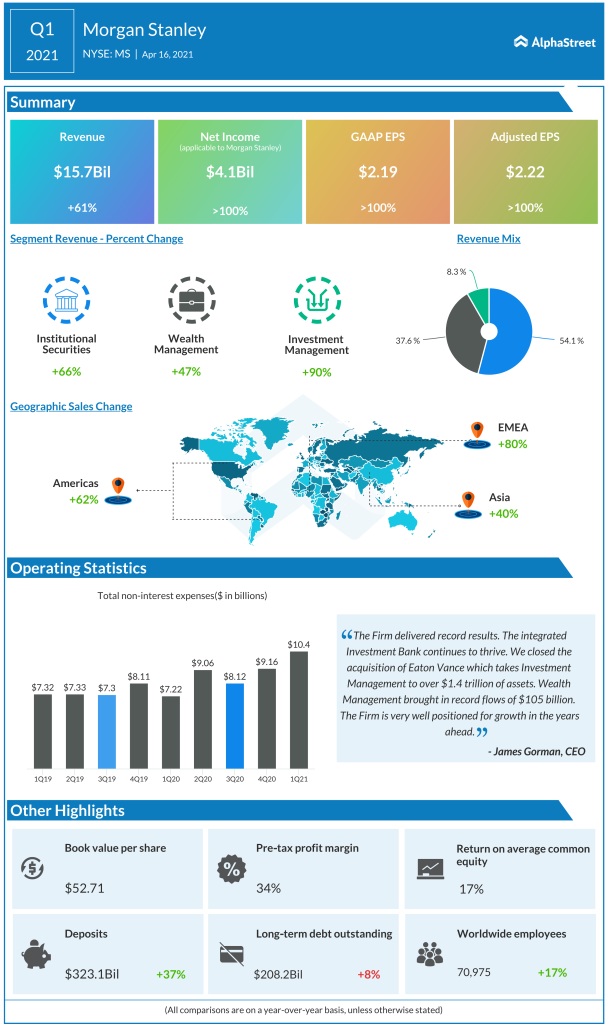

Referring to the latest M&A deals, Morgan Stanley’s chief executive officer James Gorman said, “The performance of both businesses is significantly exceeding our expectations. And, as importantly, the integration so far is proceeding without major incident. These acquisitions, when combined with our existing Wealth and Investment Management businesses, drove our client assets to $5.7 trillion, of which approximately $150 billion represented net new client assets to the firm this quarter. We are more than convinced than ever that both deals help position Morgan Stanley for growth in the years ahead.”

Of late, the main weak point of the New York-based financial services provider has been elevated operating costs, which could continue to be a drag on the bottom line going forward. But it was one of its brokerage clients that played the spoilsport in the most recent quarter. The collapse of family-run investment management firm Archegos Capital, which created a ripple effect across financial markets, had a negative impact on Morgan Stanley’s performance too.

Blowout Q1

First-quarter earnings were sharply higher compared to the year-ago period as the bottom-line benefitted from contributions from Eaton Vance and E*TRADE Financial, which were recently added to the Investment Management and Wealth Management segments, respectively. Earnings more than doubled to $2.22 per share even as the top-line climbed 61% to a record high of $15.7 billion. Institutional Securities, the company’s core operating segment, continued to be the key growth driver. The numbers also beat the estimates.

Read management’s comments on Morgan Stanley’s Q1 report

The stock was trading at a 15-year high when it suffered a sell-off following the earnings report. It closed the last session below the $79-mark but traded higher throughout Monday. The value increased about 16% since the beginning of the year.