Investing in ABT

The current slowdown looks temporary and ABT offers a good buying opportunity ahead of the upcoming earnings release and beyond, thanks to the company’s strong fundamentals and diversified portfolio, which ranges from medical devices to diagnostics and nutrition to pharmaceuticals. Experts are of the view that in the next twelve months, the stock would grow around 13% from the last closing price.

Read management/analysts’ comments on Abbott’s Q2 earnings

Last month, the FDA approved the company’s Amplatzer Talisman PFO Occlusion System used for treating people who are at risk of recurrent ischemic stroke. The regulatory agency also cleared the Amplatzer Talisman Delivery Sheath.

While overall business conditions look encouraging, Abbott’s long-term sales might come under pressure from a moderation in the demand for diagnostic products as the COVID-19 cases drop further and market reopening gathers steam. Earlier, a spike in the sales of coronavirus diagnostics products had helped the company offset softness in the core medical devices segment.

Diverse Portfolio

On the positive side, however, the demand for test kits is likely to stay in the foreseeable future, though on a moderate scale, due to the resurgence in infections and the emergence of new virus variants. Also, the company’s non-COVID-related business has come out of the slowdown and is almost back on track.

Abbott’s third-quarter earnings release is scheduled for October 20, before the opening bell, amid expectations for a 4% decrease in adjusted earnings to $0.94 per share. Meanwhile, revenues are seen growing 8% year-on-year to $9.56 billion. The market will be closely following the event since earnings had increased consistently over the past several quarters, mostly exceeding the market’s projection.

Strong Momentum

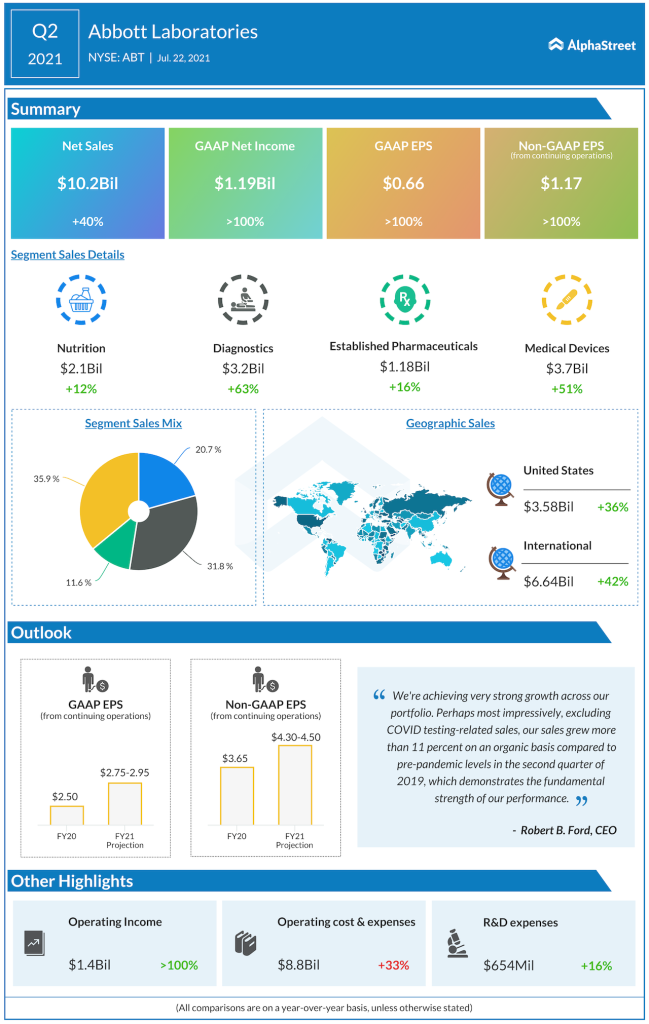

In the second quarter of 2021, sales jumped around 40% to $10.2 billion, driving up earnings to $1.17 per share. The numbers also topped Wall Street’s estimates even as all the four operating divisions and geographical segments registered double-digit growth.

“Strong sales growth in our underlying Diagnostics business is being driven by improving routine diagnostic testing as healthcare systems continue to recover from the pandemic as well as the continued rollout of our Alinity platforms. Excluding COVID testing-related sales, second-quarter sales in Core Laboratory and Molecular Diagnostics grew mid-single-digits compared to pre-pandemic levels in the second quarter of 2019,” Robert Ford, chief executive officer of Abbott.

Johnson & Johnson beats in Q2; raises FY guidance

ABT traded lower so far this week and underperformed the market. The stock regained some momentum on Thursday after closing the last session at $116.66, which is slightly below the long-term average. In the past twelve months, it gained about 7%.