| Ticker | MEDS |

| Exchange | NASDAQ |

| Founded | 2013 |

| Headquarters | Florida |

| Industry | Technology |

| Market Cap | $45 million |

Trxade Group Inc (NASDAQ: MEDS) has been serving pharmacies and drug manufacturers for about eight years, leveraging its web-based platform and mobile application. The company’s technology-based services help independent pharmacies compete effectively with larger drug retailers. Last year, it added around 300 new pharmacies in each quarter.

Besides the core business, the company also operates as a specialty pharmacy, warehouse, and prescription delivery service provider. With more than 11,800 pharmacy members in its network, Trxade serves almost 50% of the US market.

Operating Segments

The company operates in the areas of telemedicine, pharmacy, drug delivery, wholesale sales, and as a pharmaceutical marketplace. The main products are:

Bonum Health (Telemedicine app)

Community Speciality Rx (Pharmacy)

DelivMeds (Drug delivery app)

Integra Pharma Solutions (Virtual wholesaler)

Trxade Marketplace(pharmaceutical marketplace)

Key Statistics

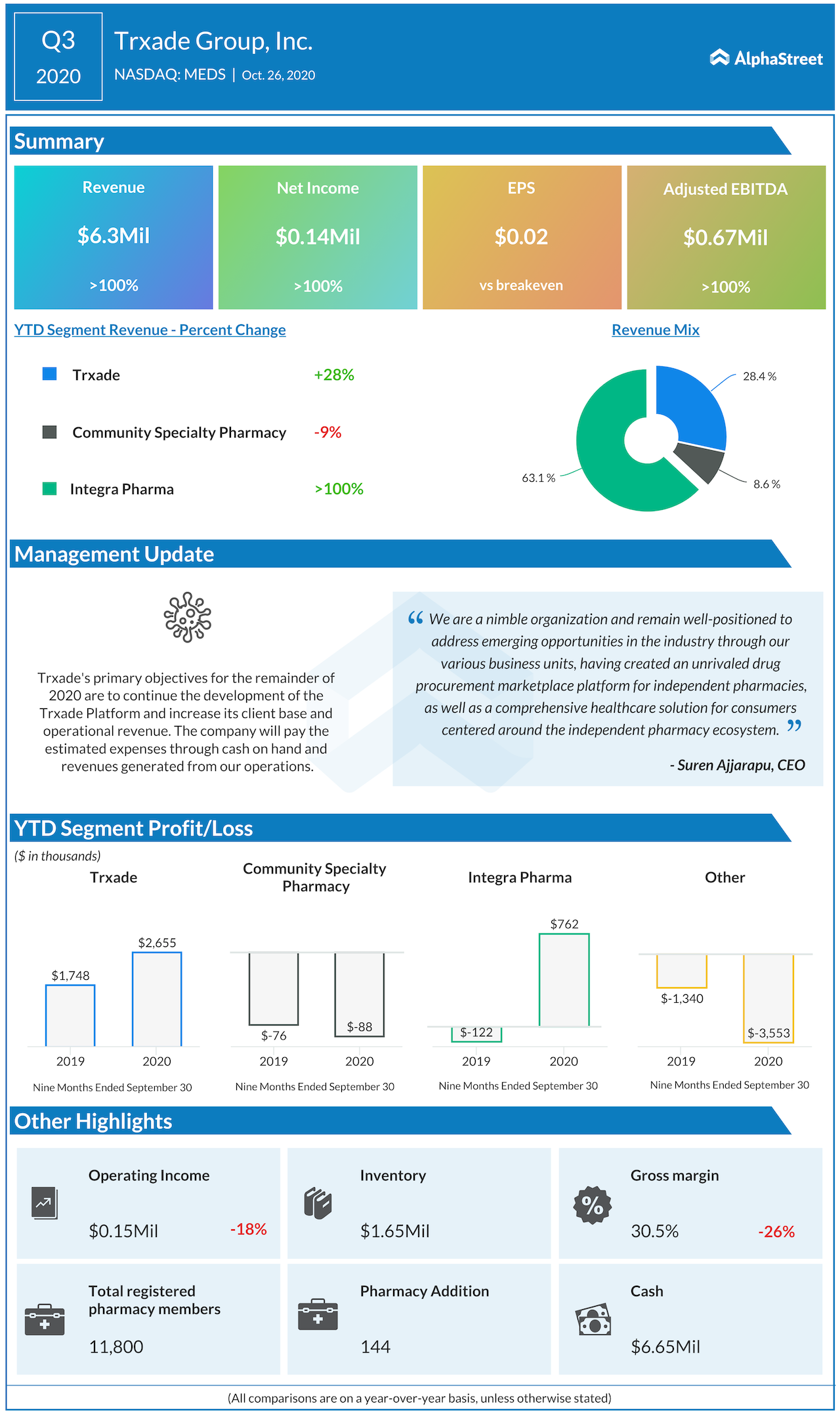

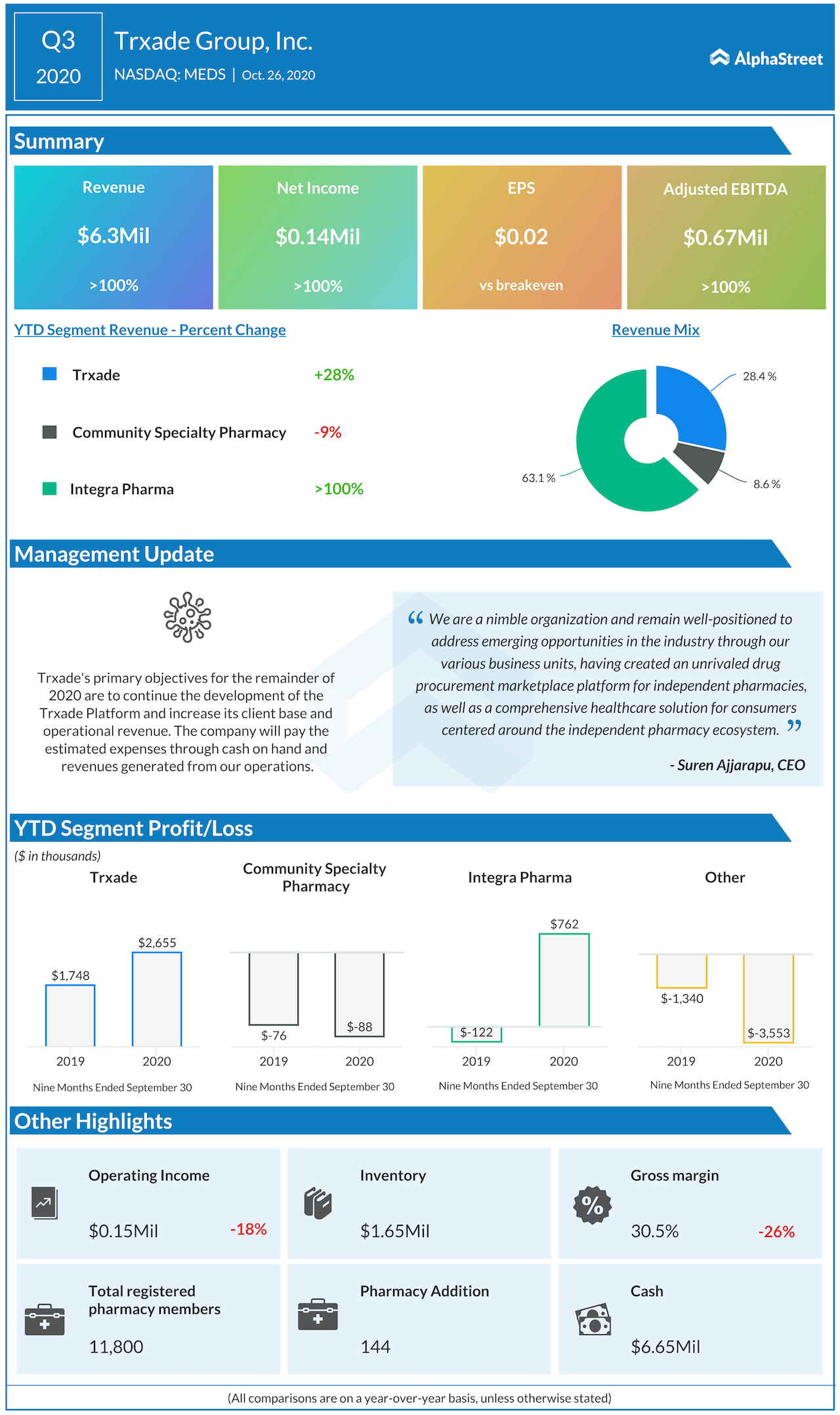

In the third quarter, Trxade posted a profit of $0.02 per share, compared to breakeven last year. Revenues more than doubled to $6.3 million aided by stable demand for personal protective equipment. While the top-line exceeded the consensus forecast, earnings missed by a cent. As many as 144 new independent pharmacies joined the network during the three-month period.

The rapidly growing Integra Pharma segment accounted for about 63% of total revenues. Another business that witnessed stable growth is the telehealth subsidiary Bonum Health — with more and more people seeking to consult doctors remotely during the pandemic. Meanwhile, the bottom-line continued to be under pressure from lower margins, a trend that is expected to change for the better post-COVID.

It’s a fact that the relevance of the Trxade platform increased during the COVID period, for the role it plays in ensuring the smooth functioning of independent pharmacies. The management is busy exploring new avenues to expand the business and maintain the momentum beyond the pandemic when the demand for personal protective equipment might soften. The company counts on the Bonum Health and Bonus Plus businesses and strong subscriptions to tackle the possible slowdown.

The Market

The company competes both with smaller players — private firms like Benzer Pharmacy, Script Health, and Medstoreland — and healthcare majors like UnitedHealth Group (NYSE: UNH), Rite Aid Corporation (NYSE: RAD), and Walgreens Boots Alliance (NASDAQ: WBA). The big players – the list also includes Walmart (WMT: NYSE) – enjoy an edge over others with thier huge cash balances and other resources.

E-commerce giant Amazon (NASDAQ: AMZN) has been making inroads into the pharma market, especially after the acquisition of PillPack a few years ago, which could pose a threat to Trxade’s market share going forward.

Outlook

Pharmacy additions witnessed a slow-but-steady uptick in recent months even as drugstores started resuming operation after the lockdown. Earlier, Trxade executives had expressed hope that in the final months of the fiscal year, pharmacy additions would be at par with the third quarter. Though most of the company’s suppliers are back in the market, the current level of supplies might not be enough to meet the huge demand. That justifies the management’s modest outlook for the fourth quarter. At the same time, December is typically a slow month for the pharmacy business.

The click-and-collect model for the prescription drug business is being adopted widely and the trend is expected to grow in the coming years. That bodes well for Trxade, which entered the market at a time when independent pharmacies were overshadowed by their bigger rivals like Cigna (NYSE: CI), CVS Health Corporation (NYSE: CVS), and Walgreens Boots Alliance, which together accounted for about 50% of America’s prescription medicine market in 2019.

Another trend that complements the new-generation drug-delivery model is the rapid adoption of advanced technology like artificial intelligence to enhance customer experience and improve communication between patients and healthcare professionals.

Recent Updates

Last month, Bonum Health clinched a partnership with pharma company KPH Healthcare Services to provide telemedicine services to certain divisions of the latter. Bonum, Trxade’s clinical-technology and telehealth solutions arm, offers virtual medicine and other services at affordable rates. The deal followed a prescription savings tie-up with SingleCare for increasing downloads and expanding the subscriber base.

Read management/analysts’ comments on Trxade’s Q3 earnings

Earlier, the Integra Pharma Solutions unit rolled out Trxade Prime, a solution designed to help pharmacies deal with the complexities involved in the prescription distribution process. It allows member pharmacies to process, consolidate, and ship orders in a cost-effective and convenient manner. DelivMeds, Trxade’s innovative mobile application that helps patients order drugs online and have them delivered on the same day, is currently being given a facelift by incorporating AI capabilities.

The Stock

Trxade’s stock has been pretty flat since the company went public early last year. It entered 2021 on a positive note and maintained a modest uptrend in the early days. Though the stock suffered in the sessions that followed the third-quarter earnings release, it regained strength later. At the end of 2020, the company had a market capitalization of about $43 million.