A Long-term Bet

Read management/analsts’ comments on Spotify’s Q1 report

Spotify being a loss-making company, investors keep tracking the business for cues on its turnaround prospects. Though the company has improved its position in recent quarters, by narrowing the loss, subscription growth is often affected by intense competition from Apple Music (NASDAQ: AAPL) and Amazon Music (NASDAQ: AMZN).

Podcast in Focus

One of the areas where the company is currently investing is podcasting, which is likely to emerge as a key revenue driver going forward. The service, which includes both originals and distribution services, is expected to drive significant advertising revenue. Of late, the growing popularity of music streaming services has resulted in a sharp increase in spending on audio-based advertising.

Meanwhile, the management is eyeing more international markets to expand the business, after launching in 80 new regions that made the company the biggest audio streamer. But, considering the extensive procedures and pandemic-induced challenges, it might take a long time for the growth initiatives to translate into revenues. That said, strategic tie-ups like the recent partnership with Facebook (NASDAQ: FB) can enhance user engagement, while the new pricing strategy will have a favorable effect on margins in the near term.

Speaking of consumer experience, we continue to see lots of opportunities to enhance our user experience across the board, and you should expect us to move quickly and invest aggressively when we do. Because the broader audio market is still in its infancy compared to music, the opportunities to innovate there are immense and evolving fast and furiously. We have long enjoyed a first-mover advantage and we will continue to prioritize introducing new capabilities across all facets of audio.

Daniel Ek, chief executive officer of Spotify

Will muted user growth, delays dampen Netflix’s prospects?

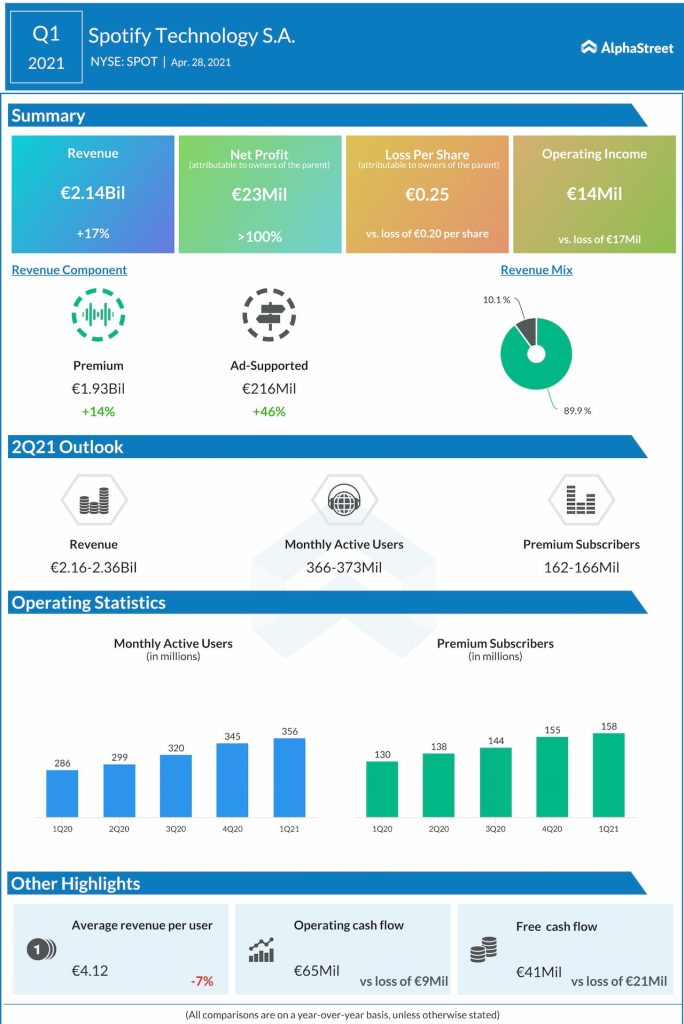

In the March quarter, the number of monthly active users rose by a fourth to 356 million but fell short of expectations. That took the sheen off the otherwise impressive results and the stock nosedived following the announcement. There was a corresponding increase in premium subscribers. While revenues jumped 17% to EUR 2.14 billion, the bottom-line was almost break-even. Investor sentiment was also hurt by the downward revision of the full-year outlook.

Losing Streak

For Spotify’s shares, it was a roller-coaster ride so far this year, after ending 2020 on a high note. They began a losing streak after peaking in February and dropped further following the company’s mixed first-quarter results. The stock opened Thursday’s session at $224.77 and traded lower in the afternoon.